Is 3SBio (SEHK:1530) Undervalued? A Fresh Look at Its Recent Share Price Swings and Valuation

Reviewed by Kshitija Bhandaru

If you own shares in 3SBio (SEHK:1530) or have it on your watchlist, recent price swings might have caught your eye. While there hasn’t been a big event making headlines, the stock’s movement could cause investors to wonder if something is shifting beneath the surface. Sometimes, quieter days can say a lot about how the market views a business, and that can be just as important as splashier news when it comes to deciding what to do next.

Looking more broadly, 3SBio has delivered a steady climb this year, with its share price up over 4% year to date and a similar gain over the past year. That said, investors have seen more volatility recently, including a 6% dip over the last week and smaller losses throughout the past month. These moves come against a backdrop of modest annual revenue growth but a decrease in net profits, which could be weighing on sentiment and shaping the stock’s momentum.

The main question is whether this cautious trading suggests a buying opportunity, or if the market has already taken into account all that 3SBio has to offer for future growth.

Price-to-Earnings of 28.3x: Is it justified?

Based on the preferred valuation metric of price-to-earnings, 3SBio’s shares look undervalued relative to both its Asian and local biotech peers. Its price-to-earnings ratio is 28.3x, which is well below the peer average of 52.7x and the industry average of 43.8x for Asian biotechs. This signals a potential value opportunity.

The price-to-earnings ratio measures how much investors are paying for each dollar of a company's earnings. In the biotechnology sector, this is a commonly used metric because of the emphasis on profits, growth potential, and the long development cycles typical of the industry.

Since 3SBio’s multiple is significantly lower than that of its comparable industry groups, the market may be underappreciating its recent earnings performance and future prospects. This discount suggests that investors might be cautious about its growth outlook or are not pricing in the potential upside strong earnings could deliver.

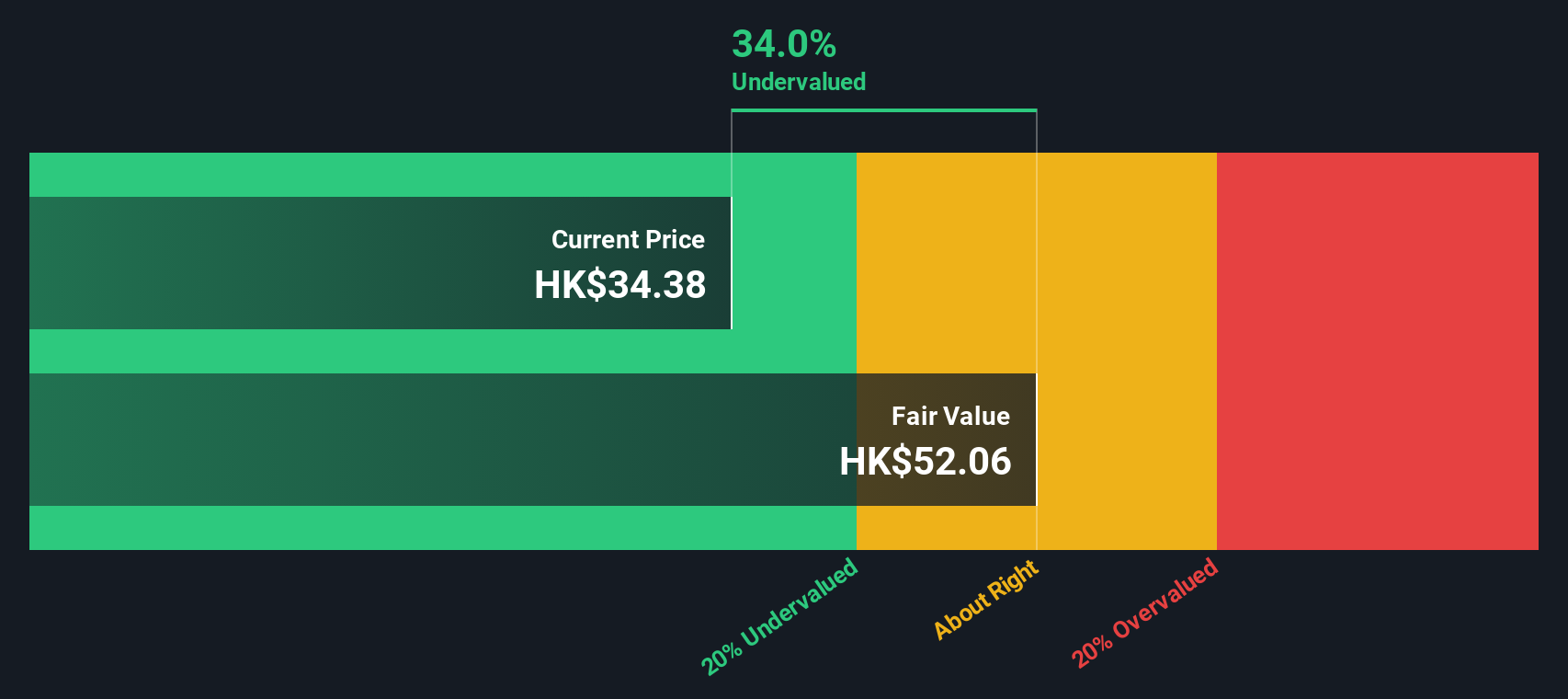

Result: Fair Value of $52.73 (UNDERVALUED)

See our latest analysis for 3SBio.However, a continued decline in net income or weaker-than-expected revenue growth could shift market sentiment and limit the stock's potential for future gains.

Find out about the key risks to this 3SBio narrative.Another View: The SWS DCF Model

Looking at 3SBio through the lens of our DCF model yields a similar picture to the price-to-earnings approach. This indicates the shares may be undervalued. But does this reinforce a genuine bargain or mask future risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own 3SBio Narrative

If you want to dig deeper or have a perspective that differs from what’s presented here, you can put together your own analysis in just a few minutes. Do it your way.

A great starting point for your 3SBio research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Set your portfolio apart and stay ahead of the crowd by tapping into innovative opportunities you may not have considered. Here are three smart starting points on Simply Wall St that you won't want to overlook:

- Uncover stocks with healthy yields and consistent payouts by checking out dividend stocks with yields > 3% for reliable income potential.

- Pinpoint up-and-coming companies in artificial intelligence and robotics by exploring AI penny stocks, which are shaping tomorrow’s technology landscape.

- Kickstart your search for standout companies trading below their intrinsic value using undervalued stocks based on cash flows to spot bargains early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 3SBio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1530

3SBio

An investment holding company, develops, produces markets, and sells biopharmaceutical products in Mainland China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives