Did CSPC’s siRNA and ADC Regulatory Wins Just Shift Its (SEHK:1093) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent announcements by CSPC Pharmaceutical Group, the company received approval to begin clinical trials for its innovative siRNA drug SYH2061 targeting complement component C5, and its co-developed HER2-targeting antibody-drug conjugate JSKN003 was granted Breakthrough Therapy Designation in China for advanced colorectal cancer.

- These regulatory milestones highlight CSPC’s expanding capabilities in developing first-in-class treatments addressing significant unmet clinical needs within China’s rapidly evolving pharmaceutical landscape.

- We’ll examine how CSPC’s pipeline progress in high-need diseases shapes its investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is CSPC Pharmaceutical Group's Investment Narrative?

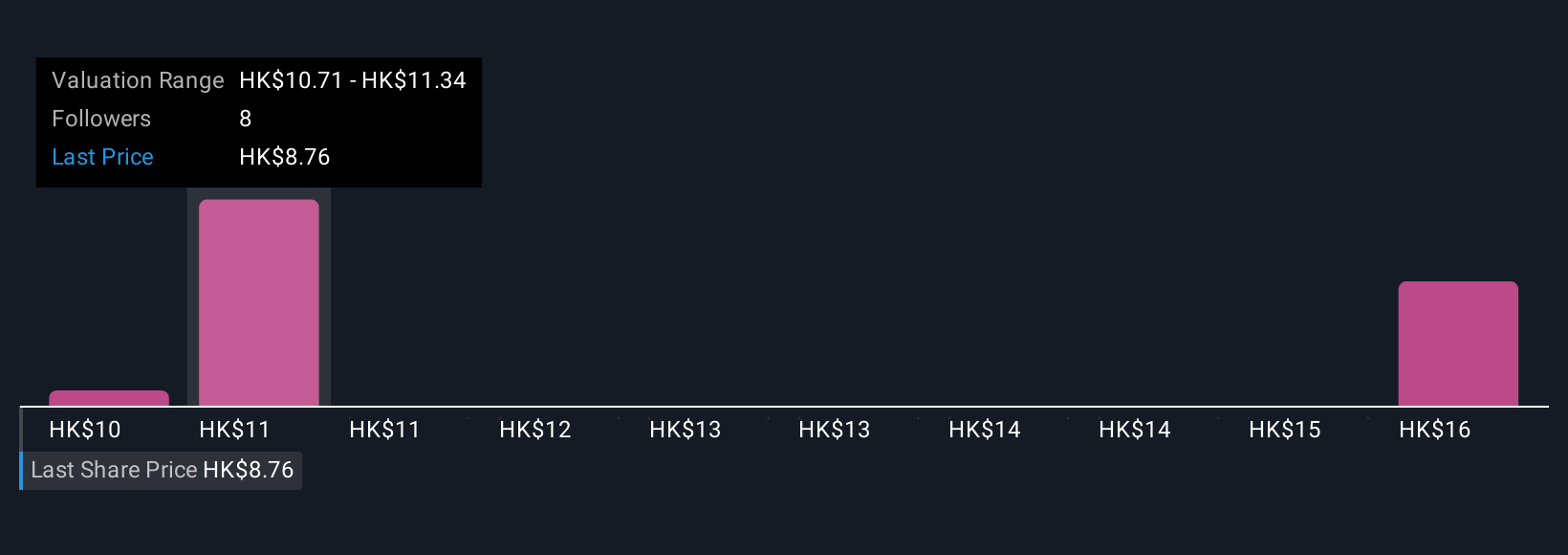

For CSPC Pharmaceutical Group, the thesis really revolves around believing the company can convert its rich drug pipeline into commercial success while navigating cyclical challenges. The recent approvals of SYH2061 and the Breakthrough Therapy Designation for JSKN003 add genuine momentum, potentially shifting short-term catalysts toward positive clinical data readouts and future regulatory milestones. These advancements may encourage greater market confidence if early efficacy signals carry through to larger trials, but actual revenue impact could be some way off. At the same time, near-term earnings have been pressured by declining sales and profits, and the company’s share price has experienced substantial volatility in recent weeks, possibly reflecting uncertain investor sentiment around pipeline risk, execution, and continuing competition within China’s pharmaceutical sector. The biggest risks remain: execution on late-stage trials, the ability to scale successful treatments, and ongoing regulatory changes. If new drugs progress smoothly, investor focus could quickly turn from current headwinds to anticipation of a renewed growth cycle for CSPC.

On the other hand, execution risk in clinical trials remains a real concern for investors. Despite retreating, CSPC Pharmaceutical Group's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 4 other fair value estimates on CSPC Pharmaceutical Group - why the stock might be worth over 2x more than the current price!

Build Your Own CSPC Pharmaceutical Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CSPC Pharmaceutical Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CSPC Pharmaceutical Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CSPC Pharmaceutical Group's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1093

CSPC Pharmaceutical Group

An investment holding company, engages in the manufacture and sale of pharmaceutical products in Mainland China, other Asian regions, Europe, North America, and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives