Assessing SSY Group (SEHK:2005) Valuation Following New Drug Approvals and Pipeline Progress

Reviewed by Simply Wall St

SSY Group (SEHK:2005) just secured multiple new drug production and registration approvals from China’s National Medical Products Administration, spanning both specialty treatments and bulk drugs. This signals tangible advancement in the company’s pharmaceutical pipeline.

See our latest analysis for SSY Group.

After a challenging start to the year, SSY Group’s share price has shown renewed momentum, achieving a 9.5% return over the past 90 days and rising 1.6% just yesterday as investors reacted to its steady flow of regulatory wins. However, the stock’s one-year total shareholder return is still down 8.7%, reflecting the longer-term pressures facing the sector even as recent approvals offer fresh reasons for optimism.

If you’re interested in discovering more companies at the forefront of healthcare and pharmaceuticals, now is a great time to explore See the full list for free.

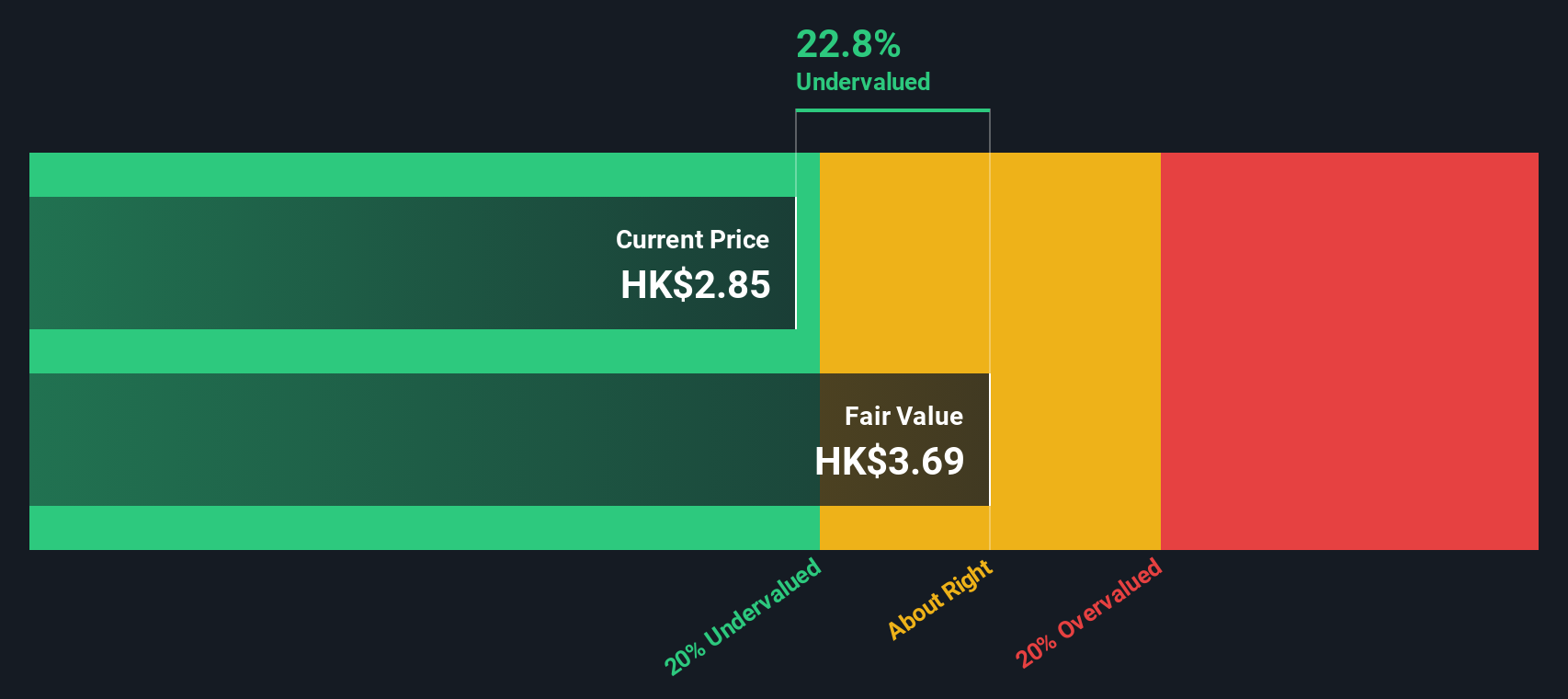

With the shares trading nearly 28% below consensus analyst price targets and at more than a 50% intrinsic discount, the question arises: is the market overlooking future upside, or has all the recent progress already been factored into the current price?

Price-to-Earnings of 13.8x: Is it justified?

SSY Group’s shares are trading on a price-to-earnings ratio of 13.8x, noticeably below peer averages and slightly above the sector norm. At yesterday’s close of HK$3.12, this implies the market is valuing SSY Group’s earnings at a discount compared to other similar companies.

The price-to-earnings (P/E) ratio is a key measure that compares a company's current share price to its per-share earnings. In pharmaceuticals, this ratio helps investors gauge whether future profit expectations justify today's price.

SSY Group’s P/E of 13.8x is considered good value against the peer average of 25.3x, suggesting the shares may be attractively priced if the company delivers on earnings growth. Compared to the Hong Kong pharmaceuticals industry average of 13.7x, SSY Group appears slightly expensive. However, relative to its estimated fair P/E ratio of 17.5x, the stock still trades at a discount, indicating potential for the market to move higher if company forecasts hold true.

Explore the SWS fair ratio for SSY Group

Result: Price-to-Earnings of 13.8x (UNDERVALUED)

However, slower revenue growth or further sector-wide pressure could quickly challenge the recent momentum behind SSY Group’s shares.

Find out about the key risks to this SSY Group narrative.

Another View: What Does Our DCF Model Suggest?

While the price-to-earnings ratio hints at undervaluation, the SWS DCF model examines SSY Group’s cash flows and estimates fair value at HK$6.43 per share, which is well above the current price. This suggests the market could be overlooking deeper value. Could this indicate a real disconnect, or is the market cautious for a reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SSY Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SSY Group Narrative

If you want to draw your own conclusions or explore alternative perspectives, you can form your personal view using the available data in just a few minutes. Do it your way

A great starting point for your SSY Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors seize opportunities before the crowd moves in. Add fresh ideas to your strategy by exploring these carefully curated stock collections available now on Simply Wall St:

- Capitalize on market upswings with these 3556 penny stocks with strong financials offering strong financials and the potential for outsized returns.

- Supercharge your portfolio by tapping into these 25 AI penny stocks fueled by breakthroughs in artificial intelligence innovation and rapid sector growth.

- Lock in stable income streams by targeting these 15 dividend stocks with yields > 3% featuring reliable yields greater than 3% that work hard for your money.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2005

SSY Group

An investment holding company, researches, develops, manufactures, trades in, and sells various pharmaceutical products to hospitals and distributors in the People’s Republic of China and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026