What Everest Medicines (SEHK:1952)'s Exclusive VIS-101 Ophthalmology License Means for Shareholders

Reviewed by Sasha Jovanovic

- In late October 2025, Everest Medicines announced it had acquired an exclusive license to develop, manufacture, and commercialize VIS-101, a bifunctional biologic for wet AMD, diabetic macular edema, and retinal vein occlusion, in Greater China, Singapore, South Korea, and Southeast Asia through a collaboration with Visara, Inc.

- This marks Everest Medicines' entry into ophthalmology, adding a late-stage asset expected to be Phase-3-ready in 2026 and enhancing its portfolio diversification efforts.

- We'll explore how Everest Medicines' move into ophthalmology with VIS-101 could reshape the company's investment narrative and growth prospects.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Everest Medicines Investment Narrative Recap

To believe in Everest Medicines as a shareholder, you need confidence in the company’s ability to deliver rapid revenue growth through portfolio expansion and commercialization success, while managing risks tied to product concentration and clinical development. The recent VIS-101 ophthalmology license adds late-stage potential, but does not materially alter the most important short-term catalyst, continued sales momentum for NEFECON, with its associated regulatory and reimbursement uncertainties still the central risk.

Among recent announcements, NEFECON’s full approval in China (May 2025) stands out for its immediate impact. While Everest’s diversification drive is gaining steam with VIS-101, the present growth story remains closely linked to NEFECON’s roll-out and effective reimbursement uptake, which will continue to shape revenue and margin trends.

In contrast, investors should be aware that further revenue concentration risk could emerge if diversification efforts like VIS-101 progress slower than expected...

Read the full narrative on Everest Medicines (it's free!)

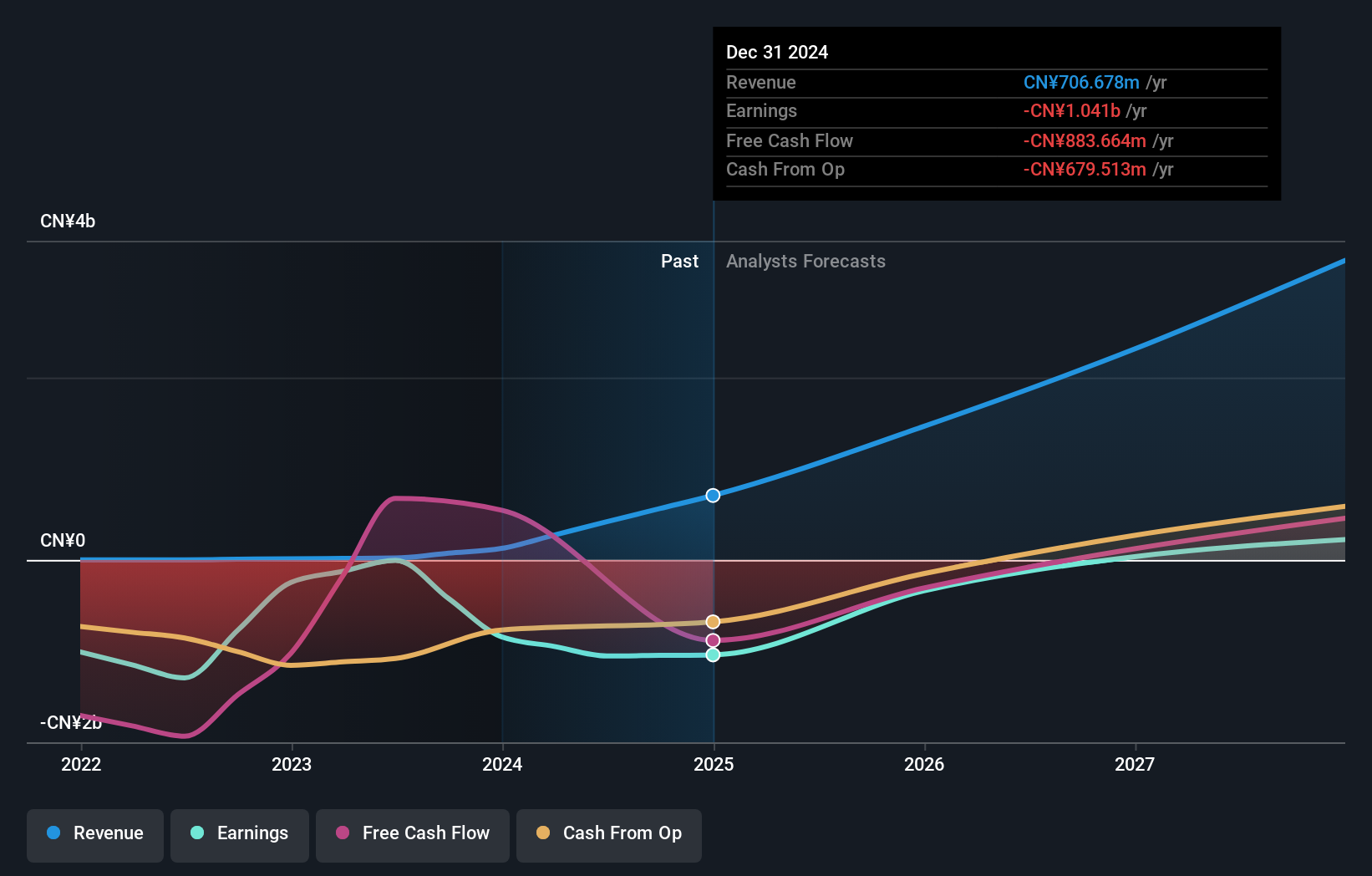

Everest Medicines' narrative projects CN¥3.6 billion revenue and CN¥770.8 million earnings by 2028. This requires 62.2% yearly revenue growth and a CN¥1.43 billion increase in earnings from the current CN¥-658.8 million.

Uncover how Everest Medicines' forecasts yield a HK$64.56 fair value, a 32% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided just 1 fair value estimate for Everest Medicines at HK$101.18 per share, well above recent market prices. While several share price catalysts exist, a key challenge remains NEFECON’s ongoing commercialization and sustained reimbursement success in China, shaping near-term revenue expectations and investor sentiment.

Explore another fair value estimate on Everest Medicines - why the stock might be worth just HK$101.18!

Build Your Own Everest Medicines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Everest Medicines research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Everest Medicines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Everest Medicines' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everest Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1952

Everest Medicines

A biopharmaceutical company, engages in the discovery, license-in, development, and commercialization of therapies and vaccines to address critical unmet medical needs in Greater China and other Asia Pacific markets.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives