- Hong Kong

- /

- Entertainment

- /

- SEHK:2306

Asian Penny Stocks To Watch In August 2025

Reviewed by Simply Wall St

As global markets experience fluctuations, with notable movements in major indices and ongoing trade policy developments, investors are keeping a close eye on the Asian market. While the term "penny stock" may evoke images of outdated trading practices, these smaller or newer companies still hold potential for significant growth when backed by strong financials. In this context, we explore three penny stocks that combine balance sheet strength with potential for growth, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.36 | THB4.31B | ✅ 4 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.49 | HK$921.6M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.52 | HK$2.1B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.55 | SGD222.91M | ✅ 3 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.16 | HK$1.94B | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.89 | SGD11.37B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.95 | THB1.4B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.88 | THB9.86B | ✅ 3 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.57 | SGD979.43M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 974 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

YH Entertainment Group (SEHK:2306)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: YH Entertainment Group, with a market cap of HK$2.02 billion, primarily focuses on artist management in Mainland China and Korea.

Operations: The company's revenue is primarily generated from Artist Management at CN¥694.57 million, followed by Music IP Production and Operation at CN¥42.21 million, and Pan-Entertainment Business at CN¥27.76 million.

Market Cap: HK$2.02B

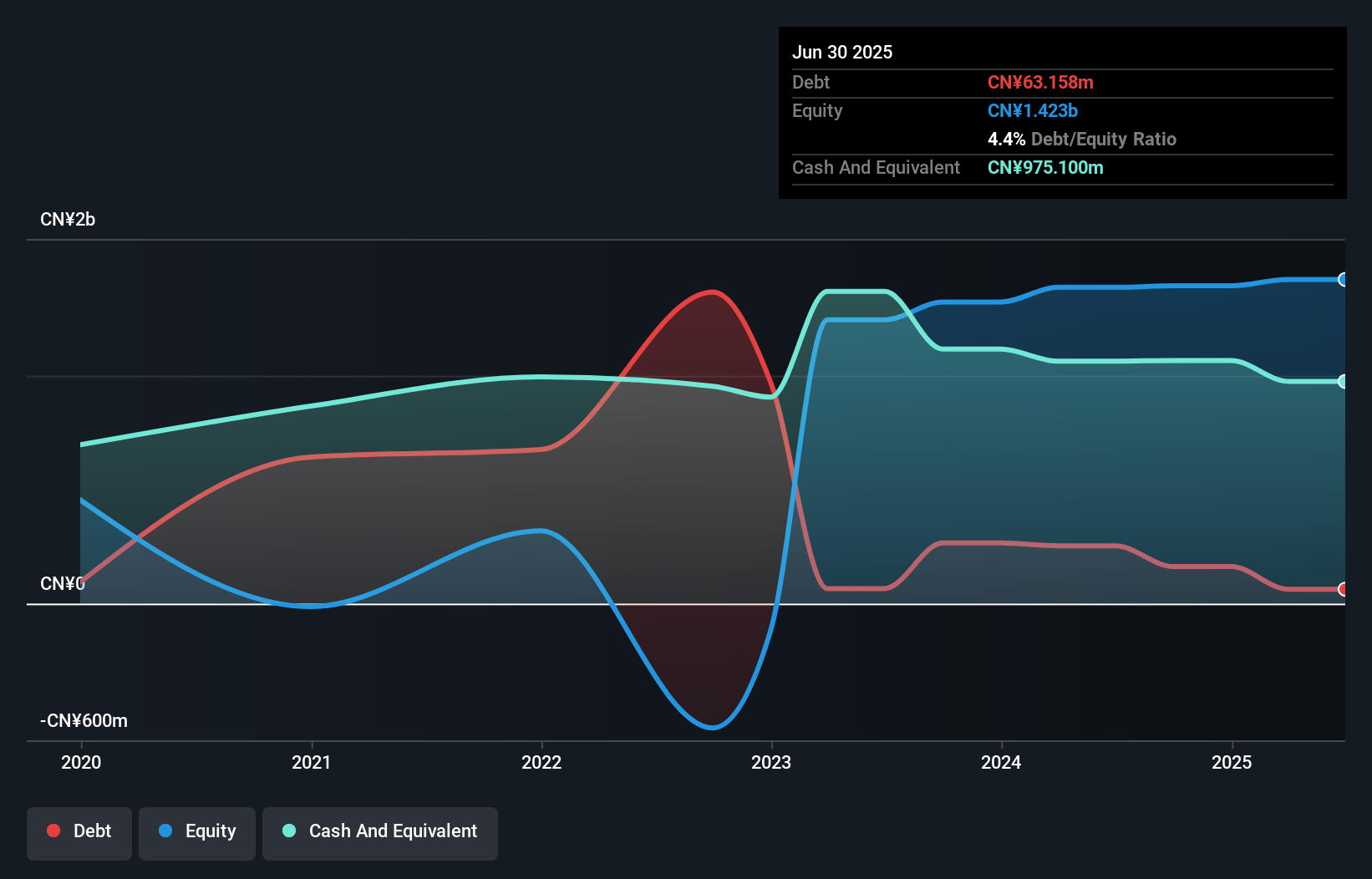

YH Entertainment Group, with a market cap of HK$2.02 billion, has recently become profitable, although its earnings have declined by 11.6% annually over the past five years. The company benefits from solid financial health, as its debt is well covered by operating cash flow and it holds more cash than total debt. However, it faces challenges with high share price volatility and low return on equity at 3.2%. Recent share buybacks aim to enhance net asset value per share and earnings per share, potentially providing some stability amidst management's relatively inexperienced board tenure of 2.9 years on average.

- Click here and access our complete financial health analysis report to understand the dynamics of YH Entertainment Group.

- Understand YH Entertainment Group's track record by examining our performance history report.

Linmon Media (SEHK:9857)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Linmon Media Limited is an investment holding company involved in the production, distribution, and licensing of drama series broadcasting rights in Mainland China and internationally, with a market cap of HK$1.45 billion.

Operations: The company generates revenue primarily from the licensing of broadcasting rights of original drama series, amounting to CN¥591.46 million, and content marketing, contributing CN¥29.86 million.

