- Hong Kong

- /

- Entertainment

- /

- SEHK:1022

Most Shareholders Will Probably Find That The Compensation For Feiyu Technology International Company Ltd.'s (HKG:1022) CEO Is Reasonable

Key Insights

- Feiyu Technology International will host its Annual General Meeting on 23rd of May

- CEO Jianjun Yao's total compensation includes salary of CN¥681.0k

- The overall pay is 36% below the industry average

- Feiyu Technology International's three-year loss to shareholders was 34% while its EPS grew by 72% over the past three years

Shareholders may be wondering what CEO Jianjun Yao plans to do to improve the less than great performance at Feiyu Technology International Company Ltd. (HKG:1022) recently. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 23rd of May. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for Feiyu Technology International

Comparing Feiyu Technology International Company Ltd.'s CEO Compensation With The Industry

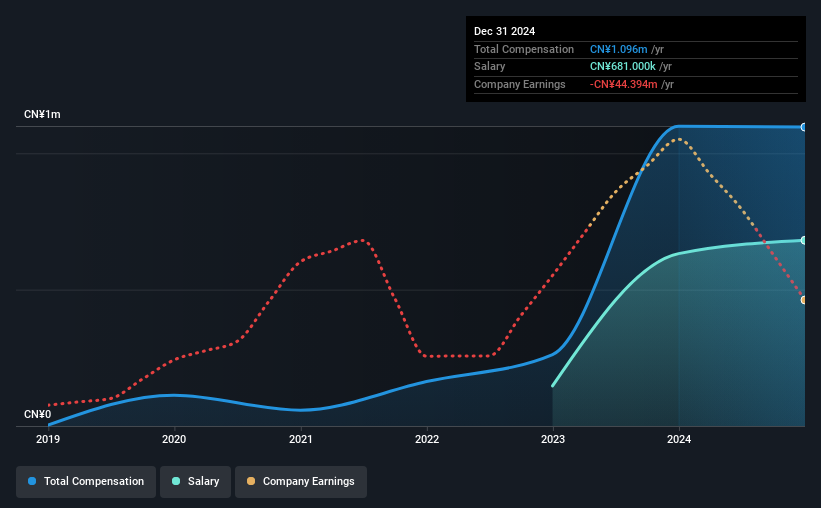

Our data indicates that Feiyu Technology International Company Ltd. has a market capitalization of HK$357m, and total annual CEO compensation was reported as CN¥1.1m for the year to December 2024. This means that the compensation hasn't changed much from last year. Notably, the salary which is CN¥681.0k, represents most of the total compensation being paid.

For comparison, other companies in the Hong Kong Entertainment industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of CN¥1.7m. Accordingly, Feiyu Technology International pays its CEO under the industry median. Furthermore, Jianjun Yao directly owns HK$100m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CN¥681k | CN¥632k | 62% |

| Other | CN¥415k | CN¥467k | 38% |

| Total Compensation | CN¥1.1m | CN¥1.1m | 100% |

Talking in terms of the industry, salary represented approximately 85% of total compensation out of all the companies we analyzed, while other remuneration made up 15% of the pie. In Feiyu Technology International's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Feiyu Technology International Company Ltd.'s Growth Numbers

Feiyu Technology International Company Ltd.'s earnings per share (EPS) grew 72% per year over the last three years. In the last year, its revenue is up 22%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Feiyu Technology International Company Ltd. Been A Good Investment?

The return of -34% over three years would not have pleased Feiyu Technology International Company Ltd. shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The fact that shareholders have earned a negative share price return is certainly disconcerting. This contrasts to the strong EPS growth recently however, and suggests that there may be other factors at play driving down the share price. A key question may be why the fundamentals have not yet been reflected into the share price. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 1 warning sign for Feiyu Technology International that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1022

Feiyu Technology International

An investment holding company, engages in the development, operation, and distribution of various games in Mainland China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives