SinoMedia Holding Limited's (HKG:623) 26% Price Boost Is Out Of Tune With Earnings

Despite an already strong run, SinoMedia Holding Limited (HKG:623) shares have been powering on, with a gain of 26% in the last thirty days. The annual gain comes to 102% following the latest surge, making investors sit up and take notice.

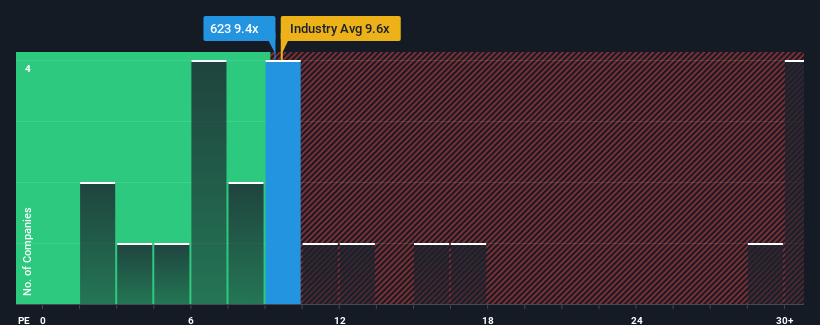

Even after such a large jump in price, there still wouldn't be many who think SinoMedia Holding's price-to-earnings (or "P/E") ratio of 9.4x is worth a mention when the median P/E in Hong Kong is similar at about 10x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

For instance, SinoMedia Holding's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for SinoMedia Holding

How Is SinoMedia Holding's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like SinoMedia Holding's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 26% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 21% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's somewhat alarming that SinoMedia Holding's P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Key Takeaway

Its shares have lifted substantially and now SinoMedia Holding's P/E is also back up to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that SinoMedia Holding currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

It is also worth noting that we have found 2 warning signs for SinoMedia Holding that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:623

SinoMedia Holding

An investment holding company, provides TV advertisement, creative content production, and digital marketing services for advertisers and advertising agents in the People's Republic of China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026