Market Cap: HK$1.45B

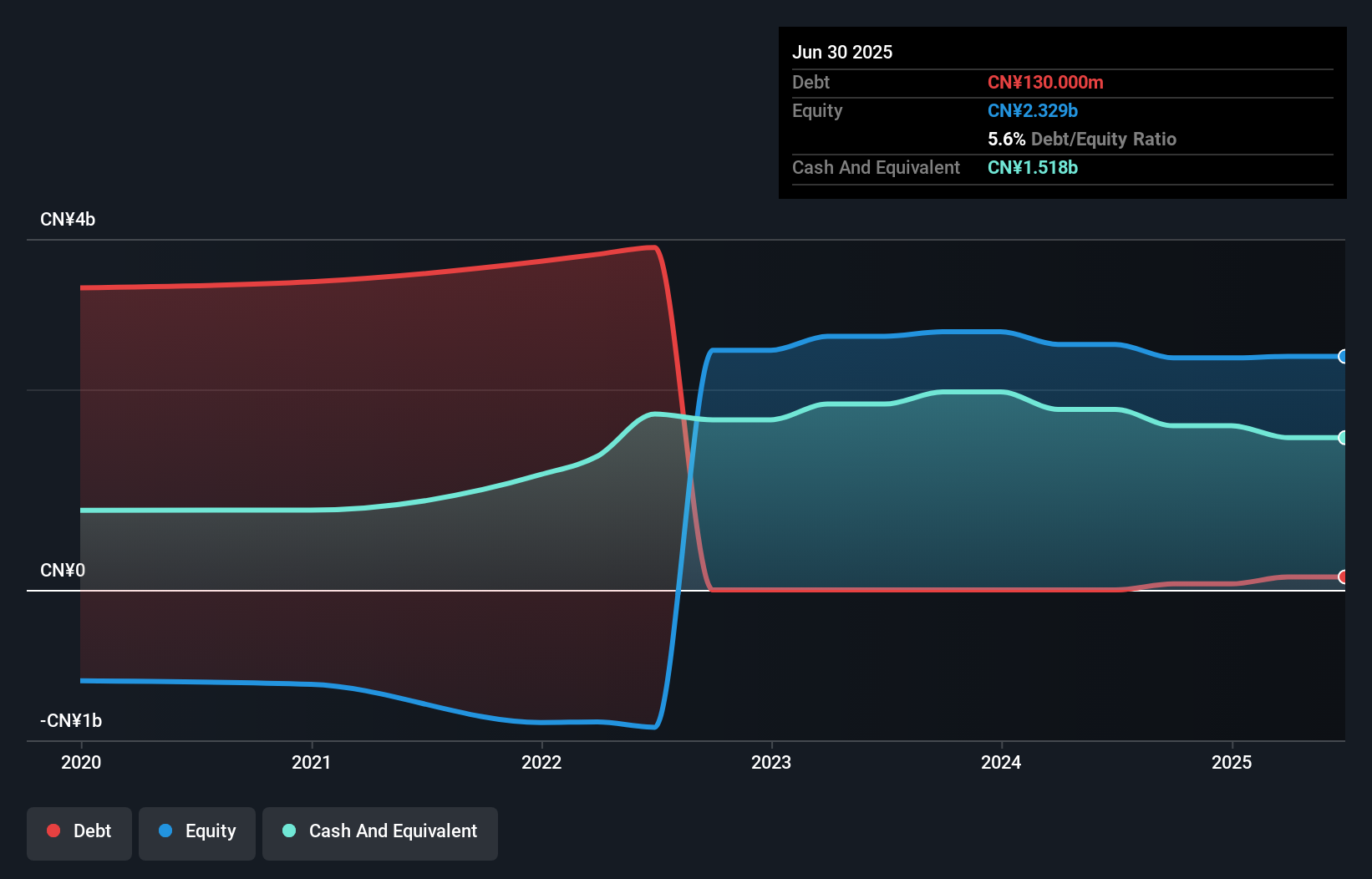

Linmon Media Limited, with a market cap of HK$1.45 billion, has shown signs of financial improvement, transitioning from a net loss to an expected net profit of RMB 10-12 million for the first half of 2025. This turnaround is attributed to revenue growth from quality original drama series and improved budget management. Despite being unprofitable in recent years with an earnings decline rate of 11.8% annually over five years, Linmon maintains strong liquidity, as its short-term assets significantly exceed liabilities and it holds more cash than total debt. However, the stock remains highly volatile compared to other Hong Kong stocks.

- Take a closer look at Linmon Media's potential here in our financial health report.

- Gain insights into Linmon Media's future direction by reviewing our growth report.

Elec-Tech International (SZSE:002005)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Elec-Tech International Co., Ltd. manufactures and sells small household appliances and LED products both in China and internationally, with a market cap of CN¥4.89 billion.

Operations: Elec-Tech International Co., Ltd. has not reported specific revenue segments.

Market Cap: CN¥4.89B

Elec-Tech International, with a market cap of CN¥4.89 billion, faces challenges typical of penny stocks, such as unprofitability and a negative return on equity (-47.42%). The company has more cash than debt but struggles with short-term liabilities exceeding its assets (CN¥460.7M vs CN¥730.3M). Despite an inexperienced board and declining earnings over the past five years, Elec-Tech's cash runway could last two years if current free cash flow trends persist. Recent events include shareholder meetings addressing audit firm changes and financial strategies amid ongoing operational adjustments in the competitive consumer durables sector.

- Get an in-depth perspective on Elec-Tech International's performance by reading our balance sheet health report here.

- Gain insights into Elec-Tech International's historical outcomes by reviewing our past performance report.

Key Takeaways

- Reveal the 974 hidden gems among our Asian Penny Stocks screener with a single click here.

- Seeking Other Investments? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2306

YH Entertainment Group

An investment holding company, operates as an artist management company in Mainland China and Korea.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives