Amid escalating geopolitical tensions and trade-related concerns, Asian markets have shown resilience, with China's recent trade agreements providing a glimmer of optimism despite ongoing deflationary pressures. In this dynamic environment, identifying high-growth tech stocks in Asia involves evaluating companies that can leverage technological innovation and strategic positioning to navigate economic challenges and capitalize on emerging opportunities.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.78% | 30.32% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.47% | 25.73% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Celltrion (KOSE:A068270)

Simply Wall St Growth Rating: ★★★★☆☆

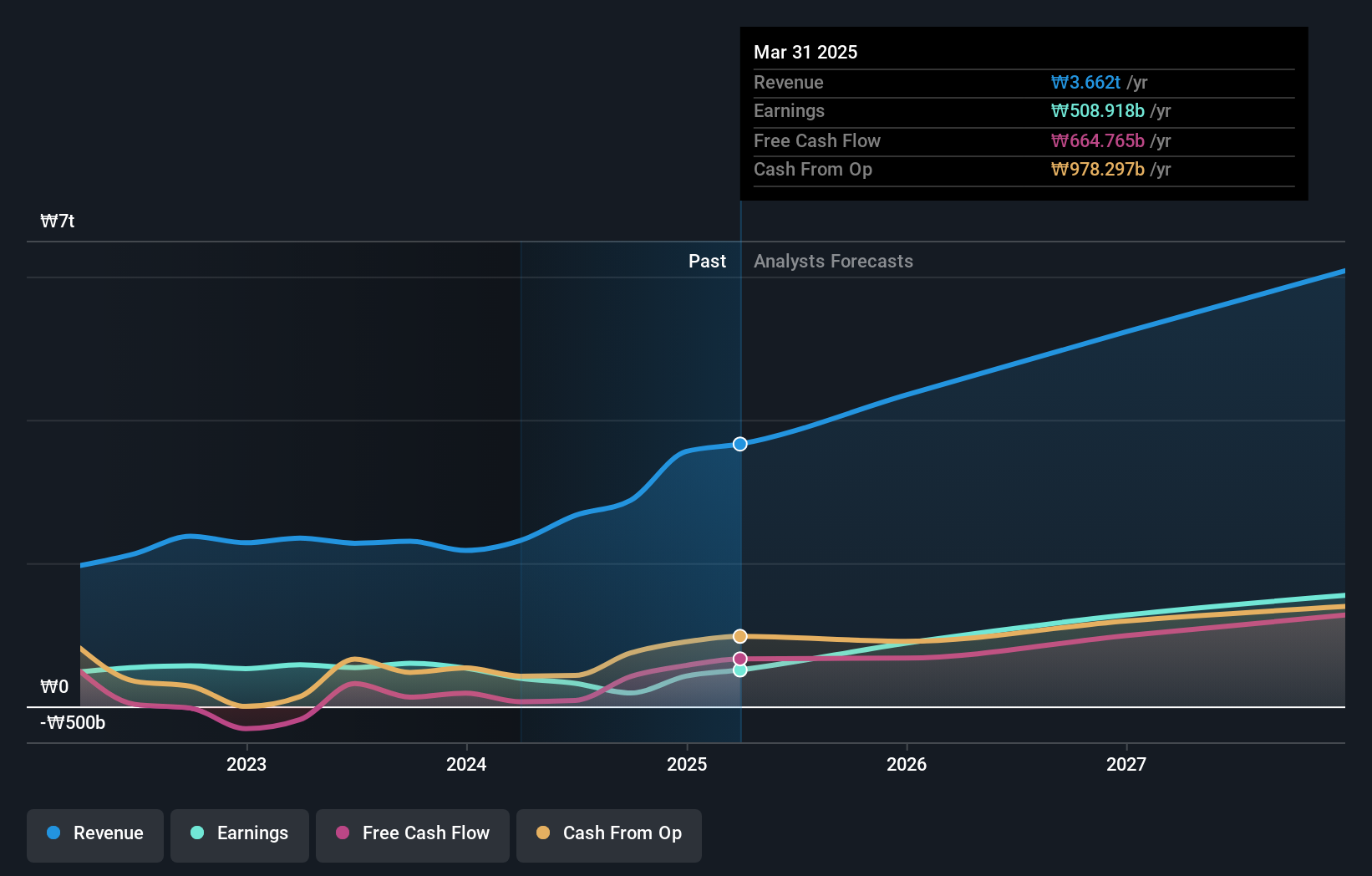

Overview: Celltrion, Inc. is a biopharmaceutical company focused on developing, producing, and selling therapeutic proteins for oncology treatments with a market capitalization of ₩35.78 trillion.

Operations: The company primarily generates revenue from its biopharmaceutical segment, which accounts for ₩6.18 trillion. It also earns from chemical drugs, contributing ₩523.71 million to its total revenue.

Celltrion, a key player in the biotech sector, is making significant strides with its FDA-approved biosimilar YUFLYMA®, enhancing patient access through strategic price adjustments and expanded interchangeable designations. The company's commitment to innovation is further underscored by a robust 27.2% forecasted annual earnings growth and an aggressive share repurchase program, signaling strong future prospects. Moreover, recent clinical trials highlight potential safety advantages of their products over competitors', positioning Celltrion favorably within the high-growth biotechnology landscape in Asia.

- Click to explore a detailed breakdown of our findings in Celltrion's health report.

Assess Celltrion's past performance with our detailed historical performance reports.

China Ruyi Holdings (SEHK:136)

