China Shuifa Singyes New Materials Holdings Limited (HKG:8073) Stock Rockets 29% As Investors Are Less Pessimistic Than Expected

China Shuifa Singyes New Materials Holdings Limited (HKG:8073) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. The last month tops off a massive increase of 209% in the last year.

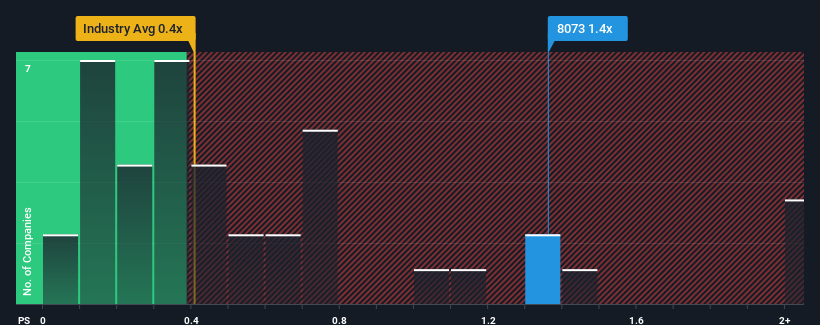

Since its price has surged higher, when almost half of the companies in Hong Kong's Chemicals industry have price-to-sales ratios (or "P/S") below 0.4x, you may consider China Shuifa Singyes New Materials Holdings as a stock probably not worth researching with its 1.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for China Shuifa Singyes New Materials Holdings

What Does China Shuifa Singyes New Materials Holdings' P/S Mean For Shareholders?

China Shuifa Singyes New Materials Holdings certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

Although there are no analyst estimates available for China Shuifa Singyes New Materials Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like China Shuifa Singyes New Materials Holdings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 60%. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 5.5% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that China Shuifa Singyes New Materials Holdings is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

The large bounce in China Shuifa Singyes New Materials Holdings' shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that China Shuifa Singyes New Materials Holdings currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

Before you settle on your opinion, we've discovered 3 warning signs for China Shuifa Singyes New Materials Holdings (1 is significant!) that you should be aware of.

If these risks are making you reconsider your opinion on China Shuifa Singyes New Materials Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8073

China Shuifa Singyes New Materials Holdings

An investment holding company, engages in the research and development, manufacture, sale, and installation of indium tin oxide films and related downstream products in Czech Republic, Mainland China and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives