- Hong Kong

- /

- Entertainment

- /

- SEHK:2660

Is Now The Time To Put Zengame Technology Holding (HKG:2660) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Zengame Technology Holding (HKG:2660). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Zengame Technology Holding

How Fast Is Zengame Technology Holding Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. To the delight of shareholders, Zengame Technology Holding has achieved impressive annual EPS growth of 57%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

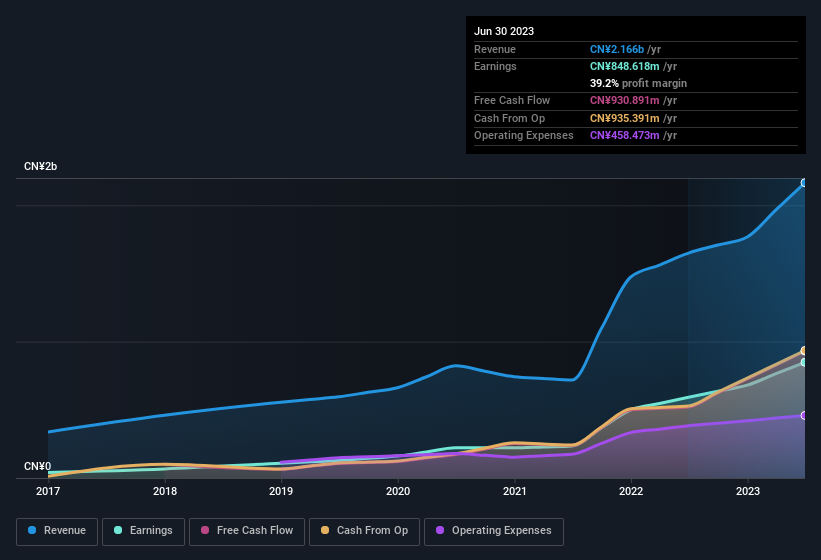

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Zengame Technology Holding shareholders is that EBIT margins have grown from 38% to 42% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Zengame Technology Holding's balance sheet strength, before getting too excited.

Are Zengame Technology Holding Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So we're pleased to report that Zengame Technology Holding insiders own a meaningful share of the business. Indeed, with a collective holding of 69%, company insiders are in control and have plenty of capital behind the venture. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. This insider holding amounts to This is an incredible endorsement from them.

Does Zengame Technology Holding Deserve A Spot On Your Watchlist?

Zengame Technology Holding's earnings per share have been soaring, with growth rates sky high. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So at the surface level, Zengame Technology Holding is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. It is worth noting though that we have found 2 warning signs for Zengame Technology Holding that you need to take into consideration.

Although Zengame Technology Holding certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Hong Kong companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Zengame Technology Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2660

Zengame Technology Holding

An investment holding company, develops and operates mobile games primarily in the People’s Republic of China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives