Those Who Purchased Changmao Biochemical Engineering (HKG:954) Shares Three Years Ago Have A 35% Loss To Show For It

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But if you try your hand at stock picking, your risk returning less than the market. We regret to report that long term Changmao Biochemical Engineering Company Limited (HKG:954) shareholders have had that experience, with the share price dropping 35% in three years, versus a market return of about 2.7%. Furthermore, it's down 20% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 13% decline in the broader market, throughout the period.

Check out our latest analysis for Changmao Biochemical Engineering

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, Changmao Biochemical Engineering actually managed to grow EPS by 21% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

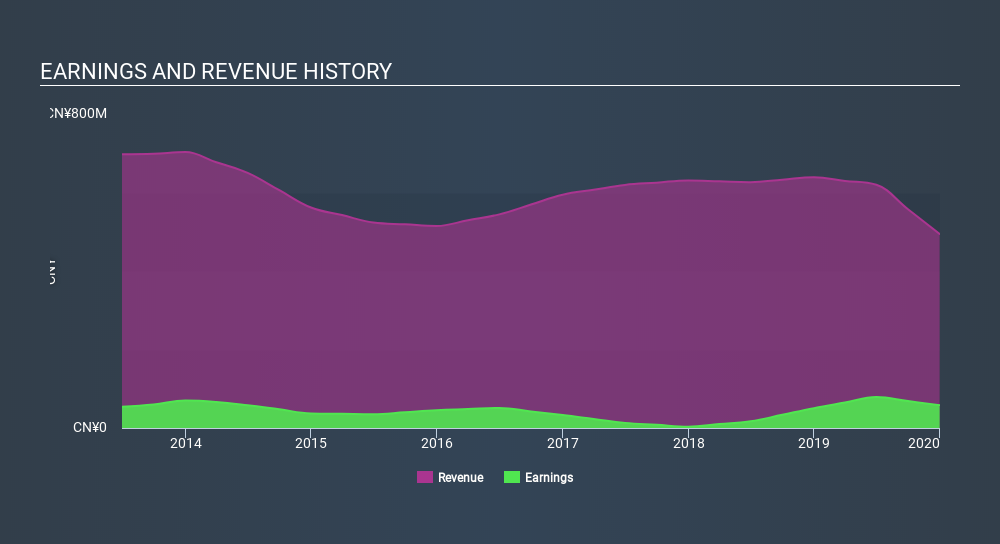

We note that the dividend seems healthy enough, so that probably doesn't explain the share price drop. Revenue has been pretty flat over three years, so that isn't an obvious reason shareholders would sell. A closer look at revenue and profit trends might yield insights.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Changmao Biochemical Engineering's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Changmao Biochemical Engineering's TSR for the last 3 years was -28%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

The total return of 17% received by Changmao Biochemical Engineering shareholders over the last year isn't far from the market return of -16%. So last year was actually even worse than the last five years, which cost shareholders 4.7% per year. It will probably take a substantial improvement in the fundamental performance for the company to reverse this trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Changmao Biochemical Engineering , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:954

Changmao Biochemical Engineering

Produces and sells organic acids for food additive, chemical, and pharmaceutical industries in Mainland China, Europe, the Asia Pacific, the United States, and internationally.

Low risk and slightly overvalued.

Market Insights

Community Narratives