Did You Manage To Avoid One Media Group's (HKG:426) Painful 55% Share Price Drop?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

One Media Group Limited (HKG:426) shareholders should be happy to see the share price up 26% in the last month. But that doesn't change the fact that the returns over the last three years have been disappointing. In that time, the share price dropped 55%. So it is really good to see an improvement. The rise has some hopeful, but turnarounds are often precarious.

See our latest analysis for One Media Group

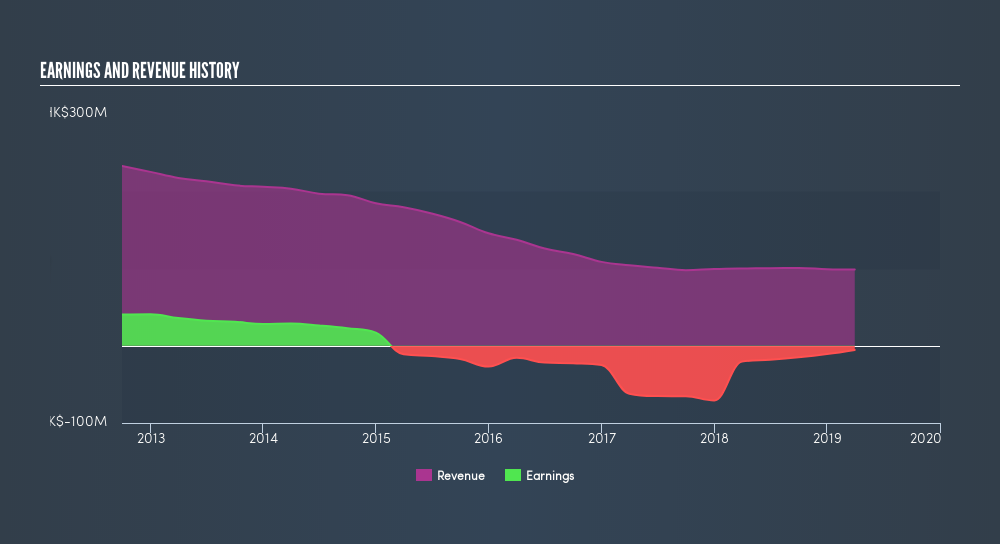

One Media Group isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, One Media Group's revenue dropped 9.7% per year. That is not a good result. The share price decline of 24% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

This free interactive report on One Media Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered One Media Group's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that One Media Group's TSR, which was a 55% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

While the broader market lost about 3.2% in the twelve months, One Media Group shareholders did even worse, losing 49%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 3.4%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:426

One Media Group

An investment holding company, engages in the magazine publishing and digital media businesses in Hong Kong and Taiwan.

Slight with imperfect balance sheet.

Market Insights

Community Narratives