Adtiger Corporations Limited's (HKG:1163) 28% Cheaper Price Remains In Tune With Revenues

To the annoyance of some shareholders, Adtiger Corporations Limited (HKG:1163) shares are down a considerable 28% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 57% share price decline.

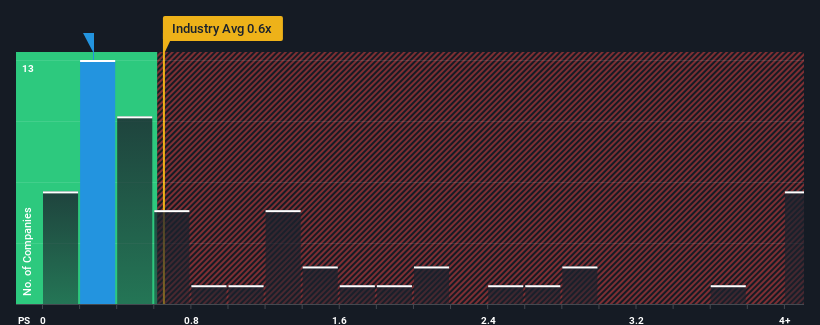

Although its price has dipped substantially, there still wouldn't be many who think Adtiger Corporations' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Hong Kong's Media industry is similar at about 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Adtiger Corporations

How Adtiger Corporations Has Been Performing

For instance, Adtiger Corporations' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Adtiger Corporations will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Adtiger Corporations?

In order to justify its P/S ratio, Adtiger Corporations would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. Even so, admirably revenue has lifted 40% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 9.9% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Adtiger Corporations' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Final Word

Adtiger Corporations' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we've seen, Adtiger Corporations' three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

Before you take the next step, you should know about the 3 warning signs for Adtiger Corporations (1 is a bit concerning!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1163

Adtiger Corporations

An investment holding company, provides online advertising services in Mainland China, Singapore, Hong Kong, Indonesia and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives