While shareholders of YiChang HEC ChangJiang Pharmaceutical (HKG:1558) are in the black over 3 years, those who bought a week ago aren't so fortunate

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But in contrast you can make much more than 100% if the company does well. To wit, the YiChang HEC ChangJiang Pharmaceutical Co., Ltd. (HKG:1558) share price has flown 140% in the last three years. Most would be happy with that. Also pleasing for shareholders was the 46% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 22% in 90 days).

While the stock has fallen 4.0% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

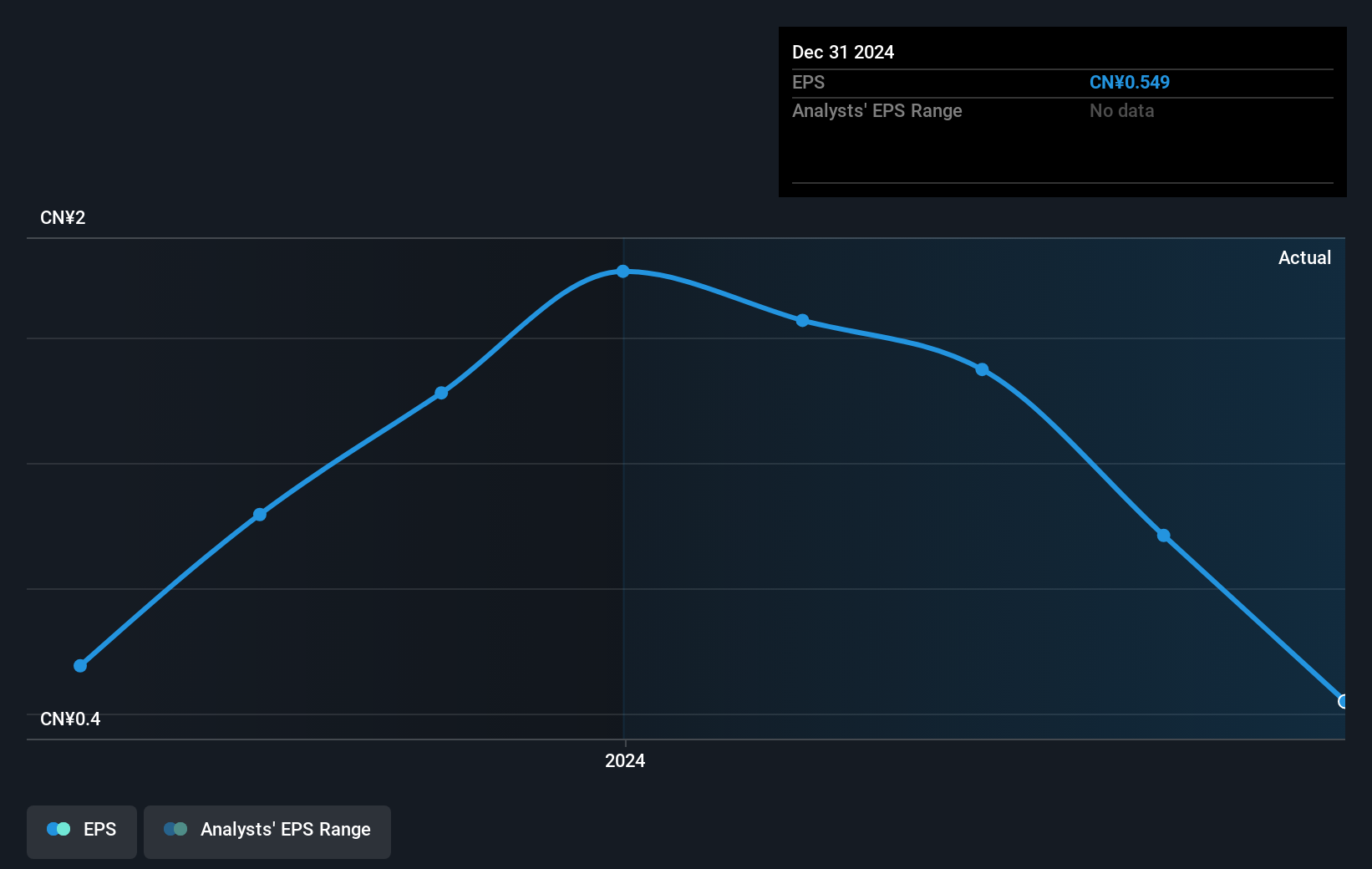

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

YiChang HEC ChangJiang Pharmaceutical became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that YiChang HEC ChangJiang Pharmaceutical has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's good to see that YiChang HEC ChangJiang Pharmaceutical has rewarded shareholders with a total shareholder return of 66% in the last twelve months. That certainly beats the loss of about 0.4% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for YiChang HEC ChangJiang Pharmaceutical you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1558

YiChang HEC ChangJiang Pharmaceutical

Engages in the research, development, manufacture, and sale of pharmaceutical products for the treatment of infectious diseases, chronic diseases, and oncology.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives