Auditors Are Concerned About Jiading International Group Holdings (HKG:8153)

The harsh reality for Jiading International Group Holdings Ltd (HKG:8153) shareholders is that its auditors, Zhonghui Anda CPA limited, expressed doubts about its ability to continue as a going concern, in its reported results to March 2023. This means that, based on the financial results to that date, the company arguably should raise capital, or otherwise strengthen the balance sheet, as soon as possible.

If the company does have to issue more shares, potential investors will be sure to consider how desperate it is for capital. So current risks on the balance sheet could have a big impact on how shareholders fare from here. The big consideration is whether it can repay its debt, since in the worst case scenario, creditors could force the company to bankruptcy.

Check out our latest analysis for Jiading International Group Holdings

How Much Debt Does Jiading International Group Holdings Carry?

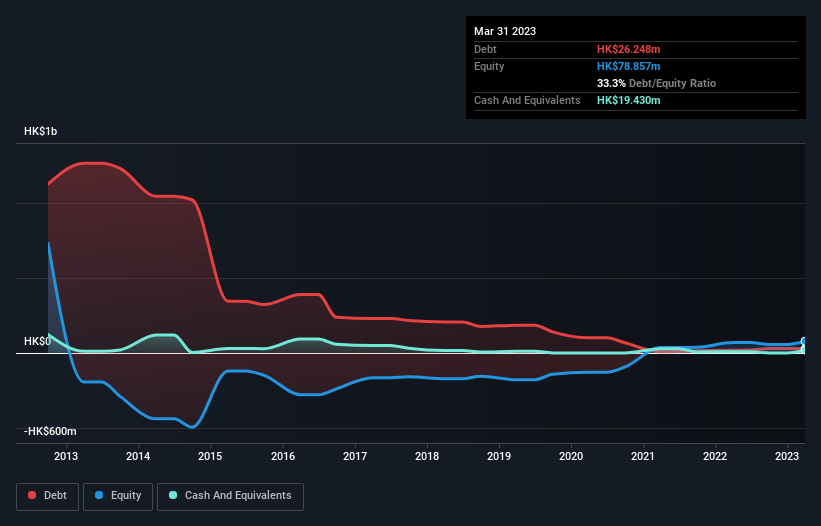

The image below, which you can click on for greater detail, shows that at March 2023 Jiading International Group Holdings had debt of HK$26.2m, up from HK$18.7m in one year. On the flip side, it has HK$19.4m in cash leading to net debt of about HK$6.82m.

How Strong Is Jiading International Group Holdings' Balance Sheet?

We can see from the most recent balance sheet that Jiading International Group Holdings had liabilities of HK$48.1m falling due within a year, and liabilities of HK$3.30m due beyond that. On the other hand, it had cash of HK$19.4m and HK$73.1m worth of receivables due within a year. So it actually has HK$41.1m more liquid assets than total liabilities.

This excess liquidity suggests that Jiading International Group Holdings is taking a careful approach to debt. Because it has plenty of assets, it is unlikely to have trouble with its lenders. There's no doubt that we learn most about debt from the balance sheet. But it is Jiading International Group Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Jiading International Group Holdings wasn't profitable at an EBIT level, but managed to grow its revenue by 52%, to HK$97m. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

While we can certainly appreciate Jiading International Group Holdings's revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. To be specific the EBIT loss came in at HK$18m. On a more positive note, the company does have liquid assets, so it has a bit of time to improve its operations before the debt becomes an acute problem. Still, we'd be more encouraged to study the business in depth if it already had some free cash flow. So it seems too risky for our taste. We're too cautious to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. That's because companies should always make sure the auditor has confidence that the company will continue as a going concern, in our view. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Jiading International Group Holdings is showing 3 warning signs in our investment analysis , and 2 of those don't sit too well with us...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8153

Jiading International Group Holdings

An investment holding company, provides advertising services in the People's Republic of China.

Flawless balance sheet slight.

Market Insights

Community Narratives