Stock Analysis

SEHK Growth Companies With High Insider Ownership To Watch In May 2024

Reviewed by Simply Wall St

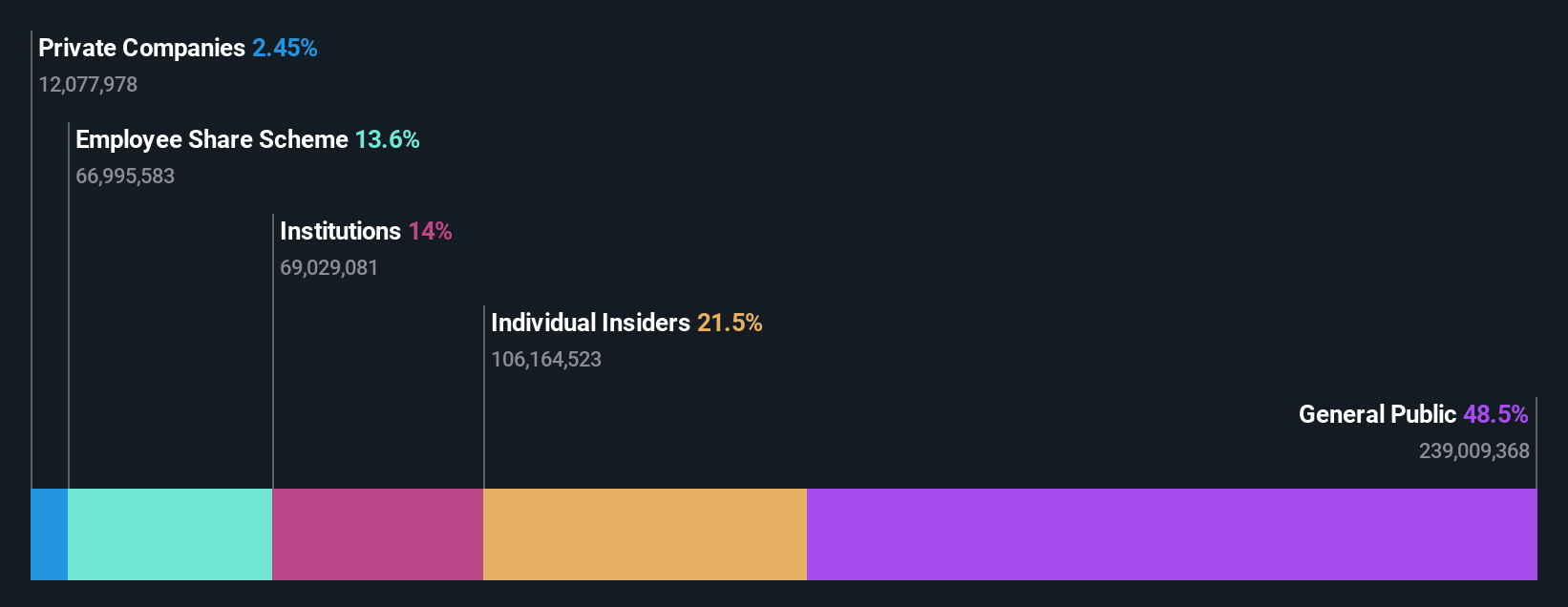

As global markets show signs of stabilization with moderated inflation rates, the Hong Kong market has notably gained traction, evidenced by a 3.11% rise in the Hang Seng Index. In such an environment, growth companies with high insider ownership in Hong Kong could present interesting opportunities for investors looking to tap into entities with potentially aligned interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

| New Horizon Health (SEHK:6606) | 16.6% | 61% |

| Fenbi (SEHK:2469) | 32.1% | 43% |

| Meitu (SEHK:1357) | 38% | 34.3% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.5% | 79.3% |

| Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

| Beijing Airdoc Technology (SEHK:2251) | 26.7% | 83.9% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.2% | 76% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 15.7% | 100.1% |

| Ocumension Therapeutics (SEHK:1477) | 17.7% | 93.7% |

Let's review some notable picks from our screened stocks.

