- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:9911

Assessing Newborn Town (SEHK:9911) Valuation Following Estimated Revenue Growth and Tencent Cloud Collaboration

Reviewed by Simply Wall St

Newborn Town (SEHK:9911) shared its estimated operating results for the first three quarters of 2025, highlighting revenue growth of roughly 38%. The company’s expansion is being shaped by advances in AI-based social networking and a new partnership with Tencent Cloud.

See our latest analysis for Newborn Town.

After surging on upbeat growth numbers and the Tencent Cloud partnership news, Newborn Town’s 1-day share price return of 7.17% and 11.68% over the past week signal fresh market enthusiasm. With a 242% share price return so far this year, and an even more impressive 244% total return over twelve months, momentum is clearly building for both short- and long-term investors.

If Newborn Town’s performance has you looking for the next wave of growth stories, this could be the perfect time to discover fast growing stocks with high insider ownership

With shares surging and AI-powered expansion accelerating, the big question for investors now is whether Newborn Town’s impressive run still leaves room for upside or if the market has already factored in its next phase of growth.

Price-to-Earnings of 19.7x: Is it Justified?

Newborn Town’s shares are trading at a price-to-earnings (P/E) ratio of 19.7x, sitting above peer averages and suggesting investors are willing to pay a premium for future growth. At the last close price of HK$11.95, the stock commands a valuation that is higher than its nearest competitors but lower than the industry average.

The price-to-earnings multiple compares a company’s current share price to its earnings per share, providing a quick gauge of relative market expectations for profitability. For a digital media company like Newborn Town, strong performance, rapid growth, or standout profitability can sometimes justify a higher-than-average P/E ratio as investors anticipate further expansion.

Currently, the P/E ratio of 19.7x is above that of its peers (18x), pointing to elevated market optimism. However, it remains below the Asian Interactive Media and Services industry average of 22.2x. Interestingly, it is also below the company’s estimated Fair Price-to-Earnings Ratio of 22.8x, suggesting there is still some headroom if market sentiment or financial results surprise on the upside.

Explore the SWS fair ratio for Newborn Town

Result: Price-to-Earnings of 19.7x (ABOUT RIGHT)

However, slowing revenue growth or unexpected shifts in the AI-driven social networking space could challenge Newborn Town’s current momentum and bullish investor sentiment.

Find out about the key risks to this Newborn Town narrative.

Another View: What Does Our DCF Model Suggest?

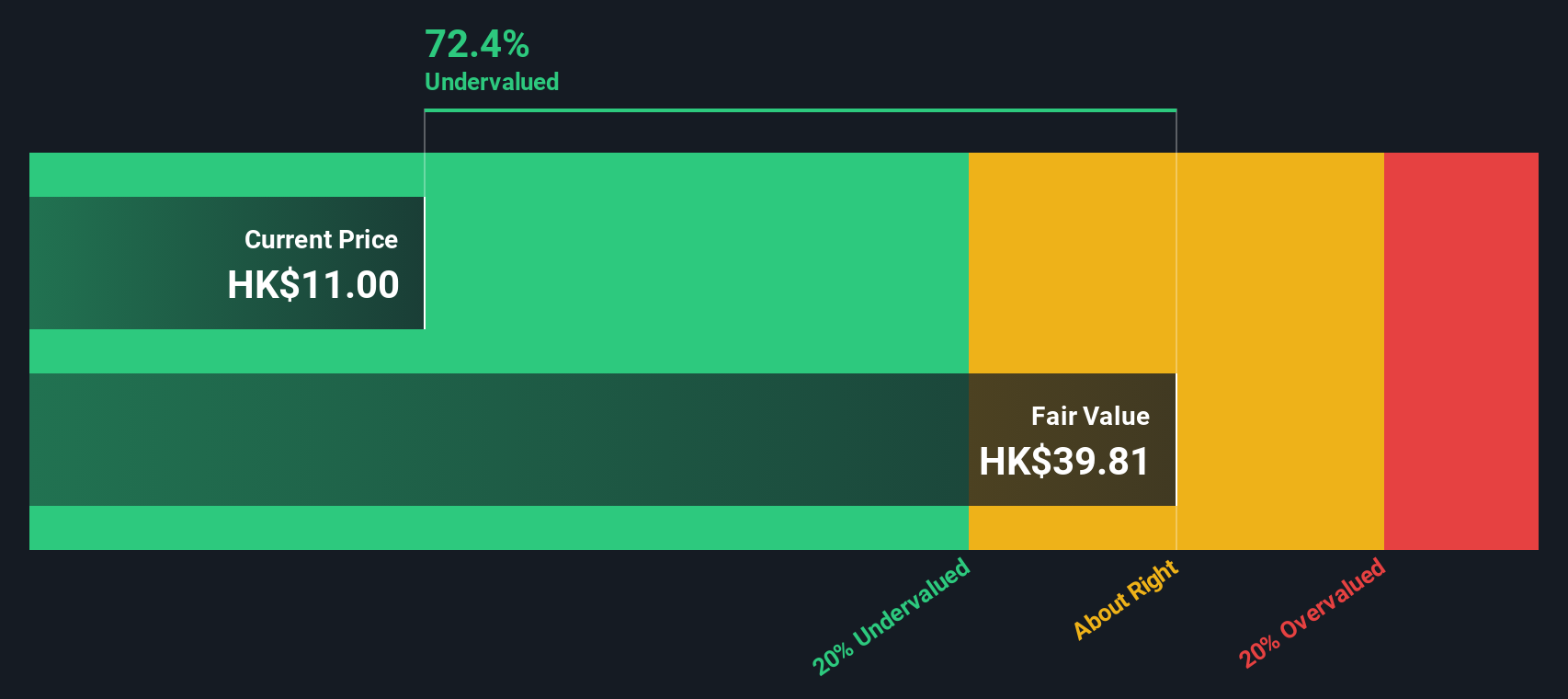

While the market’s optimism is reflected in a higher price-to-earnings ratio, the Simply Wall St DCF model comes to a sharply different conclusion. Based on our DCF model, Newborn Town’s current share price is trading well below what we estimate as its fair value. This implies the stock might be significantly undervalued right now. Does this deep discount signal an overlooked opportunity, or could the market be wary about future risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Newborn Town for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Newborn Town Narrative

If you see Newborn Town differently or want to do your own homework, you can quickly build your own narrative from scratch in just a few minutes. Do it your way

A great starting point for your Newborn Town research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Standout Opportunities?

Stay ahead of the market and uncover your next winning idea. Don’t let these top investment themes slip by; these screens offer a world of potential.

- Target consistent income and robust yields by checking out these 17 dividend stocks with yields > 3%, delivering payments that outpace the market average and add stability to your portfolio.

- Seize the future of medicine with these 33 healthcare AI stocks, showcasing innovative companies merging healthcare and artificial intelligence for tomorrow’s breakthroughs.

- Catalyze your gains with these 80 cryptocurrency and blockchain stocks, featuring trailblazers in blockchain infrastructure, digital payments, and emerging crypto trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newborn Town might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9911

Newborn Town

An investment holding company, engages in the social networking business worldwide.

Undervalued with high growth potential.

Market Insights

Community Narratives