- China

- /

- Metals and Mining

- /

- SHSE:601388

Karrie International Holdings And 2 Other Promising Asian Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating trade relations and evolving economic policies, the Asian stock market continues to capture investor interest with its diverse opportunities. Penny stocks, though often seen as a relic of past investment trends, remain relevant for those seeking growth potential in smaller or emerging companies. When these stocks are supported by robust financial health and sound fundamentals, they can offer promising prospects without many of the typical risks associated with this segment.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.94 | HK$2.39B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.51 | HK$933.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.74 | THB1.15B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.61 | HK$2.17B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.04 | SGD421.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.097 | SGD50.78M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.48 | SGD13.7B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.05 | HK$2.82B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.30 | THB8.69B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 955 stocks from our Asian Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Karrie International Holdings (SEHK:1050)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Karrie International Holdings Limited is an investment holding company that manufactures and sells metal, plastic, and electronic products across Hong Kong, Japan, Mainland China, Asia, North America, and Western Europe with a market cap of HK$6.10 billion.

Operations: The company's revenue is primarily generated from its Metal and Plastic Business, contributing HK$2.04 billion, and its Electronic Manufacturing Services Business, which brings in HK$1.20 billion.

Market Cap: HK$6.1B

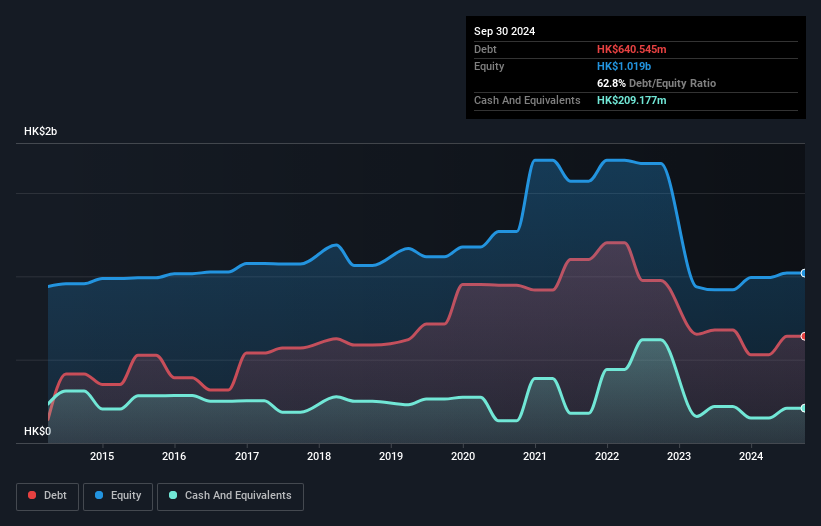

Karrie International Holdings has demonstrated robust financial health with its interest payments well covered by EBIT, and operating cash flow effectively covering its debt. Despite a high net debt to equity ratio of 41.2%, the company's short-term assets surpass both long-term and short-term liabilities, indicating sound liquidity management. Recent executive changes may bolster strategic leadership, while the issuance of convertible bonds for HK$150 million could provide additional capital for growth initiatives. However, investors should be cautious of the stock's increased volatility and relatively low return on equity at 19%.

- Click here and access our complete financial health analysis report to understand the dynamics of Karrie International Holdings.

- Evaluate Karrie International Holdings' historical performance by accessing our past performance report.

Inkeverse Group (SEHK:3700)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Inkeverse Group Limited is an investment holding company that operates mobile live streaming platforms in the People's Republic of China, with a market cap of approximately HK$2.11 billion.

Operations: The company generates revenue from its live streaming business, amounting to CN¥5.99 billion.

Market Cap: HK$2.11B

Inkeverse Group Limited, with a market cap of HK$2.11 billion, operates in the mobile live streaming sector and reported revenues of CN¥5.99 billion. The company's short-term assets significantly exceed both its short-term and long-term liabilities, reflecting strong liquidity. Despite being debt-free, Inkeverse has experienced negative earnings growth over the past year. However, recent reports show improved net income for the first half of 2025 at CN¥244.27 million compared to last year due to changes in financial instruments' fair value. Insider selling has been significant recently; nevertheless, shares have not faced meaningful dilution over the past year.

- Dive into the specifics of Inkeverse Group here with our thorough balance sheet health report.

- Understand Inkeverse Group's track record by examining our performance history report.

Yechiu Metal Recycling (China) (SHSE:601388)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yechiu Metal Recycling (China) Ltd. operates in the aluminum alloy recycling industry across Asia and the United States, with a market cap of CN¥6.87 billion.

Operations: Yechiu Metal Recycling (China) Ltd. does not report specific revenue segments.