Simply Wall St Growth Rating: ★★★★★☆

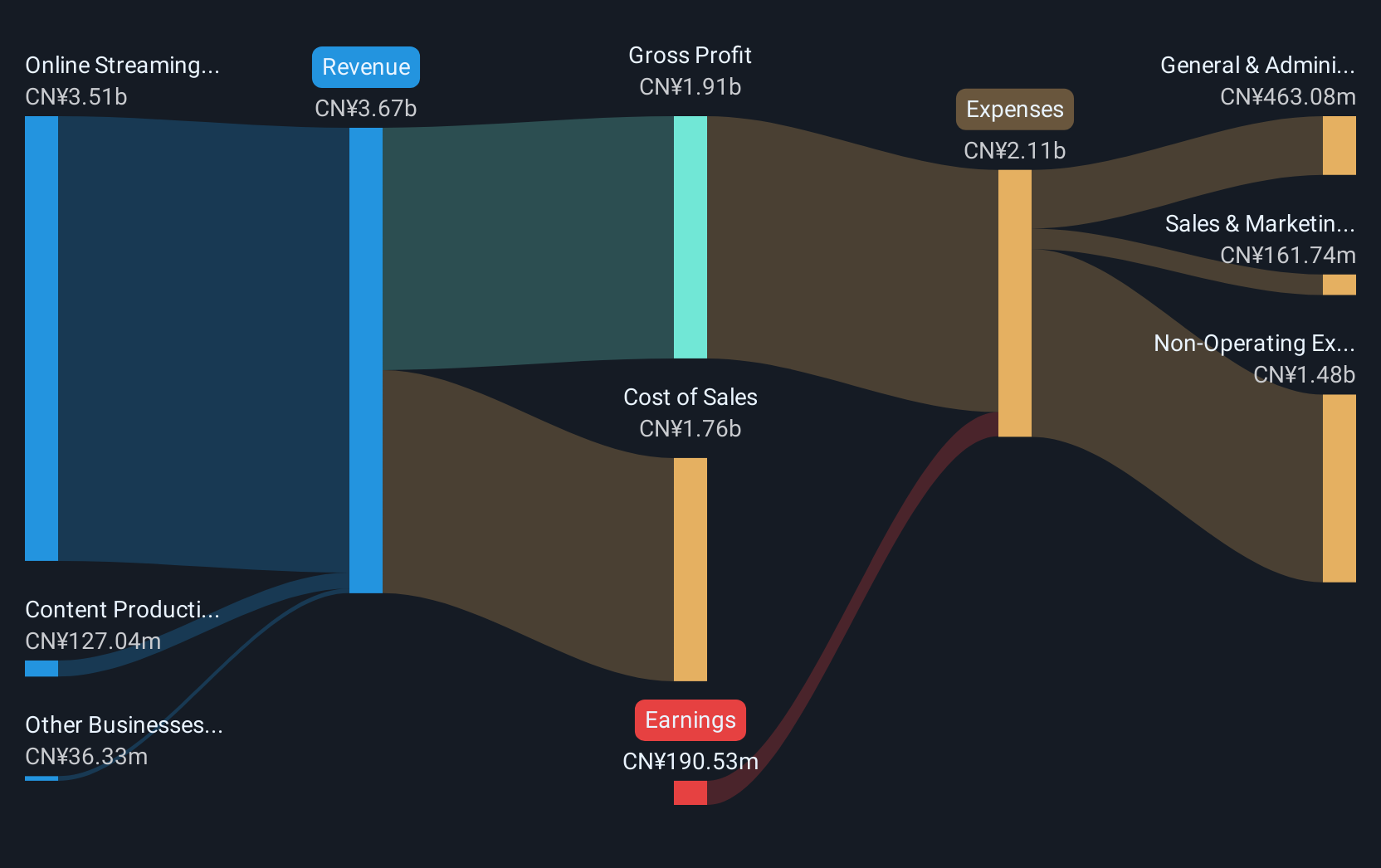

Overview: China Ruyi Holdings Limited is an investment holding company involved in content production and online streaming across Mainland China, Hong Kong, Europe, and other international markets, with a market capitalization of approximately HK$33.99 billion.

Operations: China Ruyi Holdings Limited primarily generates revenue through its online streaming and gaming businesses, which contribute CN¥3.51 billion, followed by content production at CN¥127.04 million.

Amid a challenging fiscal year, China Ruyi Holdings has demonstrated resilience with strategic financial maneuvers, including a substantial fixed-income offering of HKD 2.341 billion and aggressive private placements aimed at bolstering its capital structure. Despite reporting a net loss of CNY 190.53 million for 2024, contrasting sharply with the previous year's profit, the company is poised for recovery with projected revenue growth at an impressive rate of 27.4% annually. This outlook is supported by recent corporate actions such as share repurchases and convertible bond issues, underscoring management's commitment to navigating through volatile markets while maintaining focus on long-term growth strategies in high-tech sectors across Asia.

- Click here and access our complete health analysis report to understand the dynamics of China Ruyi Holdings.

Gain insights into China Ruyi Holdings' past trends and performance with our Past report.

Innovent Biologics (SEHK:1801)

