- Hong Kong

- /

- Basic Materials

- /

- SEHK:914

Anhui Conch Cement (SEHK:914): Assessing Its Valuation As Investors Notice Renewed Share Price Momentum

Reviewed by Simply Wall St

Price-to-Earnings of 13.3x: Is it justified?

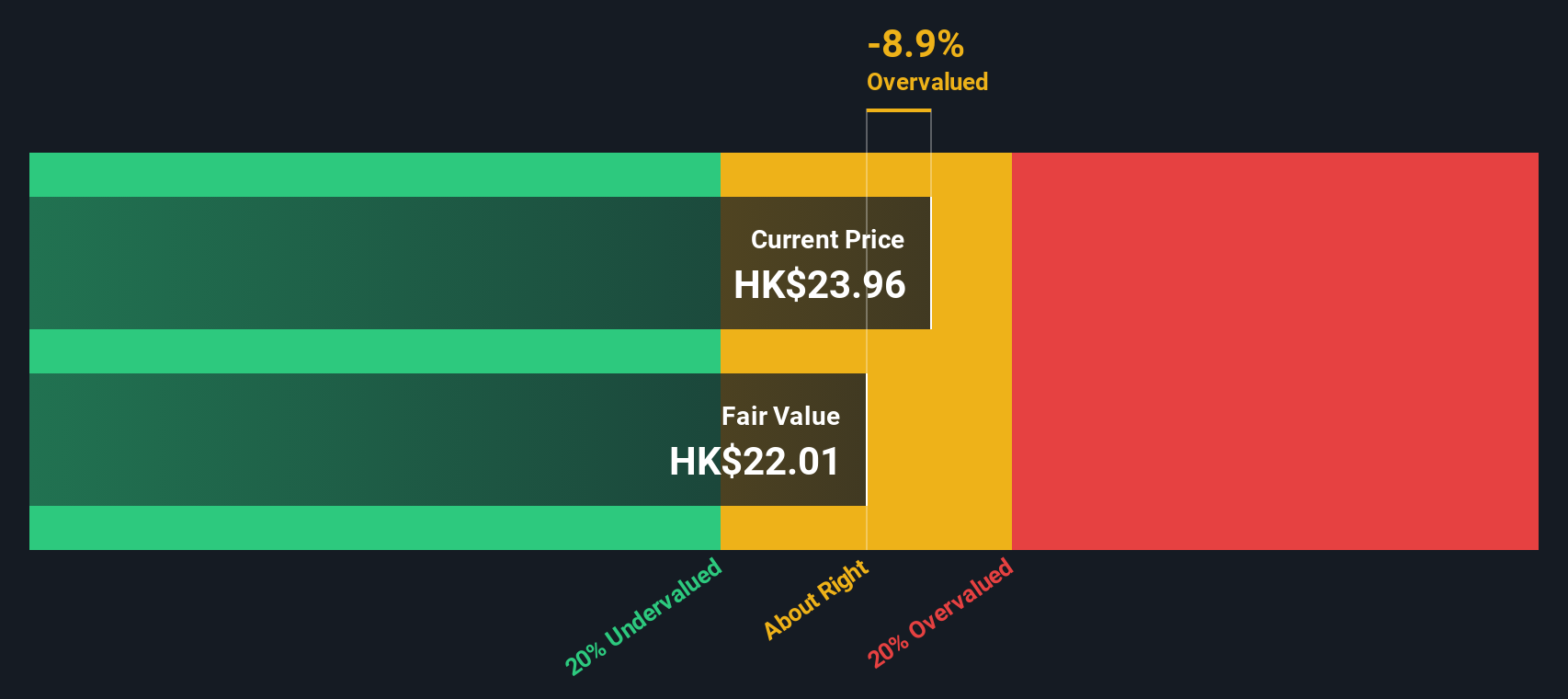

Based on the price-to-earnings (P/E) multiple, Anhui Conch Cement is trading at 13.3 times its earnings, which positions it as relatively good value compared to both its industry and peer averages. However, when measured against an estimated fair P/E of 12.2x, the stock appears slightly expensive.

The P/E ratio provides a snapshot of how much investors are willing to pay for each unit of earnings. It is a widely used benchmark for valuing companies in cyclical sectors such as materials. This is particularly relevant for Anhui Conch Cement given its recent earnings recovery and sector-wide volatility.

While the market currently rewards the company with a multiple in line with or better than its peers, investors should be aware this premium may reflect expectations for sustained profit growth and improved margins, rather than a deep discount. Whether this is justified depends on the company's ability to continue delivering results above historical performance.

Result: Fair Value of $40.64 (UNDERVALUED)

See our latest analysis for Anhui Conch Cement.However, weaker long-term returns and unpredictable sector cycles could quickly challenge the current optimism surrounding Anhui Conch Cement’s stock performance.

Find out about the key risks to this Anhui Conch Cement narrative.Another View

To check that verdict, let’s turn to our DCF model, which takes the company’s future cash flows into account. This approach also points to Anhui Conch Cement being undervalued. Does this add conviction, or raise new doubts?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Anhui Conch Cement Narrative

If you prefer your own research over ours, you can easily explore the numbers yourself and build a personal investment story in just minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Anhui Conch Cement.

Looking for more investment ideas?

Don’t let this be your only opportunity. If you want to uncover what’s next, the Simply Wall Street Screener brings even more smart investments into focus.

- Spot companies leading artificial intelligence innovation and expansion by checking out AI penny stocks, which are poised for breakthroughs in automation and technology.

- Unlock access to established businesses with strong cashflow, priced attractively for value seekers, using undervalued stocks based on cash flows and target tomorrow’s potential winners today.

- Boost your portfolio with quality stocks delivering robust annual payouts by tapping into dividend stocks with yields > 3%, which stand out for high dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:914

Anhui Conch Cement

Manufactures, sells, and trades in clinker and cement products in China and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives