There's Reason For Concern Over Joy Spreader Group Inc.'s (HKG:6988) Massive 54% Price Jump

Despite an already strong run, Joy Spreader Group Inc. (HKG:6988) shares have been powering on, with a gain of 54% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 54% in the last year.

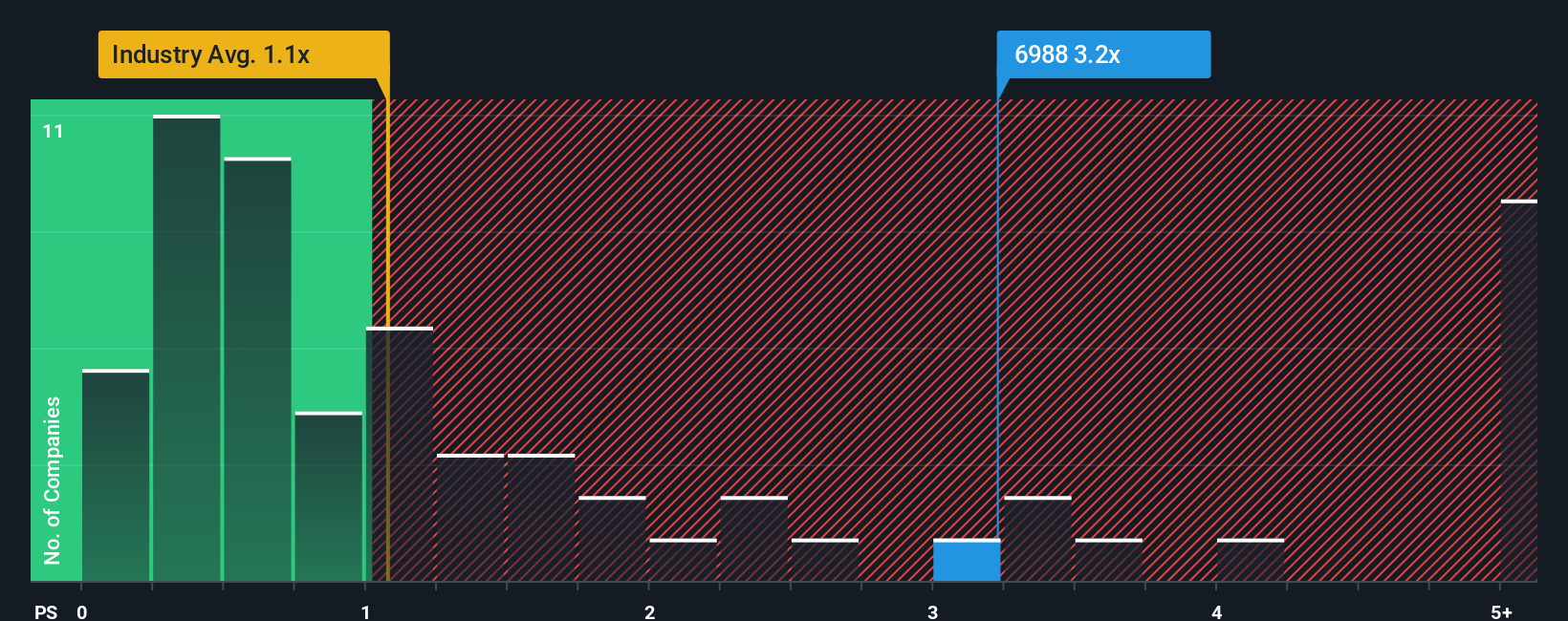

Following the firm bounce in price, you could be forgiven for thinking Joy Spreader Group is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.2x, considering almost half the companies in Hong Kong's Media industry have P/S ratios below 1.1x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Joy Spreader Group

How Joy Spreader Group Has Been Performing

For example, consider that Joy Spreader Group's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Joy Spreader Group will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Joy Spreader Group's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 98% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 92% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 14% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's alarming that Joy Spreader Group's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Shares in Joy Spreader Group have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Joy Spreader Group currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Joy Spreader Group (1 can't be ignored!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6988

Joy Spreader Group

A marketing technology company, provides digital marketing and related services in Mainland China and Hong Kong.

Flawless balance sheet with low risk.

Market Insights

Community Narratives