Simply Wall St Growth Rating: ★★★★☆☆

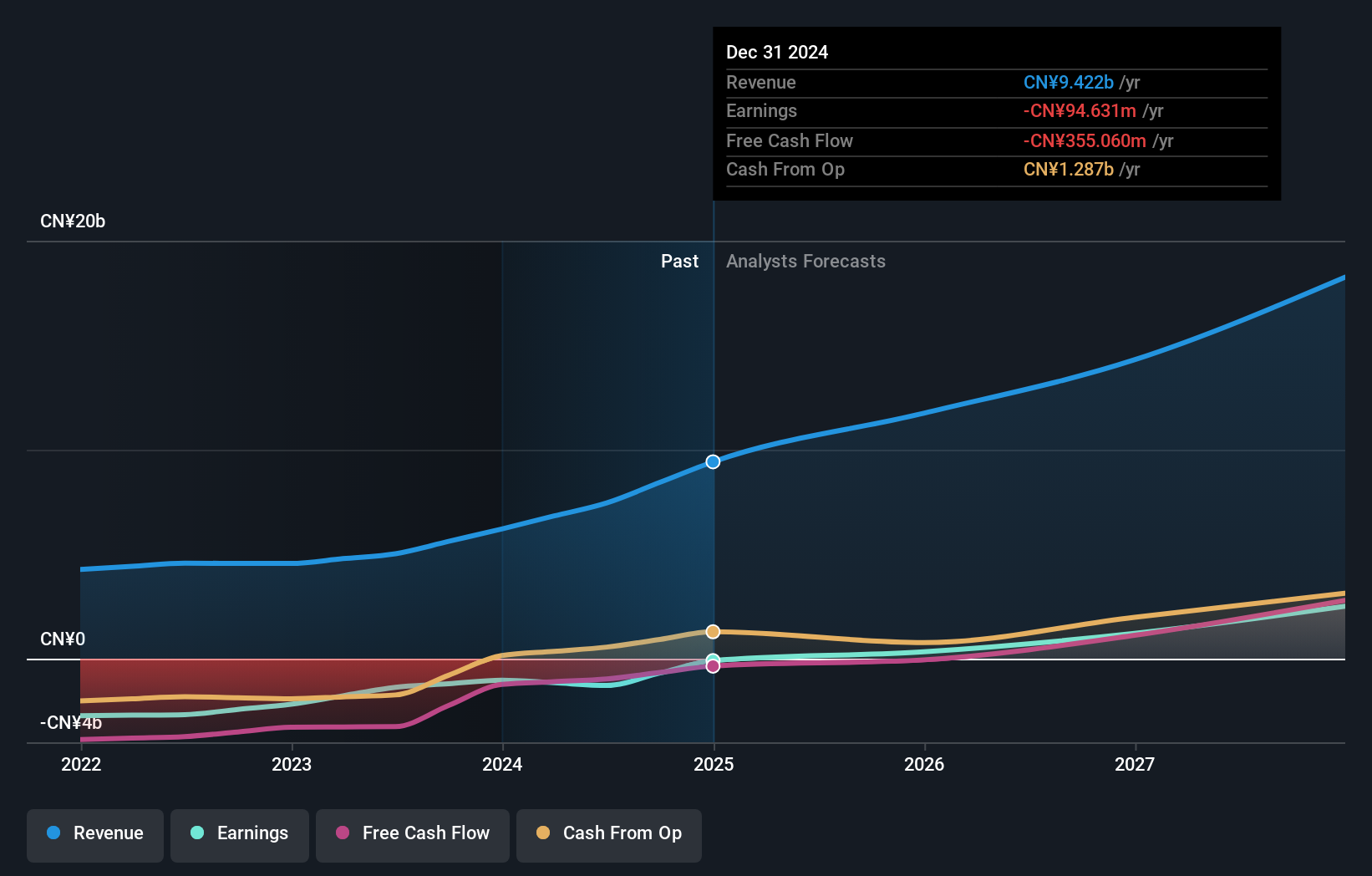

Overview: Innovent Biologics, Inc. is a biopharmaceutical company focused on the research and development of antibody and protein medicine products across China, the United States, and internationally, with a market cap of HK$132.62 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to CN¥9.42 billion.

Innovent Biologics has recently made significant strides in the biopharmaceutical field, particularly with its innovative cancer treatments. The company's recent regulatory successes include multiple Breakthrough Therapy Designations (BTDs) and Fast Track Designations (FTDs) from both U.S. and Chinese health authorities for its novel PD-1/IL-2a-bias bispecific antibody fusion protein, IBI363. These designations, which aim to expedite the development and review process for promising drugs, highlight Innovent's commitment to addressing critical unmet medical needs in oncology. Moreover, the acceptance of New Drug Applications (NDAs) by China’s NMPA for other advanced therapies underscores Innovent’s potential to impact global health outcomes significantly.

Where To Now?

- Embark on your investment journey to our 488 Asian High Growth Tech and AI Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1801

Innovent Biologics

A biopharmaceutical company, engages in the research and development of antibody and protein medicine products in the People’s Republic of China, the United States, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives