- Hong Kong

- /

- Life Sciences

- /

- SEHK:1548

Genscript Biotech Corporation (HKG:1548) May Have Run Too Fast Too Soon With Recent 27% Price Plummet

Genscript Biotech Corporation (HKG:1548) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 22% in that time.

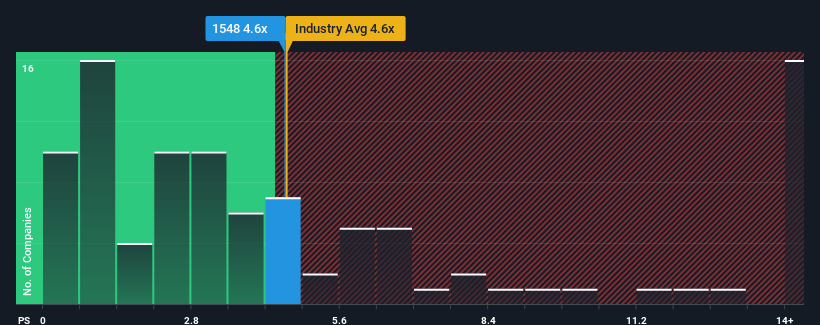

Although its price has dipped substantially, it's still not a stretch to say that Genscript Biotech's price-to-sales (or "P/S") ratio of 4.6x right now seems quite "middle-of-the-road" compared to the Life Sciences industry in Hong Kong, where the median P/S ratio is around 5.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Genscript Biotech

What Does Genscript Biotech's P/S Mean For Shareholders?

Genscript Biotech hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Genscript Biotech's future stacks up against the industry? In that case, our free report is a great place to start .What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Genscript Biotech would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 21% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 15% per year as estimated by the ten analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 18% per year, which is noticeably more attractive.

In light of this, it's curious that Genscript Biotech's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

With its share price dropping off a cliff, the P/S for Genscript Biotech looks to be in line with the rest of the Life Sciences industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of Genscript Biotech's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Genscript Biotech with six simple checks on some of these key factors.

If you're unsure about the strength of Genscript Biotech's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1548

Genscript Biotech

An investment holding company, engages in the manufacture and sale of life science research products and services in the United States of America, Europe, Mainland China, Europe, Asia Pacific, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026