Shareholders May Be A Bit More Conservative With Oriental Press Group Limited's (HKG:18) CEO Compensation For Now

As many shareholders of Oriental Press Group Limited (HKG:18) will be aware, they have not made a gain on their investment in the past three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 11 August 2021. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

See our latest analysis for Oriental Press Group

How Does Total Compensation For Shun-Chuen Lam Compare With Other Companies In The Industry?

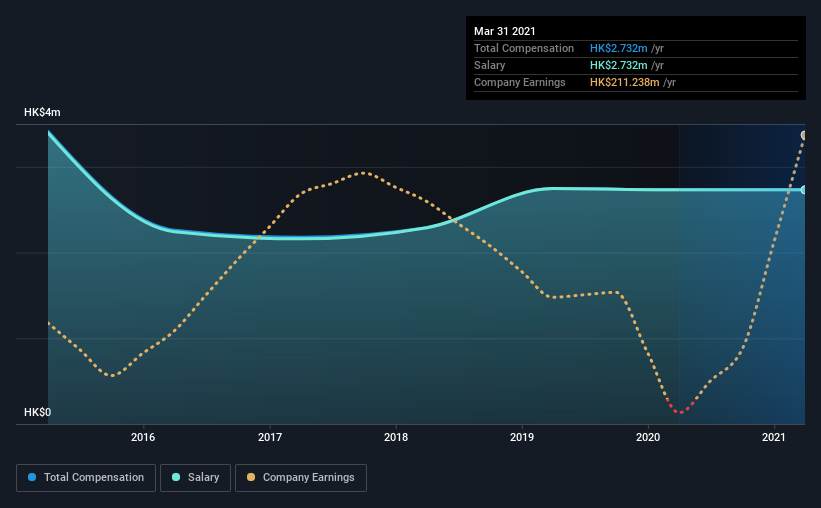

According to our data, Oriental Press Group Limited has a market capitalization of HK$1.8b, and paid its CEO total annual compensation worth HK$2.7m over the year to March 2021. That's mostly flat as compared to the prior year's compensation. Notably, the salary of HK$2.7m is the entirety of the CEO compensation.

On comparing similar companies from the same industry with market caps ranging from HK$778m to HK$3.1b, we found that the median CEO total compensation was HK$2.6m. So it looks like Oriental Press Group compensates Shun-Chuen Lam in line with the median for the industry.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$2.7m | HK$2.7m | 100% |

| Other | - | - | - |

| Total Compensation | HK$2.7m | HK$2.7m | 100% |

On an industry level, around 90% of total compensation represents salary and 10% is other remuneration. At the company level, Oriental Press Group pays Shun-Chuen Lam solely through a salary, preferring to go down a conventional route. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Oriental Press Group Limited's Growth Numbers

Oriental Press Group Limited has seen its earnings per share (EPS) increase by 10% a year over the past three years. Its revenue is down 15% over the previous year.

Shareholders would be glad to know that the company has improved itself over the last few years. While it would be good to see revenue growth, profits matter more in the end. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Oriental Press Group Limited Been A Good Investment?

With a three year total loss of 5.5% for the shareholders, Oriental Press Group Limited would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Oriental Press Group rewards its CEO solely through a salary, ignoring non-salary benefits completely. The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would be keen to know what's holding the stock back when earnings have grown. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 4 warning signs for Oriental Press Group (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Important note: Oriental Press Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:18

Oriental Enterprise Holdings

An investment holding company, engages in the publication of newspapers in Hong Kong and Australia.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success