- Japan

- /

- Consumer Finance

- /

- TSE:8508

3 Stocks Estimated To Be Undervalued By Up To 49.9%

Reviewed by Simply Wall St

Amidst a backdrop of optimism fueled by potential tariff relief and enthusiasm for AI developments, global markets have seen major indices reaching new highs, with growth stocks notably outperforming value shares. As investors navigate these buoyant conditions, identifying undervalued stocks becomes crucial; such opportunities often arise when market sentiment overlooks the intrinsic value of certain companies despite broader economic trends.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.73 | 49.8% |

| Berkshire Hills Bancorp (NYSE:BHLB) | US$28.32 | US$56.60 | 50% |

| Guangdong Mingyang ElectricLtd (SZSE:301291) | CN¥50.90 | CN¥101.71 | 50% |

| World Fitness Services (TWSE:2762) | NT$92.70 | NT$184.63 | 49.8% |

| Vertiseit (OM:VERT B) | SEK50.20 | SEK99.93 | 49.8% |

| TF Bank (OM:TFBANK) | SEK377.00 | SEK750.28 | 49.8% |

| J Trust (TSE:8508) | ¥521.00 | ¥1039.68 | 49.9% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥26.03 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5862.00 | ¥11678.51 | 49.8% |

| Tenable Holdings (NasdaqGS:TENB) | US$43.39 | US$86.65 | 49.9% |

Let's take a closer look at a couple of our picks from the screened companies.

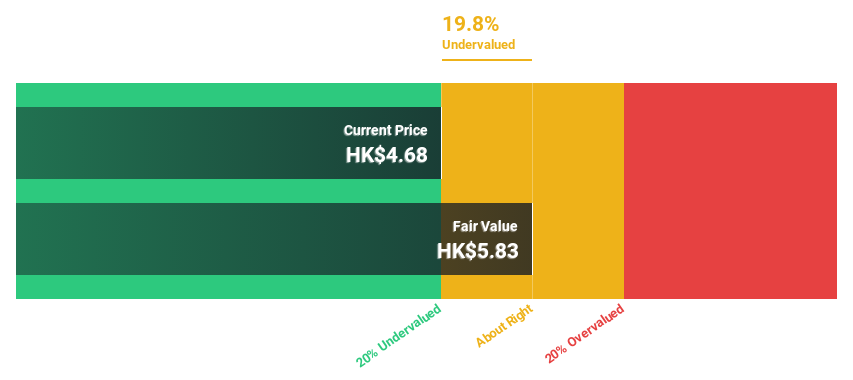

Meitu (SEHK:1357)

Overview: Meitu, Inc. is an investment holding company that creates products to enhance image, video, and design production with beauty-related solutions in China and globally, with a market cap of HK$14.26 billion.

Operations: The company's revenue is primarily derived from its Internet Business segment, which generated CN¥3.06 billion.

Estimated Discount To Fair Value: 42.1%

Meitu is trading at HK$3.64, significantly below its estimated fair value of HK$6.29, suggesting it may be undervalued based on cash flows. Despite a decline in profit margins from 24.8% to 14.9%, earnings are projected to grow at 26.87% annually, outpacing the Hong Kong market's growth rate of 11.3%. A special dividend of HK$0.109 per share is under consideration, with key dates set for February 2025 approval and payment processes.

- Upon reviewing our latest growth report, Meitu's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Meitu with our comprehensive financial health report here.

