- Hong Kong

- /

- Entertainment

- /

- SEHK:9999

The Bull Case For NetEase (SEHK:9999) Could Change Following Chartmetric Partnership With NetEase Cloud Music Data

Reviewed by Sasha Jovanovic

- On November 24, 2025, Chartmetric announced the integration of chart data from NetEase Cloud Music, granting global music professionals structured access to regional listening trends in China and closer insight into youth music engagement on one of the country's leading streaming platforms.

- This partnership aims to bridge the data gap between China's unique music ecosystem and the global industry, offering international and independent artists better visibility into Chinese market dynamics.

- We'll examine how the recognition of NetEase Cloud Music's influence among young listeners could impact the broader investment narrative for the company.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

NetEase Investment Narrative Recap

Shareholders in NetEase typically need to believe in the company's ability to sustain growth through its core gaming and digital content platforms while successfully expanding overseas. The recent integration between NetEase Cloud Music and Chartmetric enhances the platform's visibility globally, but does not materially shift the company's most important near-term catalyst, which remains the scaling of its international gaming revenues; the primary risk continues to be NetEase's heavy reliance on the slower-growth Chinese market.

Of the latest announcements, NetEase's third-quarter earnings update is most relevant. Solid year-on-year gains in revenue and net income highlight the resilience of its core operations. While the Chartmetric news spotlights NetEase Cloud Music, the short-term investment outlook for the stock is still most influenced by the revenue momentum in its gaming segment.

However, investors should keep in mind the ongoing execution risks as NetEase seeks to increase international revenue share, especially as...

Read the full narrative on NetEase (it's free!)

NetEase's outlook forecasts CN¥140.2 billion in revenue and CN¥43.2 billion in earnings by 2028. This assumes an 8.5% annual revenue growth and a CN¥9.0 billion earnings increase from the current earnings of CN¥34.2 billion.

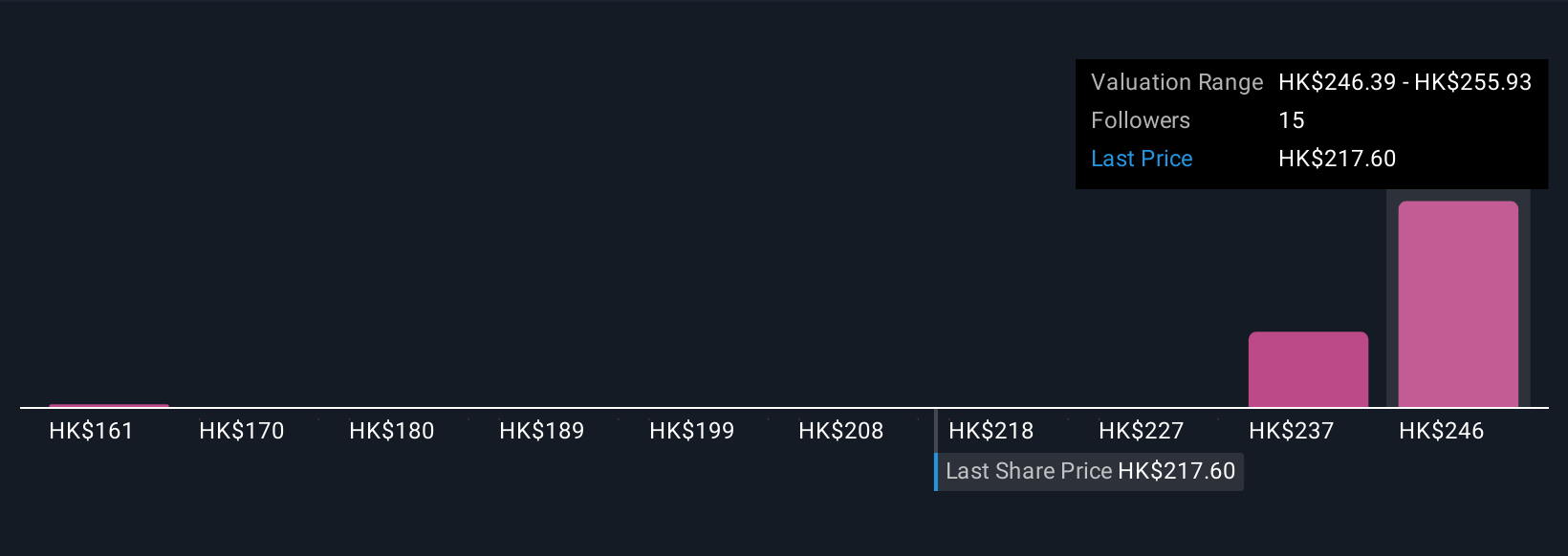

Uncover how NetEase's forecasts yield a HK$255.93 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offer fair value estimates for NetEase ranging from HK$160.54 to HK$255.93 across three analyses. This diversity in price targets stands alongside ongoing concerns over NetEase’s dependency on China for the majority of its revenue, reminding you to weigh different viewpoints on the company’s growth trajectory.

Explore 3 other fair value estimates on NetEase - why the stock might be worth 26% less than the current price!

Build Your Own NetEase Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NetEase research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free NetEase research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NetEase's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NetEase might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9999

NetEase

Engages in online games, music streaming, online intelligent learning services, and internet content services businesses in China and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success