Market Cool On GHW International's (HKG:9933) Revenues Pushing Shares 25% Lower

The GHW International (HKG:9933) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. Regardless, last month's decline is barely a blip on the stock's price chart as it has gained a monstrous 450% in the last year.

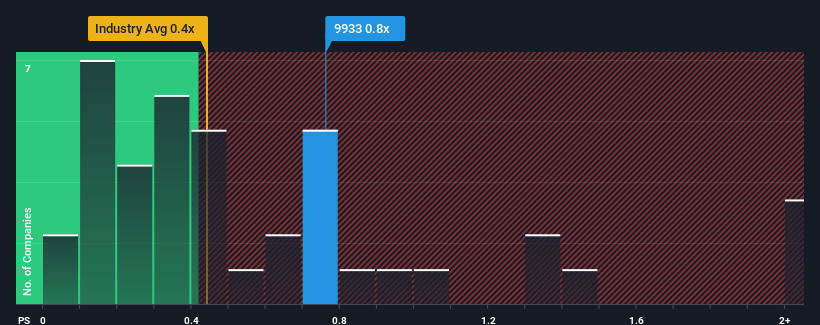

Although its price has dipped substantially, there still wouldn't be many who think GHW International's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in Hong Kong's Chemicals industry is similar at about 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for GHW International

How GHW International Has Been Performing

GHW International has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on GHW International's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like GHW International's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 8.4% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 47% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is only predicted to deliver 5.5% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it interesting that GHW International is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

With its share price dropping off a cliff, the P/S for GHW International looks to be in line with the rest of the Chemicals industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We didn't quite envision GHW International's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 4 warning signs for GHW International (2 are a bit concerning!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9933

GHW International

An investment holding company, manufactures and sells chemical and pharmaceutical products in the People’s Republic of China, Europe, Vietnam, rest of Asia, and internationally.

Slight risk with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026