China Ruyi Holdings (SEHK:136)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Ruyi Holdings Limited operates as an investment holding company focused on content production and online streaming, serving markets in the People's Republic of China, Hong Kong, Europe, and internationally, with a market capitalization of approximately HK$25.37 billion.

Operations: The company generates revenue primarily through its content production business, which brought in CN¥2.23 billion, and its online streaming and gaming segments, which together accounted for CN¥1.38 billion.

Insider Ownership: 16.3%

Earnings Growth Forecast: 14.7% p.a.

China Ruyi Holdings, despite experiencing a decline in net income and earnings per share in 2023, reported substantial sales growth from CNY 1.32 billion to CNY 3.63 billion. The company's revenue is projected to increase by 27.7% annually, outpacing the Hong Kong market's growth rate of 8%. However, its profit margins have decreased significantly from the previous year's high of 59.8% to just 19%. Additionally, shareholder dilution occurred over the past year, and return on equity is expected to remain low at around 16% in three years' time.

- Get an in-depth perspective on China Ruyi Holdings' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that China Ruyi Holdings' share price might be on the cheaper side.

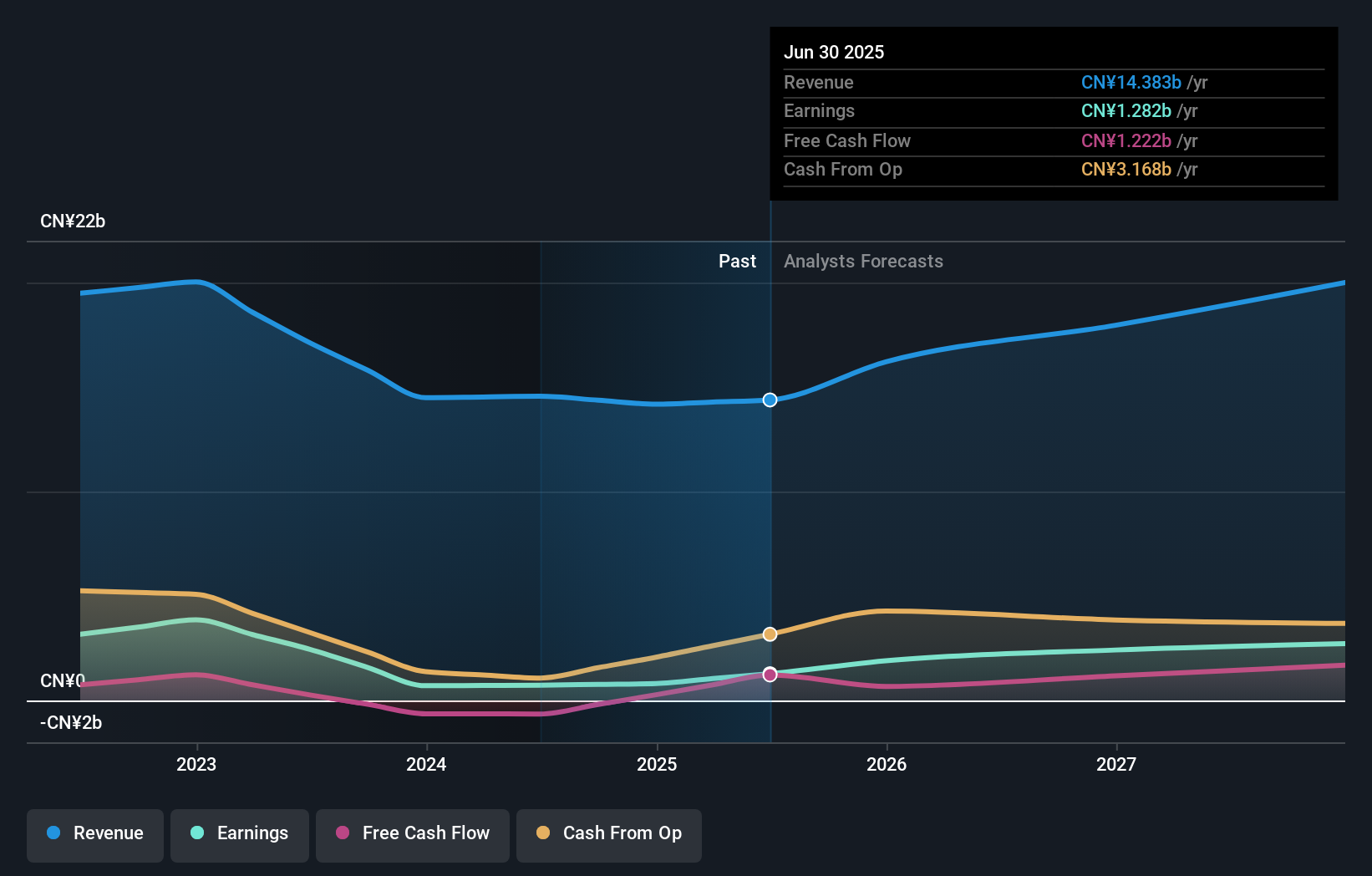

Dongyue Group (SEHK:189)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongyue Group Limited operates as an investment holding company, focusing on the manufacture and distribution of polymers, organic silicone, refrigerants, and other chemical products across China and globally. The company has a market capitalization of approximately HK$16.48 billion.

Operations: The company's revenue is primarily generated from polymers (CN¥4.55 billion), refrigerants (CN¥5.48 billion), organic silicon (CN¥4.86 billion), and dichloromethane PVC and liquid alkali (CN¥1.21 billion).

Insider Ownership: 15.4%

Earnings Growth Forecast: 35.7% p.a.

Dongyue Group, a Hong Kong-based company with high insider ownership, faces challenges despite its growth potential. In 2023, the company's net profit and revenue significantly declined due to lower market prices for major products and higher raw material costs. However, it is forecasted to achieve substantial earnings growth of 35.73% annually over the next three years, outperforming the local market's expected growth. Recent executive changes could influence strategic direction as new board members bring varied expertise in compliance and strategic investment.

- Delve into the full analysis future growth report here for a deeper understanding of Dongyue Group.

- The analysis detailed in our Dongyue Group valuation report hints at an inflated share price compared to its estimated value.