Market Cap: CN¥6.87B

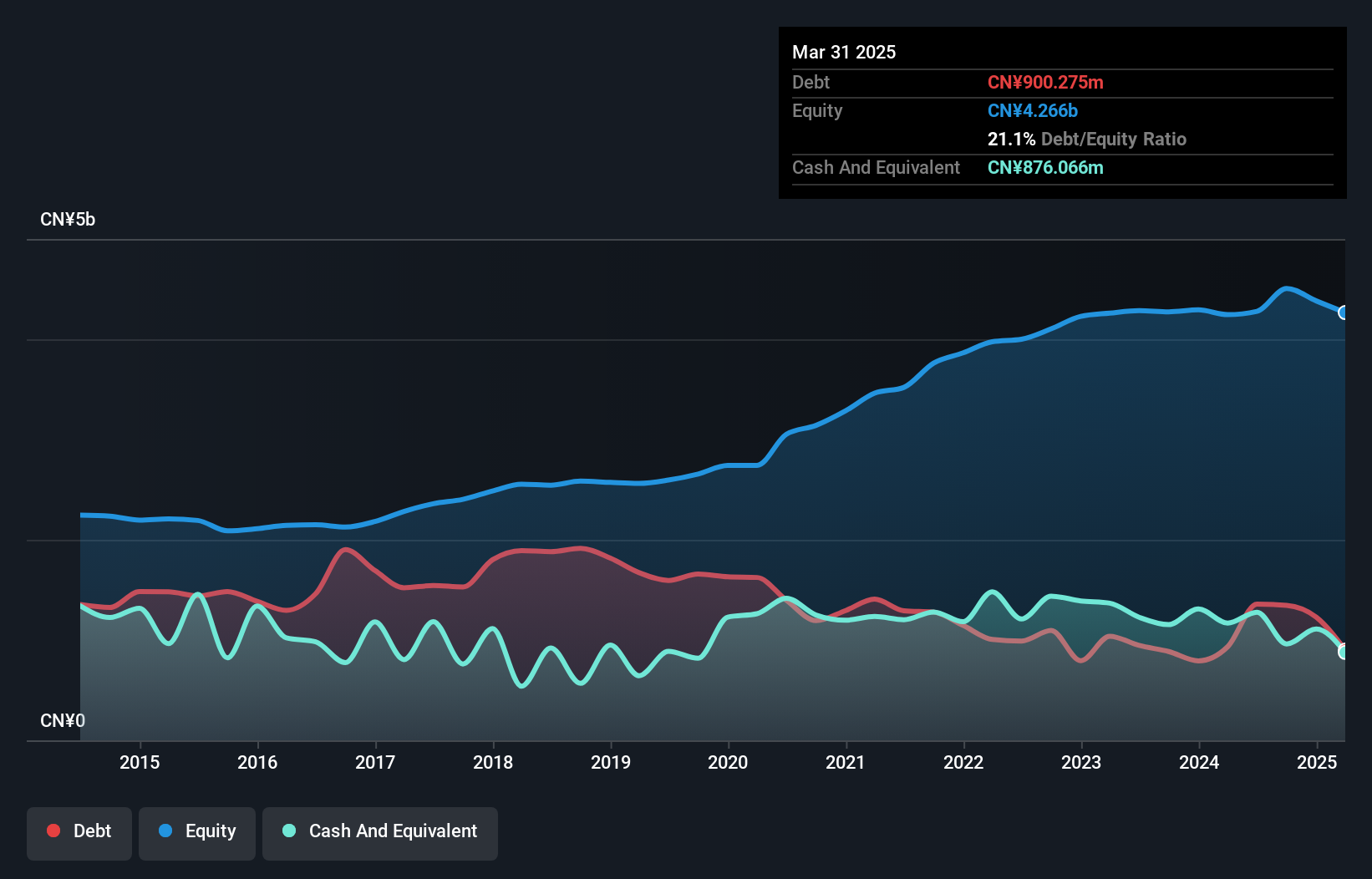

Yechiu Metal Recycling (China) Ltd., with a market cap of CN¥6.87 billion, reported sales of CN¥5.59 billion for the nine months ended September 30, 2025, showing growth from the previous year. The company's short-term assets exceed its liabilities, indicating solid liquidity management. Despite a reduced debt-to-equity ratio and satisfactory net debt levels, Yechiu's return on equity remains low at 0.8%, with profit margins declining to 0.5% from last year's 1.3%. Earnings have decreased significantly over five years; however, interest payments are well-covered by EBIT at four times coverage, reflecting financial stability amidst challenges in profit growth.

- Click to explore a detailed breakdown of our findings in Yechiu Metal Recycling (China)'s financial health report.

- Gain insights into Yechiu Metal Recycling (China)'s historical outcomes by reviewing our past performance report.

Next Steps

- Investigate our full lineup of 955 Asian Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601388

Yechiu Metal Recycling (China)

Engages in aluminum alloy recycling business in Asia and the United States.

Flawless balance sheet with low risk.

Market Insights

Community Narratives