How CSPC’s New Depression Drug Trials and Cancer Application Could Shape Its Outlook (SEHK:1093)

Reviewed by Sasha Jovanovic

- In recent developments, CSPC Pharmaceutical Group announced approval to begin clinical trials in China for SYH2056, a novel antidepressant with promising preclinical results, and received acceptance for a marketing authorization application for Pertuzumab Injection targeting HER2-positive breast cancer.

- These innovations signal CSPC’s expanding focus on high-impact therapeutic areas by advancing its pipeline to address unmet medical needs in both mental health and oncology.

- We’ll explore how CSPC’s progress in novel depression treatments could reshape its investment narrative and long-term growth outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is CSPC Pharmaceutical Group's Investment Narrative?

For investors watching CSPC Pharmaceutical Group, the belief centers on its ability to translate R&D momentum into commercial success amid recent earnings softness. The push into high-impact drugs, like the SYH2056 antidepressant now starting clinical trials and the Pertuzumab Injection for HER2-positive breast cancer, injects fresh catalysts into the near-term outlook. These projects, while early-stage, highlight CSPC’s effort to stay relevant as traditional product lines face slower demand and growing market competition. That said, new drug approvals tend to have a limited impact on short-term revenue, so near-term results are still likely anchored by CSPC’s existing portfolio and core businesses. Still, there is the underlying risk that continued profit declines, as seen in the most recent earnings, may keep weighing on sentiment unless the pipeline turns into material sales growth soon. However, ongoing margin pressures remain a crucial consideration for those following the story.

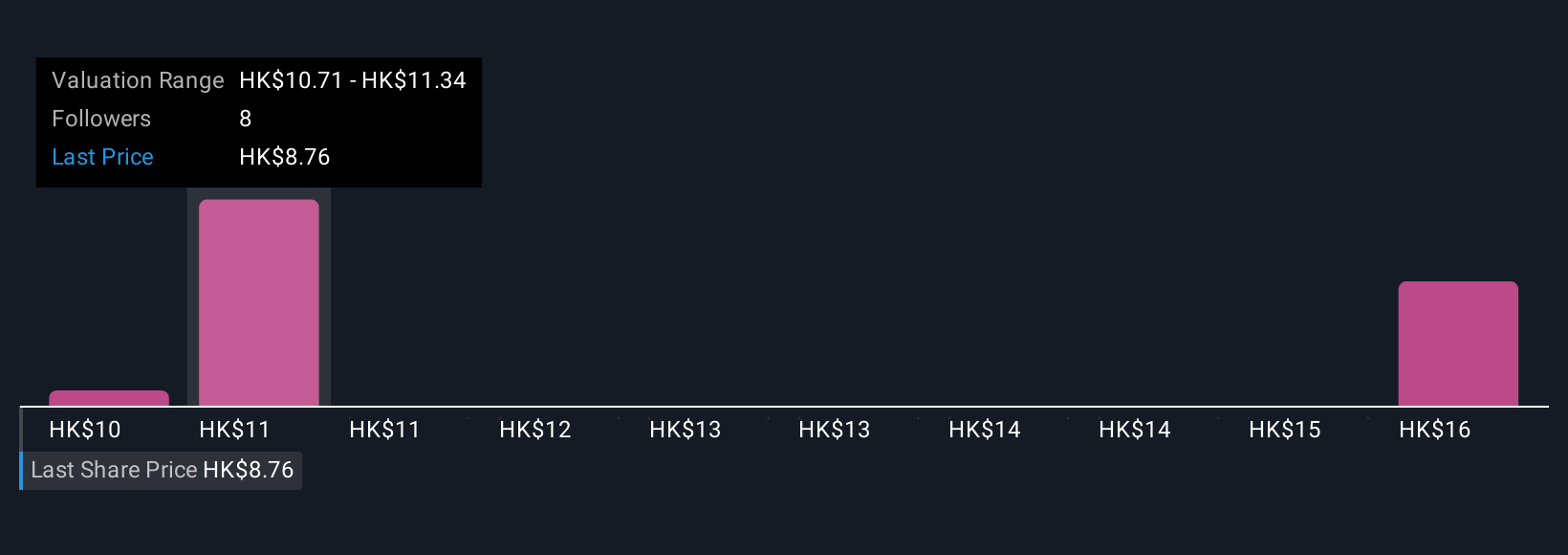

CSPC Pharmaceutical Group's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 4 other fair value estimates on CSPC Pharmaceutical Group - why the stock might be worth just HK$10.08!

Build Your Own CSPC Pharmaceutical Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CSPC Pharmaceutical Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CSPC Pharmaceutical Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CSPC Pharmaceutical Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1093

CSPC Pharmaceutical Group

An investment holding company, engages in the manufacture and sale of pharmaceutical products in Mainland China, other Asian regions, Europe, North America, and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success