- Hong Kong

- /

- Entertainment

- /

- SEHK:302

Here's Why I Think CMGE Technology Group (HKG:302) Is An Interesting Stock

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like CMGE Technology Group (HKG:302). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for CMGE Technology Group

How Fast Is CMGE Technology Group Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that CMGE Technology Group has managed to grow EPS by 27% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

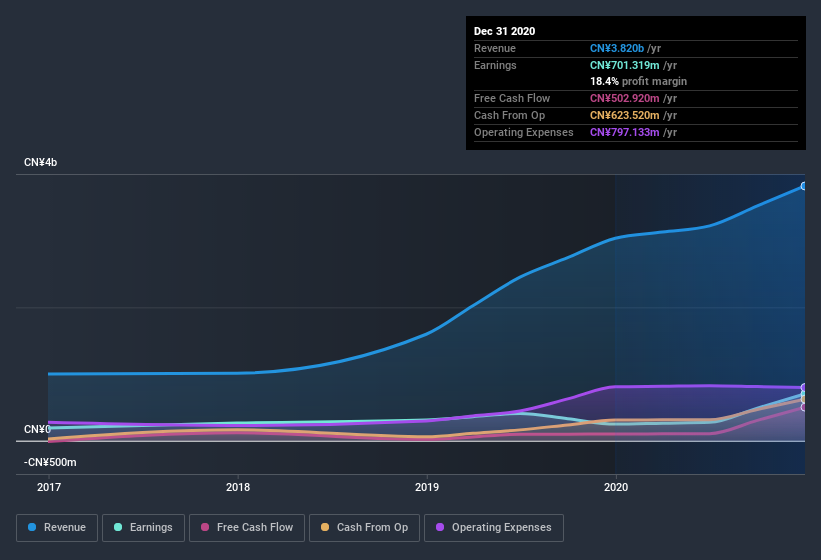

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). The good news is that CMGE Technology Group is growing revenues, and EBIT margins improved by 2.2 percentage points to 11%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of CMGE Technology Group's forecast profits?

Are CMGE Technology Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One shining light for CMGE Technology Group is the serious outlay one insider has made to buy shares, in the last year. Specifically, in one large transaction Vice Chairman of Board Hendrick Sin paid HK$2.6m, for stock at HK$2.76 per share. Big insider buys like that are almost as rare as an ocean free of single use plastic waste.

Along with the insider buying, another encouraging sign for CMGE Technology Group is that insiders, as a group, have a considerable shareholding. Given insiders own a small fortune of shares, currently valued at CN¥773m, they have plenty of motivation to push the business to succeed. At 10% of the company, the co-investment by insiders gives me confidence that management will make long-term focussed decisions.

Should You Add CMGE Technology Group To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about CMGE Technology Group's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. So I do think this is one stock worth watching. What about risks? Every company has them, and we've spotted 4 warning signs for CMGE Technology Group (of which 1 doesn't sit too well with us!) you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of CMGE Technology Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade CMGE Technology Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:302

CMGE Technology Group

An investment holding company, develops and publishes intellectual property (IP)-based games in Mainland China and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives