Asian Growth Companies With High Insider Ownership In October 2025

Reviewed by Simply Wall St

As of October 2025, Asian markets are witnessing a period of cautious optimism amid global economic uncertainties, with major indices reflecting mixed performances due to varying regional economic policies and geopolitical tensions. In this environment, growth companies in Asia with high insider ownership can be particularly appealing as they often indicate strong internal confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 113.4% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| PharmaResearch (KOSDAQ:A214450) | 35% | 30.9% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

| AprilBioLtd (KOSDAQ:A397030) | 31% | 87.1% |

We'll examine a selection from our screener results.

Meitu (SEHK:1357)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meitu, Inc. is an investment holding company that develops and provides photo, video, and design production products along with AI-powered solutions in Mainland China and internationally, with a market cap of HK$42.33 billion.

Operations: The company's revenue primarily comes from its Internet Business segment, which generated CN¥3.54 billion.

Insider Ownership: 22.6%

Meitu, Inc. demonstrates significant growth potential with forecasted revenue and earnings growth rates of 20.3% and 21.34% per year, respectively, surpassing the Hong Kong market averages. Despite recent substantial insider selling, Meitu's stock trades at a notable discount to its estimated fair value and has been added to the FTSE All-World Index. Recent financials show increased sales of CNY 1.82 billion for H1 2025 and net income improvement to CNY 397 million year-over-year.

- Dive into the specifics of Meitu here with our thorough growth forecast report.

- Our valuation report unveils the possibility Meitu's shares may be trading at a discount.

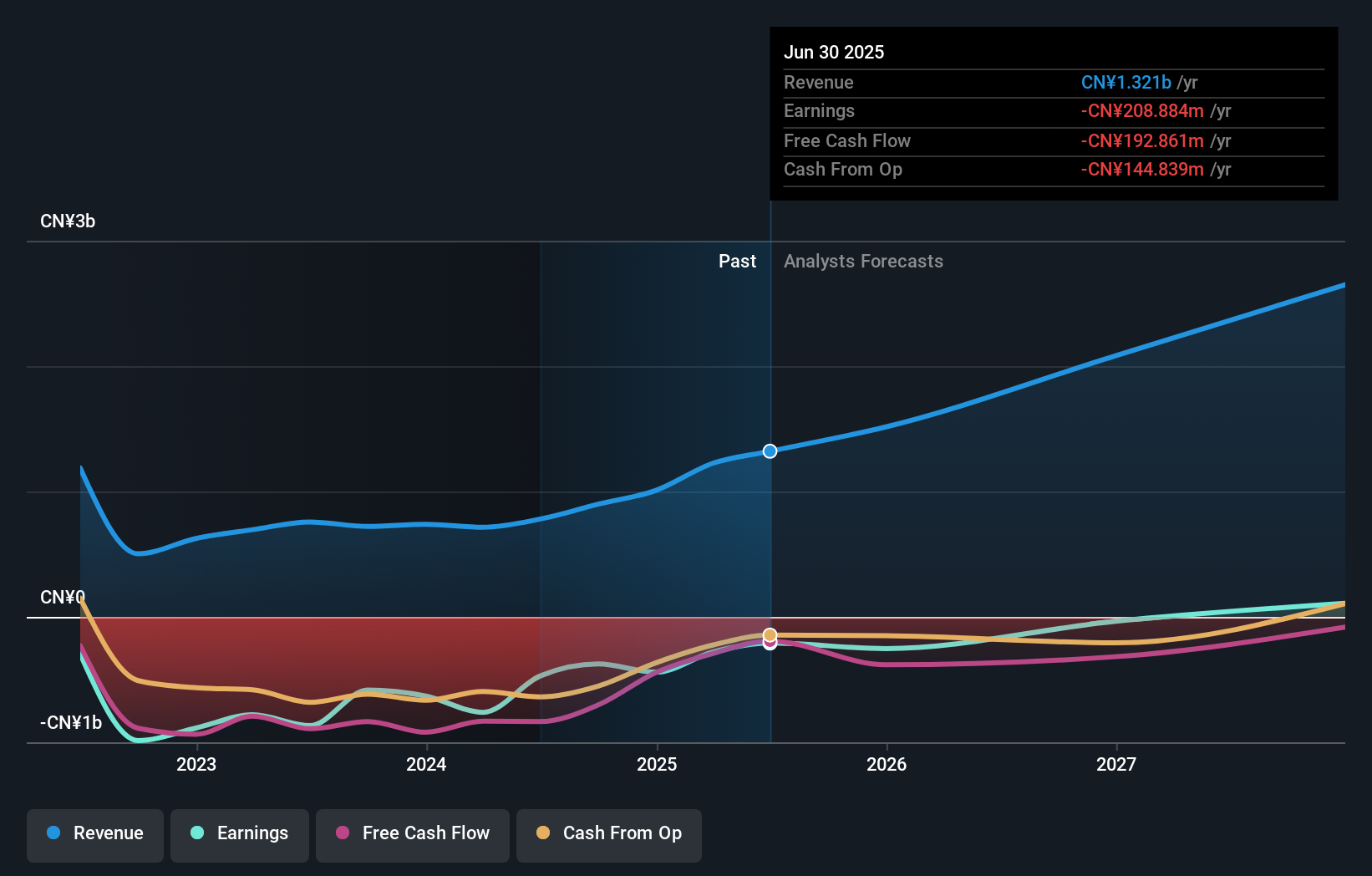

InnoCare Pharma (SEHK:9969)

Simply Wall St Growth Rating: ★★★★★☆

Overview: InnoCare Pharma Limited is a biopharmaceutical company focused on discovering, developing, and commercializing drugs for cancer and autoimmune diseases in China, with a market cap of HK$36.34 billion.

Operations: The company generates revenue from its pharmaceuticals segment, amounting to CN¥1.32 billion.

Insider Ownership: 20.9%

InnoCare Pharma exhibits promising growth prospects, with its revenue forecasted to grow at 22.8% annually, outpacing the Hong Kong market. Recent approvals for orelabrutinib in Singapore and China bolster its oncology portfolio, enhancing treatment options for lymphoma patients. Despite substantial insider selling recently, InnoCare's stock trades below estimated fair value. The company's H1 2025 financials reflect a narrowed net loss of CNY 30.09 million amid rising sales of CNY 730.35 million year-over-year.

- Click here and access our complete growth analysis report to understand the dynamics of InnoCare Pharma.

- The analysis detailed in our InnoCare Pharma valuation report hints at an inflated share price compared to its estimated value.

