Junshi Biosciences (SEHK:1877) Losses Worsen Despite 23.7% Revenue Growth, Challenging Bullish Narratives

Reviewed by Simply Wall St

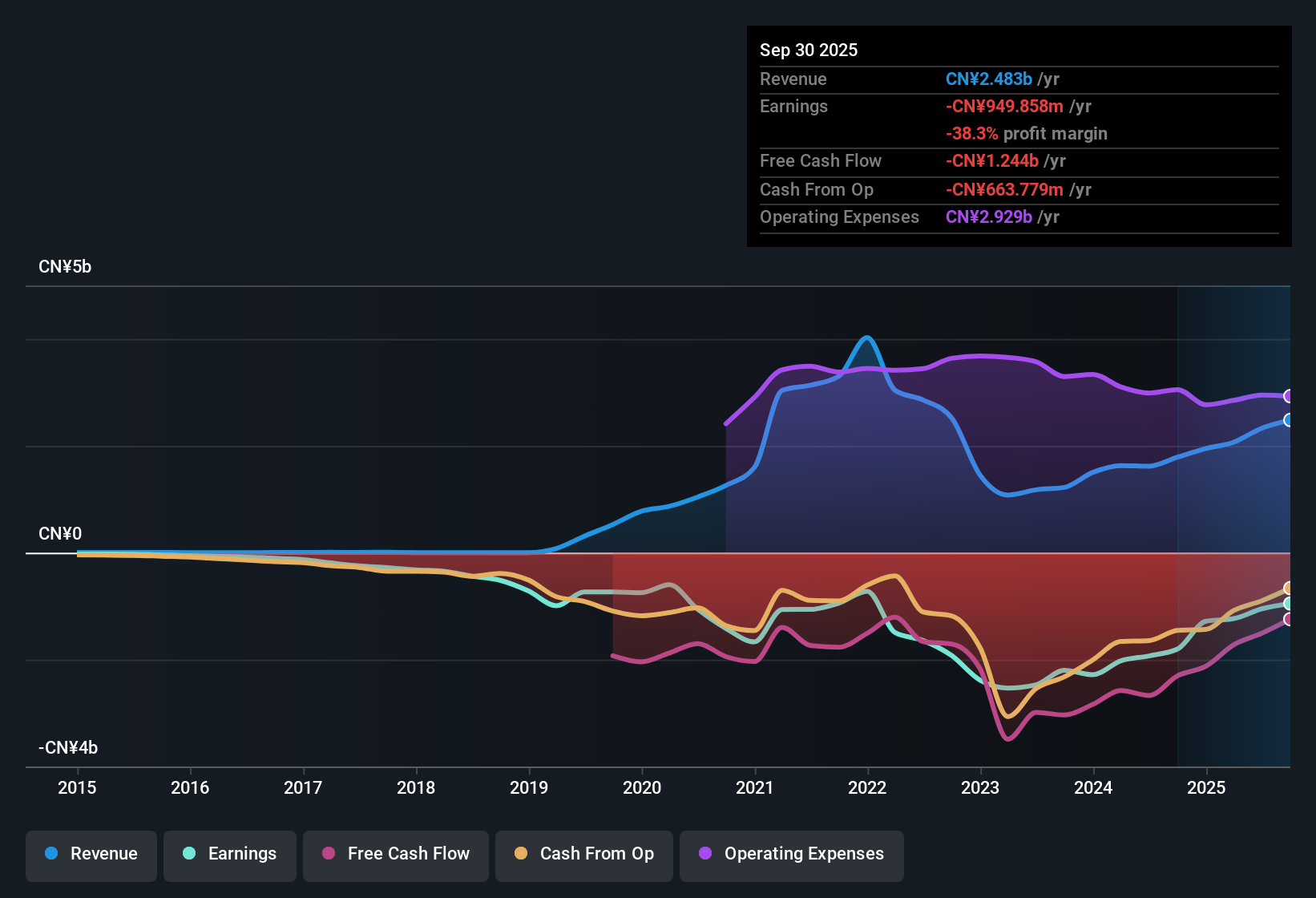

Shanghai Junshi Biosciences (SEHK:1877) remains unprofitable, with annual losses worsening by an average of 2.7% over the past five years, and net profit margins showing no signs of improvement. Despite this, analysts expect revenue to grow at a robust 23.7% per year, significantly outpacing the 8.6% growth forecast for the broader Hong Kong market. With the company expected to stay in the red for at least three more years, investors are weighing the attraction of high sales growth against the lack of a clear path to profitability.

See our full analysis for Shanghai Junshi Biosciences.Now that the headline numbers are out, it is time to see how this performance measures up to the widely followed narratives. This is where consensus can be confirmed or called into question.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Grow Faster Than Revenue

- Annual losses have increased at a rate of 2.7% per year over the past five years. This highlights that while Junshi’s revenue is growing quickly, its expenses are still outpacing top-line progress.

- Although the prevailing market view highlights Junshi's rapid 23.7% revenue growth forecast as a long-term positive, high losses challenge bullish hopes for near-term profitability.

- The company’s net profit margins have not improved, which supports caution around the bullish scenario that scaling revenue alone will fix the path to profits.

- Forecasts suggest persistent losses for at least three more years, making cost discipline and business sustainability areas to watch closely.

Valuation Looks Compelling vs Peers

- Junshi’s shares trade at a price-to-sales ratio of 9.5x, which is more attractive than both sector rivals at 13.7x and the broader Hong Kong biotech industry at 15.4x, despite ongoing operating losses.

- The prevailing market view points to the current share price of HK$25.16 being well below the DCF fair value estimate of HK$43.37, highlighting the argument for a valuation disconnect.

- Bulls see the fair value gap as a sign that the stock is underappreciated relative to its long-term growth prospects, and argue the downside risk may already be priced in.

- Cautious investors, however, note that sustained unprofitability could prevent shares from closing that value gap without a turnaround in profitability.

Share Price Stability Remains a Concern

- Recent months have brought unstable share price performance, which is a tangible risk for investors wary of volatility in unprofitable biotech names.

- According to the prevailing market perspective, this unpredictability increases the importance of closely following revenue delivery and expense control, even as sector trends remain broadly supportive.

- Sector-wide interest in biotech innovation suggests there is potential for sentiment-driven rallies, but current price swings reinforce the need for clear progress toward profitability.

- Without margin improvement or positive earnings surprises, the share price may remain under pressure despite high revenue projections.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Shanghai Junshi Biosciences's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Junshi’s inability to turn rapid revenue growth into profits and persistent cost overruns raises concerns about the sustainability and predictability of its performance.

If you want to focus on consistency and reliability, check out our handpicked selection of companies delivering steady performance across cycles with stable growth stocks screener (2127 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1877

Shanghai Junshi Biosciences

A biopharmaceutical company, engages in the discovery, development, and commercialization of various drugs in the therapeutic areas of malignant tumors, neurological, autoimmune, chronic metabolic, nervous system, and infectious diseases in the People's Republic of China.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives