Why Mobvista (SEHK:1860) Is Down 9.2% After Reporting Revenue Growth but Unexpected Net Loss

Reviewed by Sasha Jovanovic

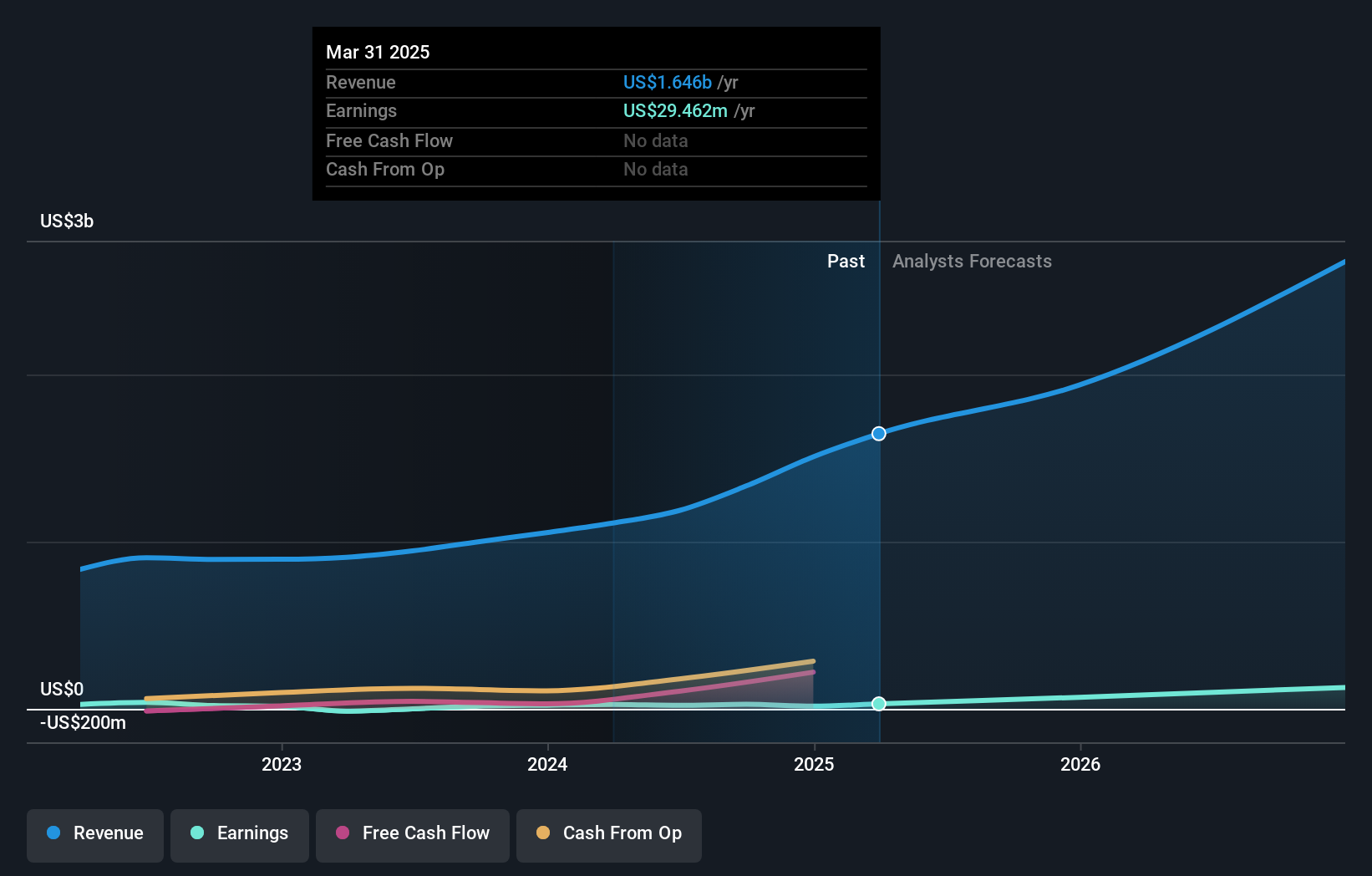

- Mobvista Inc. recently announced its earnings results for the third quarter and nine months ended September 30, 2025, reporting strong year-on-year revenue growth to US$531.57 million for the quarter, but recording a net loss of US$54.53 million compared to a net profit a year earlier.

- This shift from profitability to losses came despite robust revenue expansion, marking a significant reversal in the company's recent financial trajectory.

- We’ll consider how Mobvista’s increased revenue but unexpected net loss alters the company’s investment outlook and future considerations.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Mobvista's Investment Narrative?

For an investor to feel comfortable holding Mobvista stock, they need to buy into the company’s ability to convert fast-growing revenue into sustainable profits despite the recent swing to a net loss. The third quarter’s earnings marked a sharp contrast to earlier periods of increasing profitability and will likely refocus attention on cost behavior and short-term margin pressure. This result could influence near-term expectations for key catalysts like the Mintegral platform’s growth, which has been driving revenue higher, but now raises questions about operational scalability and earnings quality. The news also potentially amplifies immediate risks such as heightened competition and volatility, especially considering the already large share price swings and the stock’s rich valuation multiples versus peers. While management is experienced and revenue growth remains robust, the shift to losses could cause market sentiment and analyst forecasts to adjust, particularly around profitability timelines and risk assessment.

On the flipside, unexpected swings in quarterly profits could still surprise shareholders. Despite retreating, Mobvista's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on Mobvista - why the stock might be worth just HK$20.00!

Build Your Own Mobvista Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mobvista research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mobvista research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mobvista's overall financial health at a glance.

No Opportunity In Mobvista?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1860

Mobvista

Engages in the provision of advertising and marketing technology services required to develop the mobile internet ecosystem to customers worldwide.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026