- Hong Kong

- /

- Entertainment

- /

- SEHK:1981

Cathay Media and Education Group Inc.'s (HKG:1981) 28% Share Price Surge Not Quite Adding Up

Cathay Media and Education Group Inc. (HKG:1981) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 33% over that time.

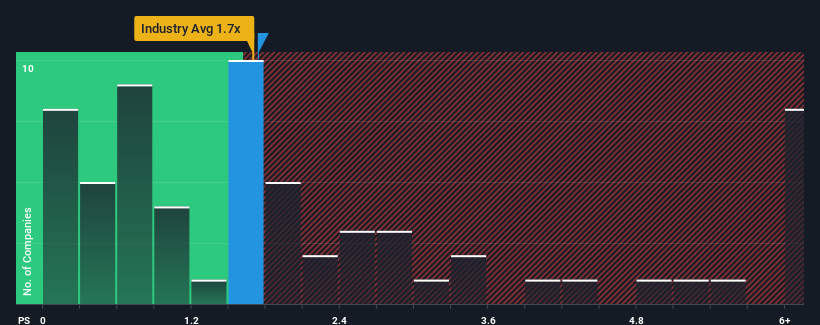

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Cathay Media and Education Group's P/S ratio of 1.7x, since the median price-to-sales (or "P/S") ratio for the Entertainment industry in Hong Kong is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Cathay Media and Education Group

How Cathay Media and Education Group Has Been Performing

With revenue growth that's inferior to most other companies of late, Cathay Media and Education Group has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Cathay Media and Education Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Cathay Media and Education Group's Revenue Growth Trending?

In order to justify its P/S ratio, Cathay Media and Education Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 3.9% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 13% each year over the next three years. That's shaping up to be materially lower than the 18% per year growth forecast for the broader industry.

In light of this, it's curious that Cathay Media and Education Group's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

Its shares have lifted substantially and now Cathay Media and Education Group's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given that Cathay Media and Education Group's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Cathay Media and Education Group with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Cathay Media and Education Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1981

Cathay Group Holdings

An investment holding company, provides higher and vocational education services in Mainland China.

Flawless balance sheet and good value.

Market Insights

Community Narratives