Hong Kong Economic Times Holdings' (HKG:423) Shareholders Will Receive A Bigger Dividend Than Last Year

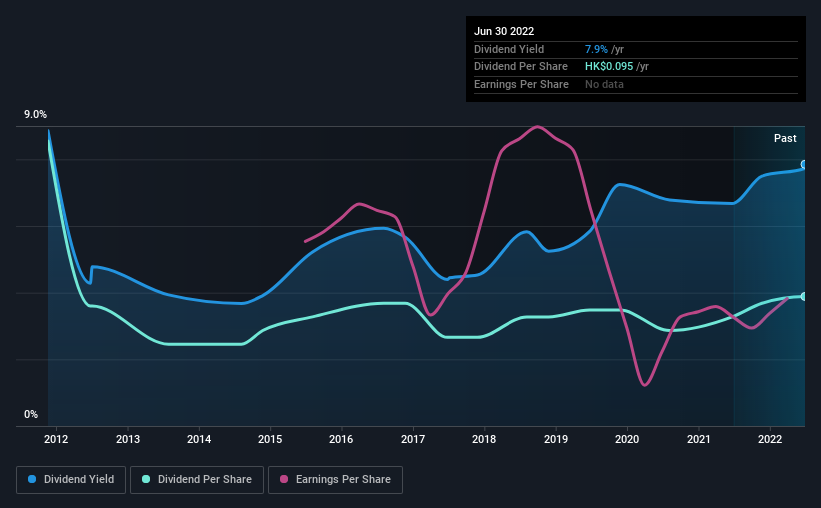

The board of Hong Kong Economic Times Holdings Limited (HKG:423) has announced that it will be increasing its dividend on the 9th of September to HK$0.065. This will take the dividend yield from 7.9% to 7.9%, providing a nice boost to shareholder returns.

See our latest analysis for Hong Kong Economic Times Holdings

Hong Kong Economic Times Holdings Is Paying Out More Than It Is Earning

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Prior to this announcement, the company was paying out 124% of what it was earning, however the dividend was quite comfortably covered by free cash flows at a cash payout ratio of only 36%. Given that the dividend is a cash outflow, we think that cash is more important than accounting measures of profit when assessing the dividend, so this is a mitigating factor.

Over the next year, EPS could expand by 2.8% if the company continues along the path it has been on recently. However, if the dividend continues growing along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 122% over the next year.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. The first annual payment during the last 10 years was HK$0.21 in 2012, and the most recent fiscal year payment was HK$0.095. This works out to be a decline of approximately 7.6% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend's Growth Prospects Are Limited

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Earnings has been rising at 2.8% per annum over the last five years, which admittedly is a bit slow. So the company has struggled to grow its EPS yet it's still paying out 124% of its earnings. Limited recent earnings growth and a high payout ratio makes it hard for us to envision strong future dividend growth, unless the company should have substantial pricing power or some form of competitive advantage.

Our Thoughts On Hong Kong Economic Times Holdings' Dividend

Overall, we always like to see the dividend being raised, but we don't think Hong Kong Economic Times Holdings will make a great income stock. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We don't think Hong Kong Economic Times Holdings is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 3 warning signs for Hong Kong Economic Times Holdings (of which 1 is concerning!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong Economic Times Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:423

Hong Kong Economic Times Holdings

An investment holding company, operates as a diversified multi-media company primarily in Hong Kong and Mainland China.

Flawless balance sheet and good value.

Market Insights

Community Narratives