- Hong Kong

- /

- Metals and Mining

- /

- SEHK:98

Here's Why I Think Xingfa Aluminium Holdings (HKG:98) Is An Interesting Stock

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Xingfa Aluminium Holdings (HKG:98). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Xingfa Aluminium Holdings

Xingfa Aluminium Holdings's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. Impressively, Xingfa Aluminium Holdings has grown EPS by 26% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

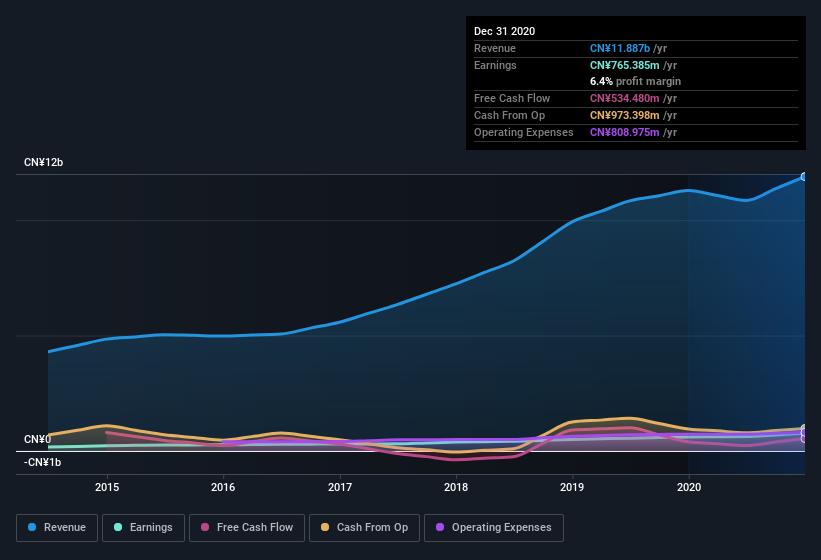

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Xingfa Aluminium Holdings's EBIT margins were flat over the last year, revenue grew by a solid 5.4% to CN¥12b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Xingfa Aluminium Holdings's balance sheet strength, before getting too excited.

Are Xingfa Aluminium Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see Xingfa Aluminium Holdings insiders walking the walk, by spending CN¥6.1m on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. We also note that it was the Executive Director, Yung Koon Law, who made the biggest single acquisition, paying HK$3.7m for shares at about HK$8.42 each.

The good news, alongside the insider buying, for Xingfa Aluminium Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they have a glittering mountain of wealth invested in it, currently valued at CN¥839m. That equates to 17% of the company, making insiders powerful and aligned with other shareholders. So it might be my imagination, but I do sense the glimmer of an opportunity.

Is Xingfa Aluminium Holdings Worth Keeping An Eye On?

For growth investors like me, Xingfa Aluminium Holdings's raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So it's fair to say I think this stock may well deserve a spot on your watchlist. What about risks? Every company has them, and we've spotted 2 warning signs for Xingfa Aluminium Holdings you should know about.

The good news is that Xingfa Aluminium Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:98

Xingfa Aluminium Holdings

An investment holding company, manufactures and sells aluminium profiles in the People’s Republic of China.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success