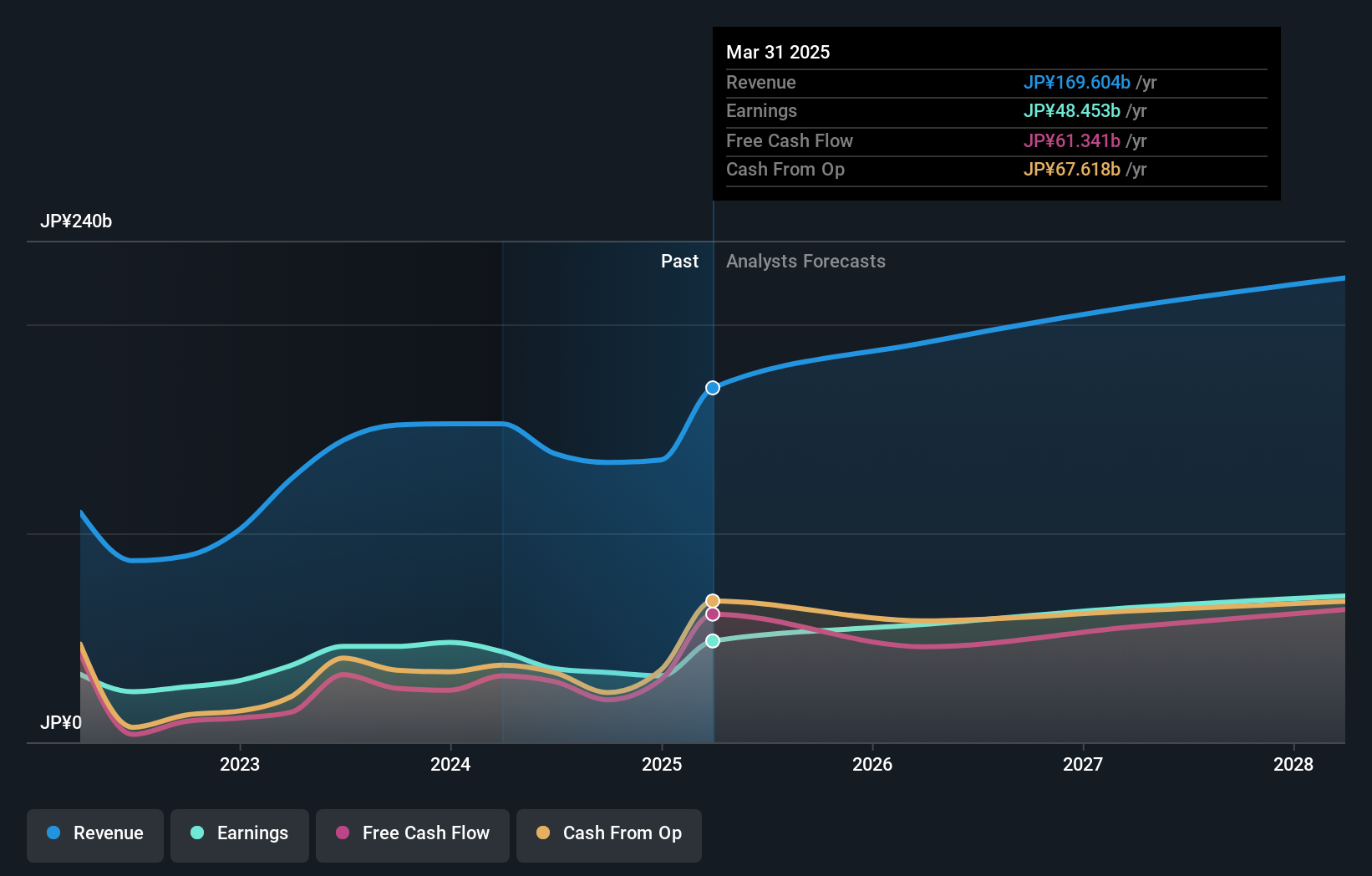

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is engaged in planning, developing, manufacturing, selling, and distributing home video games, online games, mobile games, and arcade games both in Japan and internationally with a market cap of ¥1.72 trillion.

Operations: The company's revenue is primarily derived from Digital Content at ¥133.57 billion, followed by Arcade Operations at ¥23.49 billion and Amusement Equipment at ¥21.21 billion.

Insider Ownership: 10.5%

Capcom's growth trajectory is supported by its strategic multi-platform expansion, exemplified by the upcoming Resident Evil Requiem release for Nintendo Switch 2. The company's earnings are expected to grow faster than the Japanese market, with a forecasted annual increase of 8.7%. Despite moderate revenue growth projections of 7% annually, Capcom's insider ownership remains high without significant recent insider trading activity. Recent collaborations like the Monster Hunter Wilds co-promotion enhance brand visibility and engagement.

- Click to explore a detailed breakdown of our findings in Capcom's earnings growth report.

- Our valuation report here indicates Capcom may be overvalued.

Next Steps

- Explore the 619 names from our Fast Growing Asian Companies With High Insider Ownership screener here.

- Looking For Alternative Opportunities? Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9969

InnoCare Pharma

A biopharmaceutical company, engages in discovering, developing, and commercializing drugs for the treatment of cancer and autoimmune diseases in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success