Innovent Biologics (SEHK:1801) Valuation Check After 40% Product Revenue Growth and Mazdutide Milestone

Reviewed by Simply Wall St

Innovent Biologics (SEHK:1801) just reported a 40% jump in product revenue for the third quarter, fueled by strong growth in both its established oncology portfolio as well as newer offerings like mazdutide and SINTBILO.

See our latest analysis for Innovent Biologics.

Innovent’s shares have been on a rollercoaster in recent weeks, but momentum is clearly building overall. The stock’s 1-year total shareholder return sits at an impressive 148%, even after some profit-taking since last month. Excitement around soaring product revenue, breakthrough Phase 3 data for mazdutide, and a blockbuster partnership with Takeda are fueling investor optimism, despite near-term share price swings.

If Innovent’s strong run caught your attention, it could be the perfect moment to see what else is gaining traction and check out See the full list for free.

But with shares up nearly 150% over the past year and optimism running high, is Innovent Biologics still an undervalued growth play? Or has the market already priced in its future success?

Price-to-Earnings of 120.6x: Is it justified?

Innovent Biologics trades at a price-to-earnings (P/E) ratio of 120.6x, which directly reflects investor optimism and lofty growth expectations baked into the current share price of HK$87.

The P/E ratio shows how much investors are willing to pay for each dollar of earnings. In the biotech sector, high multiples can signal a powerful growth story but also reflect elevated risk if those future earnings do not materialize.

However, Innovent's P/E stands massively above the Asian Biotechs industry average of just 43.7x and the peer average of 42x. The stock's P/E is also more than triple the estimated fair P/E ratio of 35.4x. This suggests the market has pushed the valuation well beyond longer-term earnings fundamentals.

Explore the SWS fair ratio for Innovent Biologics

Result: Price-to-Earnings of 120.6x (OVERVALUED)

However, risks remain if future earnings growth disappoints, or if competitive pressures in the biotech sector begin to weigh more heavily on profit margins.

Find out about the key risks to this Innovent Biologics narrative.

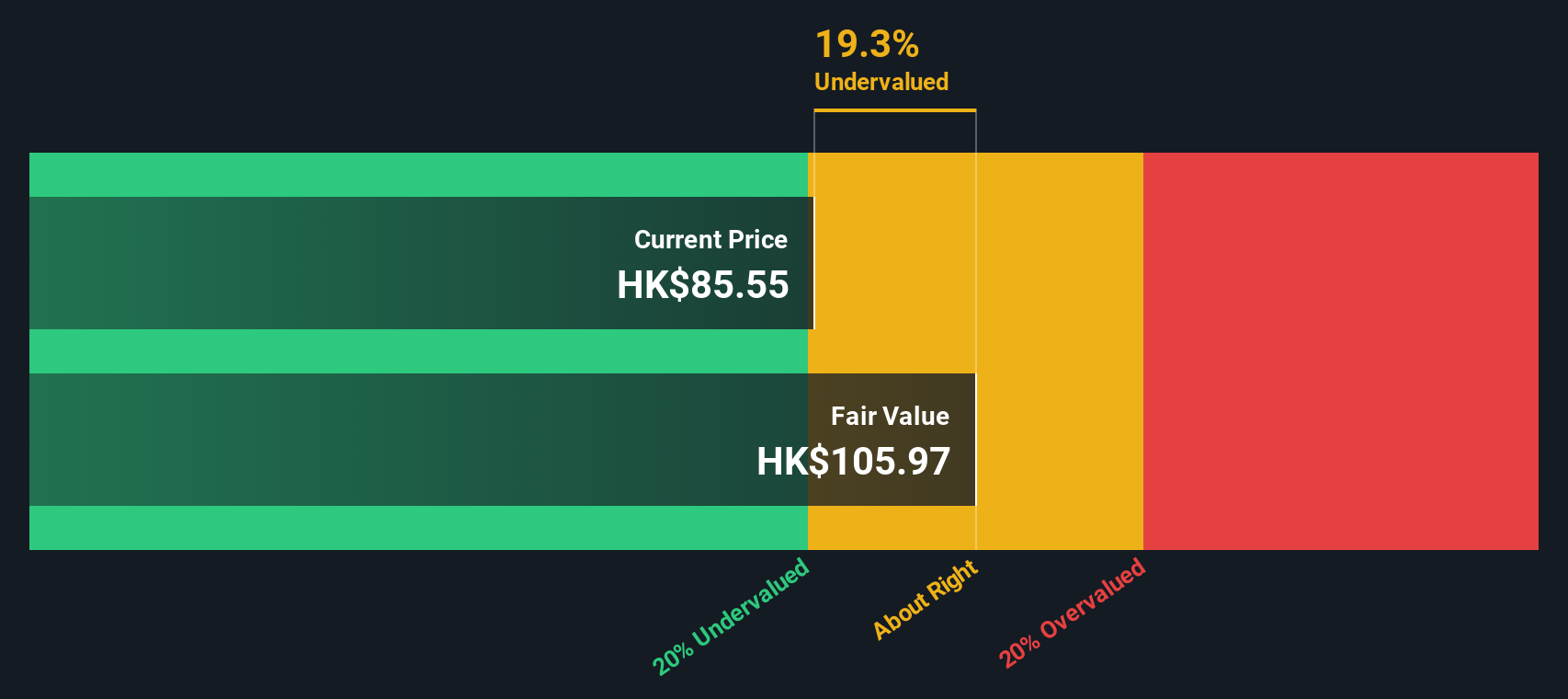

Another View: SWS DCF Model Suggests Value Upside

While the market’s P/E ratio points to Innovent Biologics being overvalued, our SWS DCF model tells a different story. The model estimates a fair value of HK$104.15 versus the current share price of HK$87, implying the stock is actually trading 16.5% below its intrinsic value.

Look into how the SWS DCF model arrives at its fair value.

This sharp divergence between earnings multiples and intrinsic valuation leaves investors with a critical question: are long-term cash flow projections more reliable than the sentiment-driven P/E ratio? The answer could influence the next move for Innovent’s share price.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Innovent Biologics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Innovent Biologics Narrative

If you want to see the data from another angle or trust your independent research, you can easily build your own story in minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Innovent Biologics.

Looking for More Winning Investment Opportunities?

Don’t miss your chance to seize the next big breakthrough. Powerful investment themes are thriving beyond Innovent, and you could be on the front line.

- Spot companies harnessing the power of artificial intelligence and shape your portfolio with these 26 AI penny stocks before the crowd catches on.

- Secure steady income by reviewing these 22 dividend stocks with yields > 3% featuring reliable yield from proven performers in today's market.

- Capitalize on innovation, growth, and volatility by identifying these 3590 penny stocks with strong financials positioned for explosive potential that most investors overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1801

Innovent Biologics

A biopharmaceutical company, engages in the research and development of antibody and protein medicine products in the People’s Republic of China, the United States, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives