- Hong Kong

- /

- Metals and Mining

- /

- SEHK:975

Even With A 27% Surge, Cautious Investors Are Not Rewarding Mongolian Mining Corporation's (HKG:975) Performance Completely

Mongolian Mining Corporation (HKG:975) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. The last month tops off a massive increase of 127% in the last year.

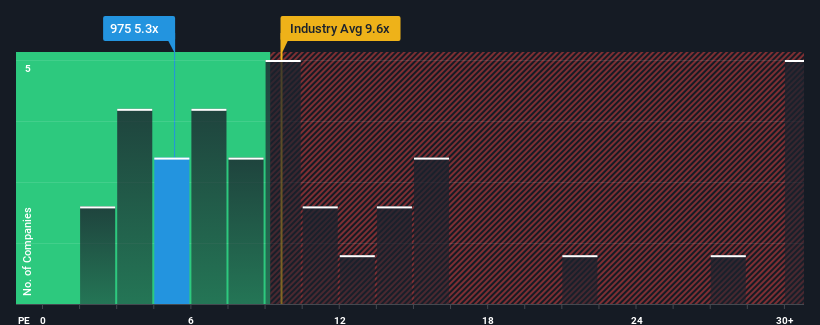

Even after such a large jump in price, Mongolian Mining's price-to-earnings (or "P/E") ratio of 5.3x might still make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 11x and even P/E's above 20x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For instance, Mongolian Mining's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Mongolian Mining

Is There Any Growth For Mongolian Mining?

Mongolian Mining's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 4.5% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 1,595% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 22% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Mongolian Mining's P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Mongolian Mining's P/E?

The latest share price surge wasn't enough to lift Mongolian Mining's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Mongolian Mining currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Mongolian Mining with six simple checks.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:975

Mongolian Mining

Engages in mining, processing, transporting, and selling coking coal products in China.

Excellent balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026