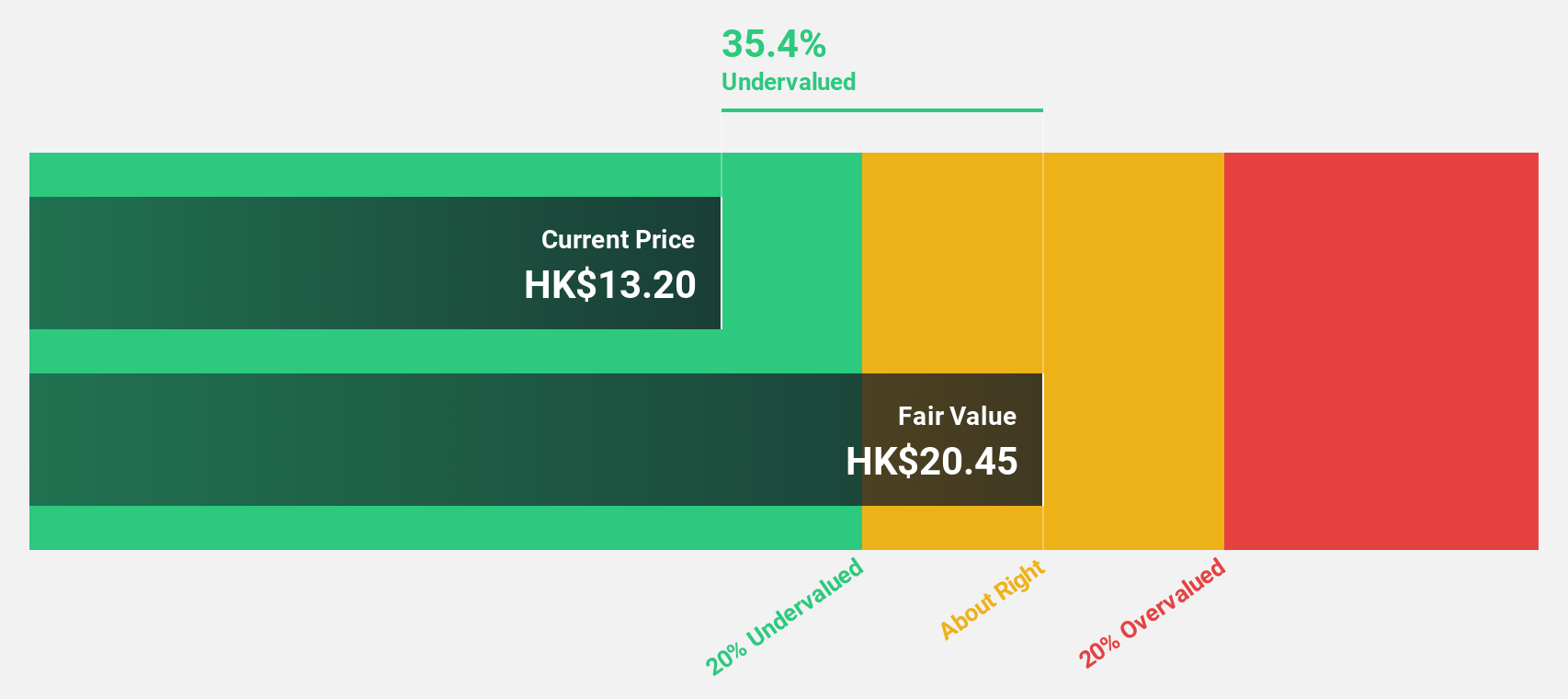

Beijing Chunlizhengda Medical Instruments (SEHK:1858)

Overview: Beijing Chunlizhengda Medical Instruments Co., Ltd. operates in the medical instruments sector, focusing on the development and manufacturing of orthopedic implants and related surgical instruments, with a market cap of HK$4.42 billion.

Operations: The company's revenue primarily comes from the manufacture and trading of surgical implants, instruments, and related products, amounting to CN¥924.65 million.

Estimated Discount To Fair Value: 36.9%

Beijing Chunlizhengda Medical Instruments is trading at HK$8.55, which is 36.9% below its estimated fair value of HK$13.54, highlighting its potential undervaluation based on cash flows. Despite facing a significant decline in net profit due to centralized procurement policies, the company forecasts robust earnings growth of 29.6% annually over the next three years, surpassing the Hong Kong market's growth rate of 11.3%.

- In light of our recent growth report, it seems possible that Beijing Chunlizhengda Medical Instruments' financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Beijing Chunlizhengda Medical Instruments.

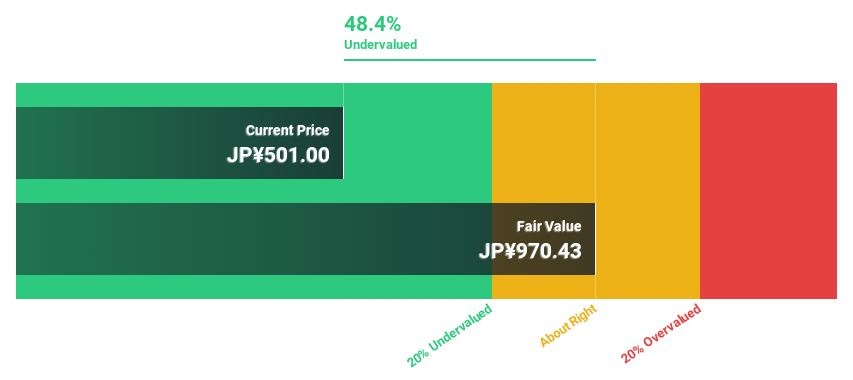

J Trust (TSE:8508)

Overview: J Trust Co., Ltd. offers a range of financial services in Japan and has a market capitalization of ¥67.74 billion.

Operations: The company's revenue segments include the Investment Business at ¥40 million, Real Estate Business at ¥17.82 billion, Japan Financial Business at ¥15.86 billion, Southeast Asia Financial Business at ¥46.35 billion, and South Korea and Mongolia Financial Business at ¥46.40 billion.

Estimated Discount To Fair Value: 49.9%

J Trust is trading at ¥521, significantly undervalued at 49.9% below its estimated fair value of ¥1039.68, based on cash flow analysis. The company has completed a share buyback plan worth ¥1,999.97 million, enhancing shareholder value. Despite a decline in profit margins from 17.1% to 1.8%, earnings are forecast to grow robustly at 35.89% annually over the next three years, outpacing the Japanese market's growth rate of 8.1%.

- Insights from our recent growth report point to a promising forecast for J Trust's business outlook.

- Take a closer look at J Trust's balance sheet health here in our report.

Make It Happen

- Reveal the 890 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8508

Undervalued with excellent balance sheet.

Market Insights

Community Narratives