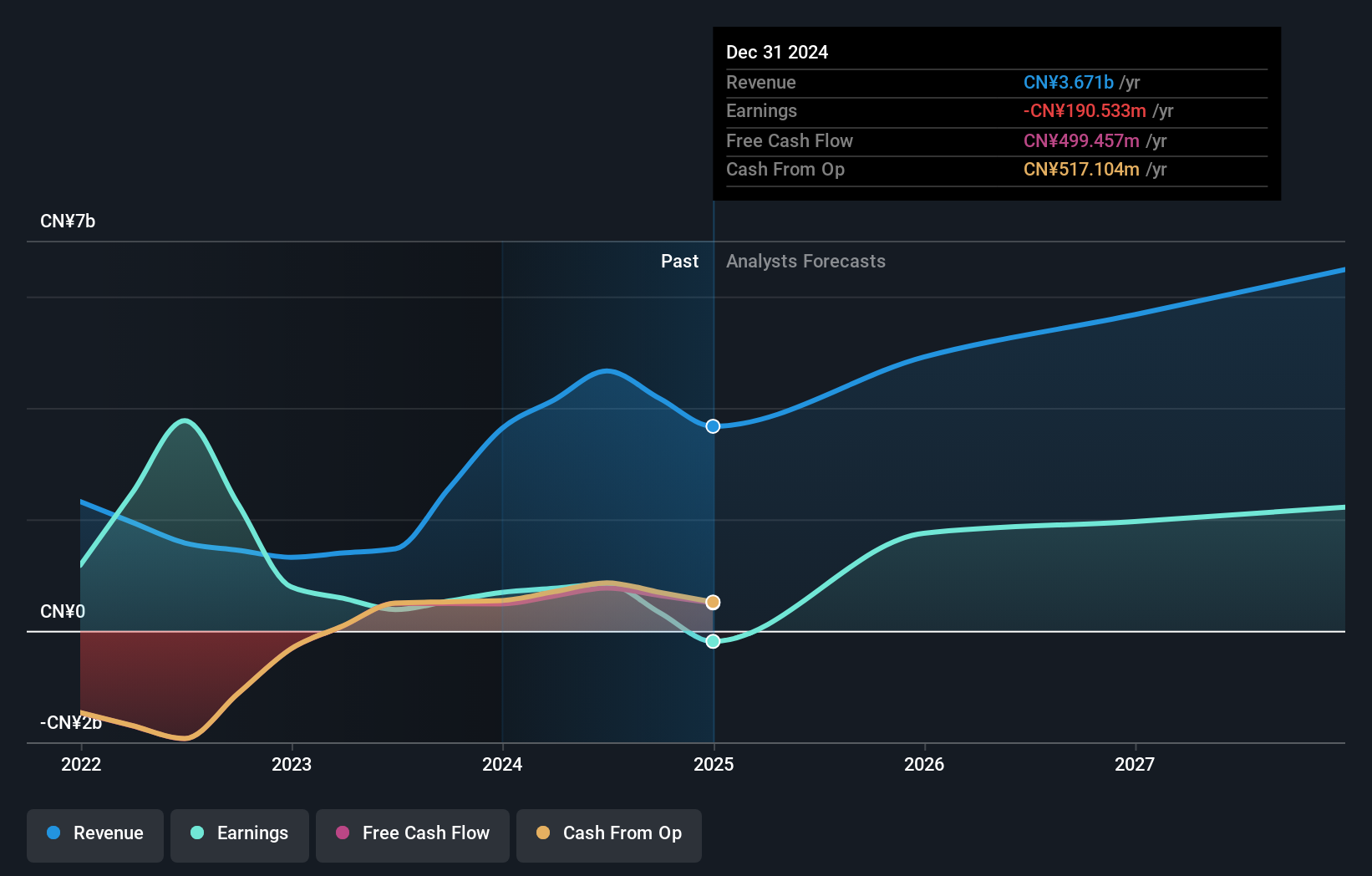

Beijing Fourth Paradigm Technology (SEHK:6682)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in the People's Republic of China, with a market capitalization of approximately HK$23.99 billion.

Operations: The company generates revenue through three primary segments: the Sage AI Platform (CN¥2.51 billion), Sagegpt AIGS Services (CN¥415.50 million), and Shift Intelligent Solutions (CN¥1.28 billion).

Insider Ownership: 22.8%

Earnings Growth Forecast: 96% p.a.

Beijing Fourth Paradigm Technology, a Hong Kong growth company with high insider ownership, recently announced a share repurchase program boosting potential earnings per share. Despite a highly volatile share price in the last three months, the company's revenue grew by 36.4% over the past year and is expected to grow at 19.3% annually. However, its Return on Equity is forecasted low at 6%. The firm is set to become profitable within three years, surpassing average market growth expectations.

- Unlock comprehensive insights into our analysis of Beijing Fourth Paradigm Technology stock in this growth report.

- Upon reviewing our latest valuation report, Beijing Fourth Paradigm Technology's share price might be too optimistic.

Next Steps

- Delve into our full catalog of 52 Fast Growing SEHK Companies With High Insider Ownership here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Beijing Fourth Paradigm Technology is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6682

Beijing Fourth Paradigm Technology

An investment holding company, provides platform-centric artificial intelligence (AI) solutions in the People's Republic of China.

Excellent balance sheet with reasonable growth potential.