Unfortunately for shareholders, when Mei Ah Entertainment Group Limited (HKG:391) reported results for the period to March 2021, its auditors, PricewaterhouseCoopers LLP, expressed uncertainty about whether it can continue as a going concern. Thus we can say that, based on the results to that date, the company should raise capital or otherwise raise cash, without much delay.

Given its situation, it may not be in a good position to raise capital on favorable terms. So shareholders should absolutely be taking a close look at how risky the balance sheet is. Debt is always a risk factor in these cases, as creditors could be in a position to wind up the company, in the worst case scenario.

View our latest analysis for Mei Ah Entertainment Group

How Much Debt Does Mei Ah Entertainment Group Carry?

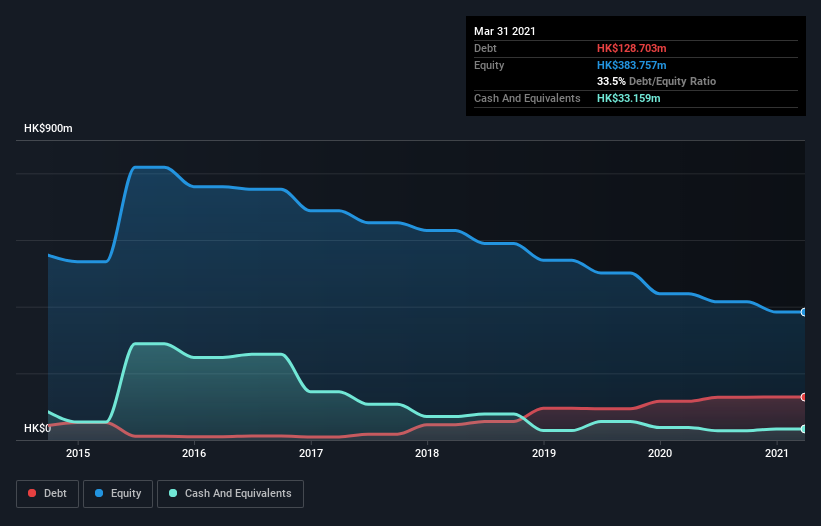

As you can see below, at the end of March 2021, Mei Ah Entertainment Group had HK$128.7m of debt, up from HK$116.4m a year ago. Click the image for more detail. However, it does have HK$33.2m in cash offsetting this, leading to net debt of about HK$95.5m.

How Healthy Is Mei Ah Entertainment Group's Balance Sheet?

The latest balance sheet data shows that Mei Ah Entertainment Group had liabilities of HK$190.1m due within a year, and liabilities of HK$207.1m falling due after that. On the other hand, it had cash of HK$33.2m and HK$36.6m worth of receivables due within a year. So its liabilities total HK$327.4m more than the combination of its cash and short-term receivables.

Mei Ah Entertainment Group has a market capitalization of HK$556.8m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. There's no doubt that we learn most about debt from the balance sheet. But it is Mei Ah Entertainment Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Mei Ah Entertainment Group had a loss before interest and tax, and actually shrunk its revenue by 38%, to HK$96m. That makes us nervous, to say the least.

Caveat Emptor

Not only did Mei Ah Entertainment Group's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost HK$52m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled HK$592k in negative free cash flow over the last twelve months. So to be blunt we think it is risky. We prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. That's because we find it more comfortable to invest in companies that always keep the balance sheet reasonably strong. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example Mei Ah Entertainment Group has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:391

Mei Ah Entertainment Group

An investment holding company, engages in channel operation business primarily in Hong Kong, Mainland China, and Taiwan.

Imperfect balance sheet with minimal risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026