- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

Kuaishou Technology (SEHK:1024) Seeks Growth in AI and E-commerce Amidst Revenue and Profit Challenges

Reviewed by Simply Wall St

Kuaishou Technology (SEHK:1024) continues to assert its dominance in the Chinese digital sector, with impressive user engagement metrics and financial growth. Challenges in the live streaming segment and rising marketing expenses have emerged, yet the company remains resilient, bolstered by strategic investments in AI and e-commerce. This report examines Kuaishou's competitive advantages, critical performance issues, future market prospects, and the external factors influencing its trajectory.

Competitive Advantages That Elevate Kuaishou Technology

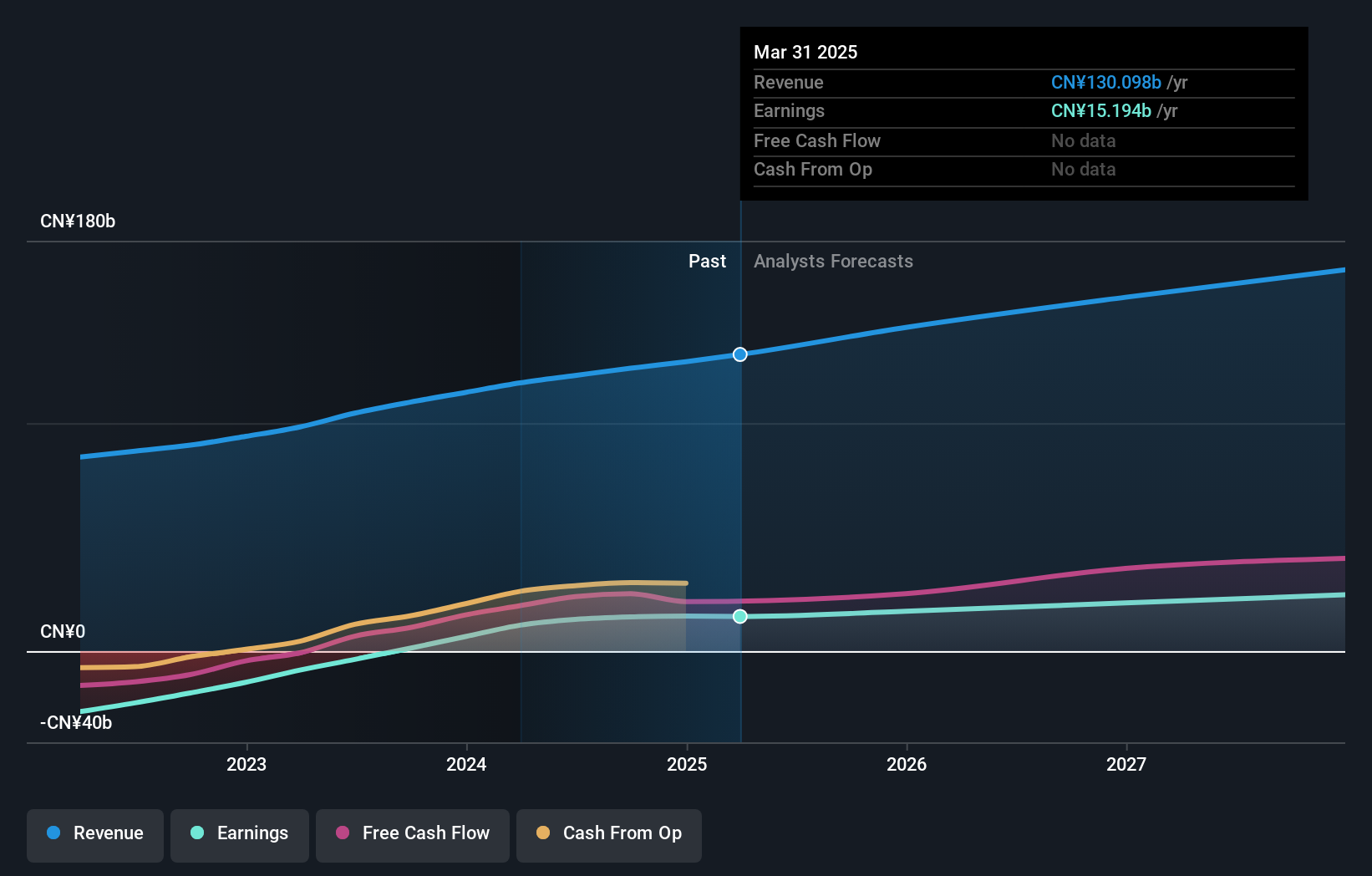

Kuaishou Technology has demonstrated exceptional prowess in user engagement and growth. With Daily Active Users (DAUs) exceeding 400 million and Monthly Active Users (MAUs) reaching 714 million, the platform's user base underscores its dominant position as the third largest app in China. Cheng Yixiao, Co-Founder, Chairman, and CEO, emphasized this achievement, noting the average daily time spent per DAU at 132.2 minutes, which reflects strong user involvement. Financially, Kuaishou's total revenue surged by 11.4% year-over-year to RMB 31.1 billion, with core commercial business revenues climbing nearly 20%. This growth is complemented by a significant 24.4% rise in adjusted net profit, reaching RMB 3.9 billion, as CFO Jin Bing highlighted the resilience and strength of their core business. The integration of AI models further enhances their ecosystem, improving content creation and recommendation capabilities, a testament to their strategic investment in technology. Notably, the company is trading below its estimated fair value (HK$46.75 vs. HK$85.79), aligning with industry averages and reflecting its strong market positioning.

Critical Issues Affecting the Performance of Kuaishou Technology and Areas for Growth

While Kuaishou's financial health is commendable, certain challenges persist. The live streaming segment, a foundational component of their ecosystem, experienced a 3.9% year-over-year revenue decline to RMB 9.3 billion, indicating hurdles in sustaining growth within this area. Efforts to establish a sustainable live streaming environment were acknowledged by Cheng Yixiao, yet the decline remains a concern. Additionally, selling and marketing expenses rose by 15.9% to RMB 10.4 billion, impacting profit margins. Jin Bing attributed this increase to heightened spending on business promotions, including online marketing services and e-commerce initiatives. Furthermore, the revenue growth forecast of 8.7% per year falls short of the desired 20% threshold, highlighting the need for strategic adjustments to meet market expectations.

Future Prospects for Kuaishou Technology in the Market

Opportunities abound for Kuaishou, particularly in AI and e-commerce. The company's optimism regarding AI initiatives, especially Kling AI, suggests potential for rapid revenue growth in the coming year. An executive expressed confidence in AI-driven revenue streams, underscoring the strategic importance of these initiatives. The e-commerce expansion, focusing on live streaming and short video formats, is poised to unlock significant market potential. Cheng Yixiao's emphasis on maintaining a strong market presence through these channels is indicative of their growth strategy. Additionally, overseas markets, particularly in Brazil, present promising prospects, with a remarkable 104.1% year-over-year revenue increase, driven by local content operations and user acquisition strategies.

Market Volatility Affecting Kuaishou Technology's Position

External factors pose notable threats to Kuaishou's growth trajectory. Economic headwinds present risks to user growth and revenue, as acknowledged by Cheng Yixiao, who noted the company's ability to expand its user base despite these challenges. Intensified competition in online marketing and e-commerce could pressure margins and market share, necessitating continued efforts to enhance their Online Marketing Services revenue. Regulatory scrutiny remains a latent threat, given Kuaishou's significant role in China's tech industry, potentially impacting operational and growth strategies. These dynamics require vigilant navigation to sustain and enhance Kuaishou's market position.

Conclusion

Kuaishou Technology's impressive user engagement metrics, with over 400 million daily active users, highlight its strong market presence as the third largest app in China, which is further bolstered by a significant 24.4% rise in adjusted net profit to RMB 3.9 billion. However, challenges such as the decline in live streaming revenue and increased marketing expenses necessitate strategic adjustments to maintain profitability. The company's focus on AI and e-commerce, particularly in emerging markets like Brazil, offers promising growth avenues, potentially offsetting these challenges. Trading below its estimated fair value of HK$85.79, Kuaishou presents an attractive investment opportunity, reflecting its potential for future growth and resilience in navigating market volatility.

Turning Ideas Into Actions

- Are you invested in Kuaishou Technology already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St , where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives