- Hong Kong

- /

- Entertainment

- /

- SEHK:1060

Damai Entertainment Holdings (SEHK:1060): Exploring Valuation After Doubling Its Connected Transaction Cap for Drama Expansion

Reviewed by Simply Wall St

Damai Entertainment Holdings (SEHK:1060) has increased its annual cap for connected transactions, raising the limit from RMB100 million to RMB200 million. This change follows higher-than-expected business volume, largely due to the company’s growing drama series production.

See our latest analysis for Damai Entertainment Holdings.

Damai Entertainment’s decision to boost transaction limits comes after an eventful year for the business, with the stock’s share price rising a remarkable 91.4% year-to-date. Strong demand for its drama series appears to be fueling renewed growth momentum and investor optimism, reflected in a 109.4% total return over the last year. However, some short-term volatility remains.

If this kind of momentum has inspired you to discover what else is moving, it’s the perfect moment to broaden your search and explore fast growing stocks with high insider ownership

But with share prices already surging and recent upgrades to transaction limits, does Damai Entertainment still offer room for upside, or has the market already priced in its strong growth prospects? This leaves investors to question if an opportunity remains.

Price-to-Earnings of 44.2x: Is it justified?

At its last close of HK$0.89, Damai Entertainment Holdings trades on a price-to-earnings ratio (P/E) of 44.2x, making its stock considerably more expensive than its industry peers. While recent growth and future earnings projections are factors, investors should note how much of the excitement is already embedded in the current price.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of company earnings. In sectors like entertainment, where profits can swing on hit releases or IP success, this ratio can reflect big expectations for future growth.

So is this premium justified? Despite the company’s robust profit acceleration, Damai’s 44.2x P/E is far higher than the Hong Kong Entertainment industry average of 15.9x and even above the estimated fair P/E ratio of 30.9x. This suggests the market is applying extremely high expectations for future earnings growth, which may leave little margin for disappointment compared to peers in the sector. The fair P/E ratio implies the market could recalibrate how it values the company if expectations moderate.

Explore the SWS fair ratio for Damai Entertainment Holdings

Result: Price-to-Earnings of 44.2x (OVERVALUED)

However, slower revenue growth or failed content releases could quickly challenge the current optimism around Damai Entertainment’s lofty valuation.

Find out about the key risks to this Damai Entertainment Holdings narrative.

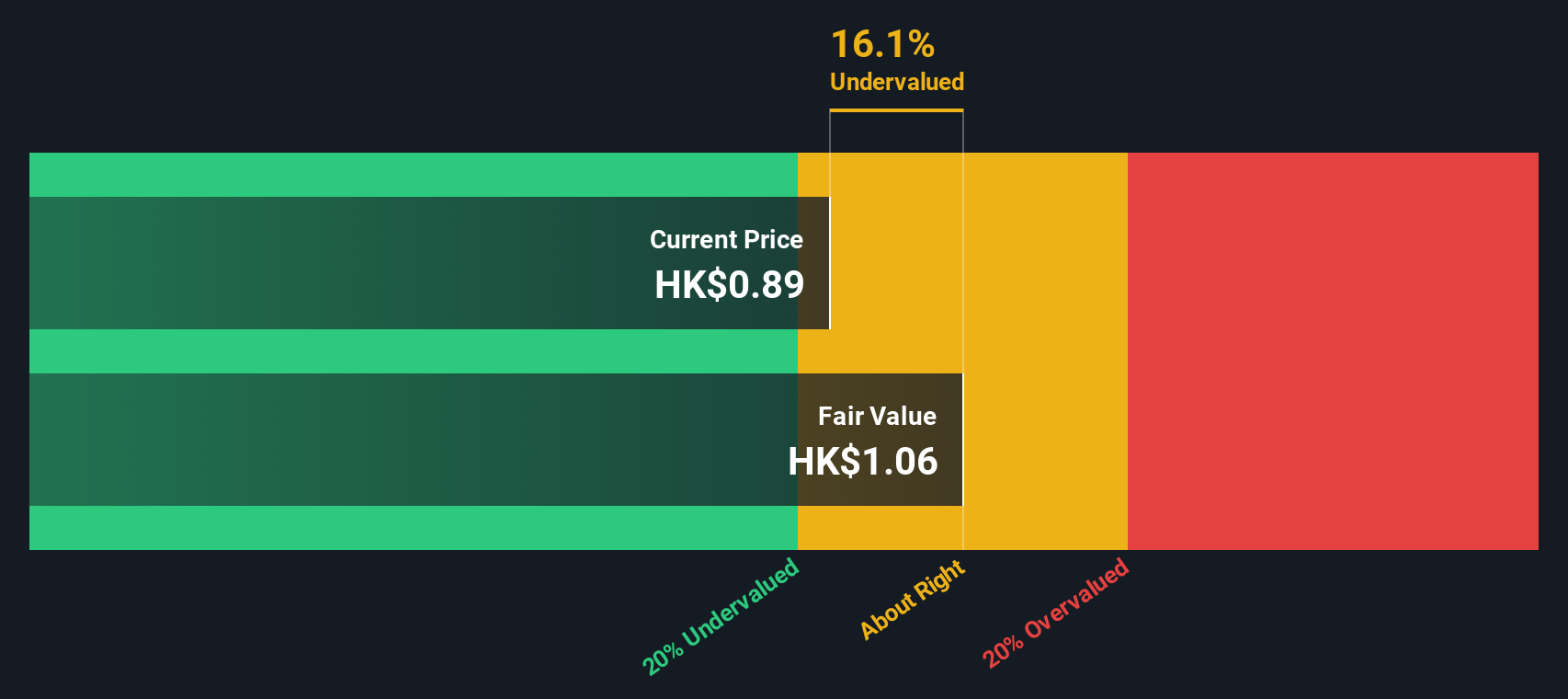

Another View: SWS DCF Model Suggests Upside

Taking a step back from earnings multiples, our DCF model presents a different perspective for Damai Entertainment Holdings. According to this assessment, the stock is trading at 16.1% below its estimated fair value. This suggests potential upside and raises new questions about whether the current market price is as stretched as it appears from a traditional P/E perspective.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Damai Entertainment Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Damai Entertainment Holdings Narrative

If you have a different perspective or want to dive into the numbers yourself, it only takes a few minutes to build your own view. Do it your way

A great starting point for your Damai Entertainment Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t sit on the sidelines while new investment opportunities race ahead. Use these unique screeners to spot the next wave of potential in today’s markets.

- Catch rising trends in artificial intelligence by reviewing these 25 AI penny stocks, which are using advanced algorithms to disrupt entire industries.

- Boost your passive income strategy when you explore these 15 dividend stocks with yields > 3%, featuring companies offering attractive dividend yields above 3%.

- Get early access to innovative technology with these 28 quantum computing stocks, leading advances in quantum computing and creating tomorrow’s breakthroughs today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1060

Damai Entertainment Holdings

An investment holding company, operates in the content, technology, and IP merchandising and commercialization businesses in Hong Kong and the People's Republic of China.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026