Ascletis Pharma (SEHK:1672) Is Up 5.5% After Revealing Promising Obesity Drug Updates at ObesityWeek 2025 Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Ascletis Pharma announced positive Phase Ib results for its ASC30 oral and subcutaneous formulations, showing notable placebo-adjusted mean body weight reduction, a favorable safety profile, and ultra-long half-lives supporting both monthly and quarterly dosing, with these updates presented recently at ObesityWeek 2025.

- The company also unveiled new preclinical results where a combination of ASC47 and ASC31 outperformed monotherapies in promoting both weight and fat loss, and advanced its pipeline by selecting ASC36, a once-monthly amylin receptor agonist, as a clinical candidate for obesity.

- We’ll explore how the latest clinical results for ASC30’s unique dosing profile could reinforce Ascletis Pharma’s overall investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Ascletis Pharma's Investment Narrative?

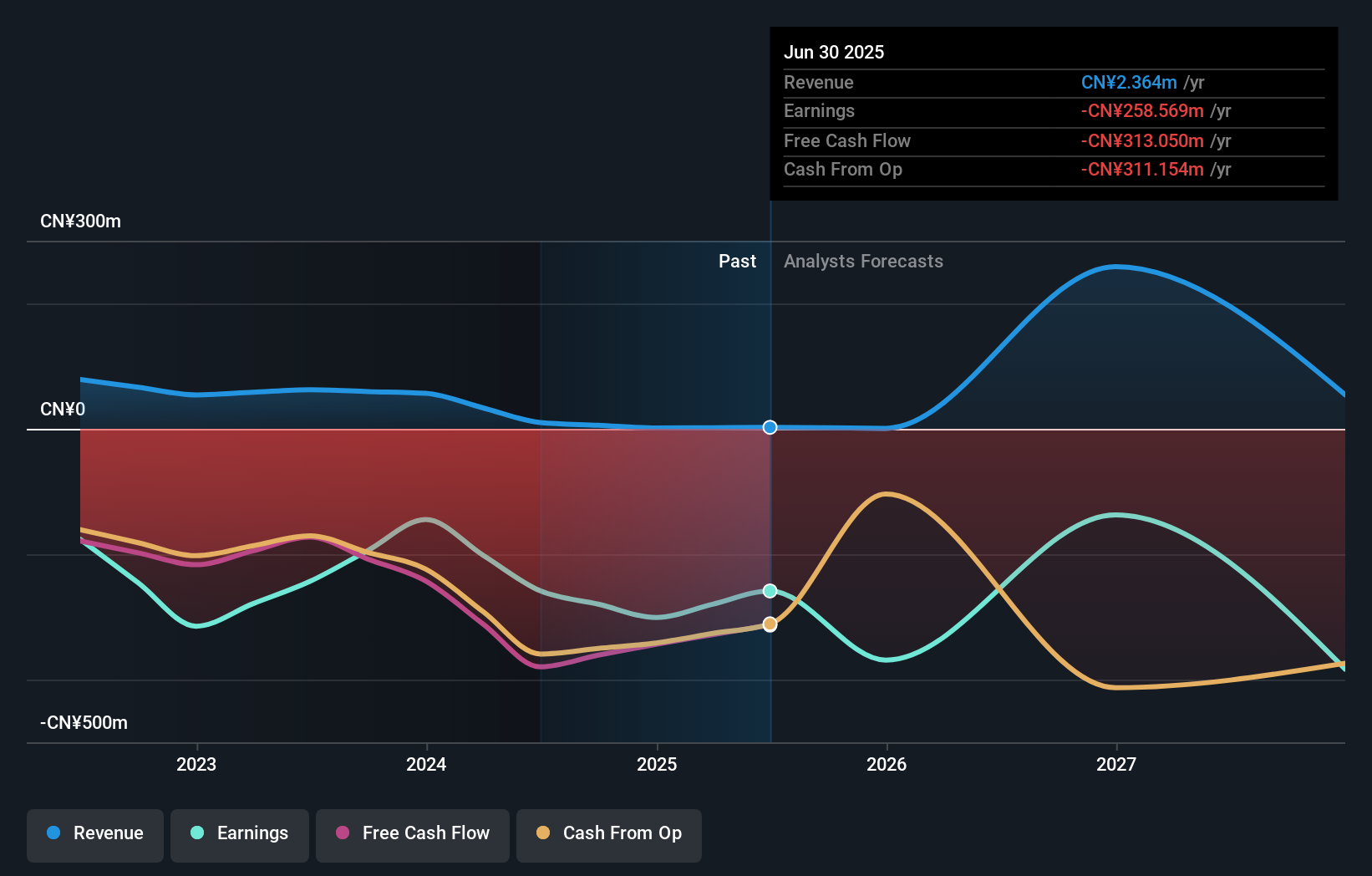

For investors looking at Ascletis Pharma, the belief revolves around the company’s bold pipeline in obesity therapeutics, where genuine differentiation and commercial impact have been elusive across biotech globally. The recent Phase Ib data showing ASC30’s significant weight reduction and the potential for ultra-long dosing intervals is a meaningful step; it highlights not just clinical progress, but also suggests improved convenience and adherence, two hurdles for wider adoption. As a result, short-term catalysts now look clearer: further clinical readouts and regulatory milestones for ASC30 and related candidates may take on higher importance in shaping sentiment and valuation. In parallel, risks connected to consistent losses and timeline uncertainties don’t recede quickly, financials remain under pressure and the business is unprofitable, though narrowed losses have been reported. The latest news may sharpen investor focus on pipeline progress, but does not eliminate the challenge of commercializing innovative, competitive compounds in a rapidly evolving obesity market.

Yet, persistent unprofitability and volatile price swings remain factors any investor should watch closely. According our valuation report, there's an indication that Ascletis Pharma's share price might be on the expensive side.Exploring Other Perspectives

Explore another fair value estimate on Ascletis Pharma - why the stock might be worth less than half the current price!

Build Your Own Ascletis Pharma Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ascletis Pharma research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Ascletis Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ascletis Pharma's overall financial health at a glance.

No Opportunity In Ascletis Pharma?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1672

Ascletis Pharma

A biotechnology company, engages in the research and development, manufacture, marketing, and sale of pharmaceutical products in Mainland China.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives