- Hong Kong

- /

- Basic Materials

- /

- SEHK:743

Asia Cement (China) Holdings (SEHK:743) Profitability Improves, Challenging Persistent Bearish Growth Narrative

Reviewed by Simply Wall St

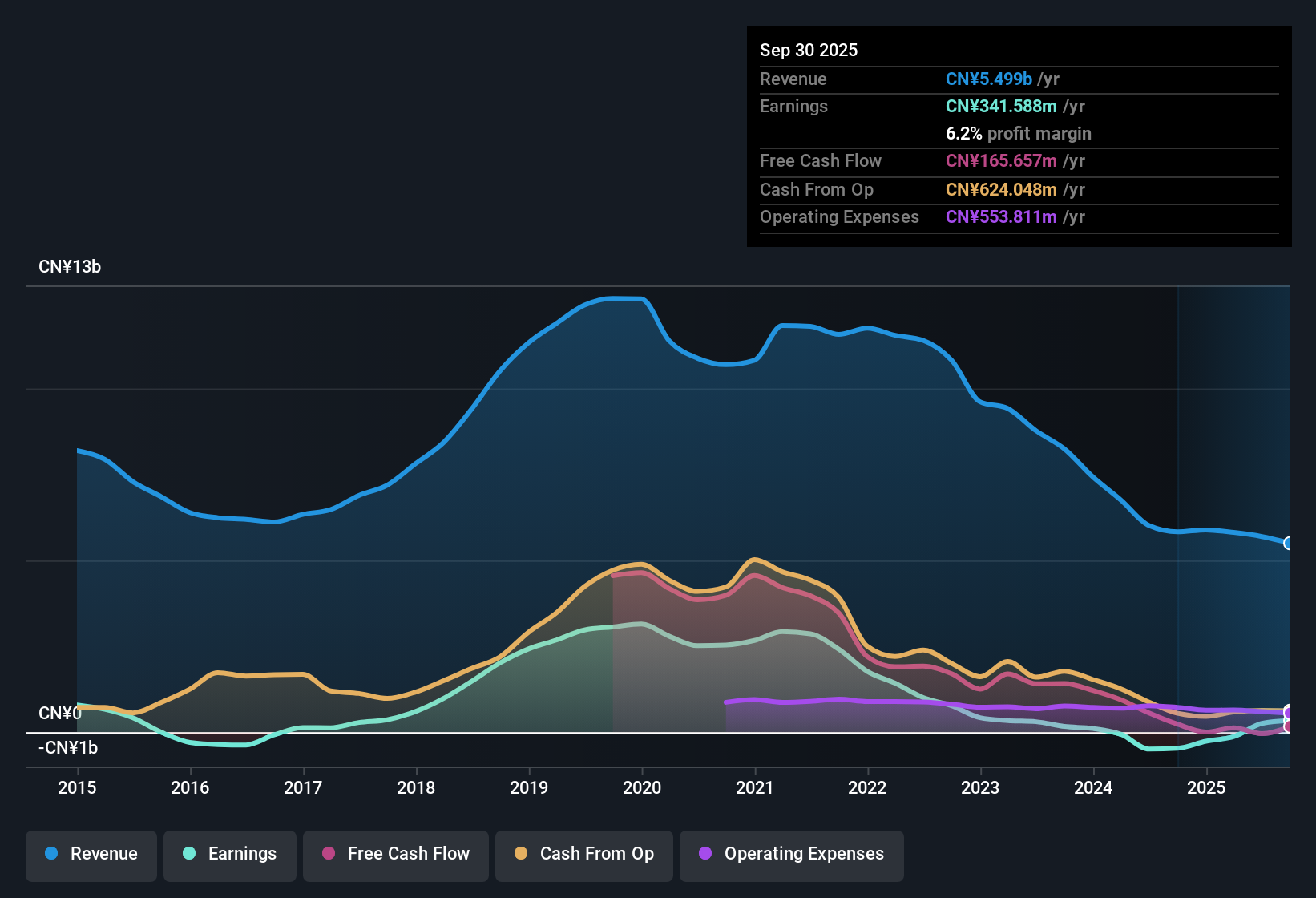

Asia Cement (China) Holdings (SEHK:743) recently posted a return to profitability, as net profit margin improved during the past year. However, the company’s earnings have declined by 64.6% per year over the last five years, and forecasts point to a further annual revenue decrease of 1.1% for the next three years. With shares trading at HK$2.56, which is well above an estimated fair value of HK$0.48, investors now face cautious sentiment surrounding the stock's growth outlook, despite its attractive Price-To-Earnings ratio of 10.7x compared to industry peers.

See our full analysis for Asia Cement (China) Holdings.The next section puts these latest numbers head-to-head with the prevailing investment narratives, highlighting where the facts confirm consensus and where new questions may be raised.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Turns Positive, But Growth Remains Stalled

- Net profit margin improved as Asia Cement (China) Holdings returned to profitability this year; however, annual earnings have declined by 64.6% per year over the past five years, highlighting how profit recovery is not stemming from sustainable revenue expansion.

- Despite the swing back to profit, ongoing revenue shrinkage places a ceiling on future upside according to prevailing market view.

- Forecasts point to a further 1.1% annual revenue decrease over the next three years, which could limit lasting margin gains.

- The persistent multi-year earnings decline contrasts with the company's reputation for high quality earnings, creating tension in the bull case.

Peer Valuation Discount Anchors Appeal for Value Investors

- The current Price-To-Earnings ratio of 10.7x offers a notable discount versus the Asian Basic Materials industry average (15.6x) and its direct peer group (19.7x). This signals that shares may be comparatively attractive for investors prioritizing valuation over growth.

- The prevailing market view highlights how this valuation gap could provide downside protection, but cautions that without a turnaround in earnings trends, the discount might persist.

- With shares trading at HK$2.56, which is well above the DCF fair value estimate of HK$0.48, investors face a trade-off between short-term value and long-term growth concerns.

- The company's high quality earnings may justify the peer discount for now; however, sector trends or company-specific news could quickly change sentiment.

No Immediate Revenue Turnaround Signaled in Forecasts

- Forward-looking estimates suggest revenue is set to continue contracting at an average rate of 1.1% per year for the next three years, underscoring that recent profitability does not reflect a wider business recovery.

- The prevailing market view underscores that Asia Cement (China) Holdings will likely move in line with sector trends, with share price performance largely hampered by the lack of a clear growth catalyst.

- A muted revenue outlook maintains a sideways narrative for the stock, as substantial price moves depend on policy-driven sector tailwinds or unexpected operational surprises.

- This scenario aligns with investors adopting a “wait-and-see” approach, with trading volumes and sentiment expected to stay moderate until meaningful catalysts emerge.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Asia Cement (China) Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite a recent return to profitability, Asia Cement (China) Holdings faces ongoing revenue shrinkage and lacks a clear driver for sustainable growth in the future.

If you're seeking steadier performance and reliable expansion, use our stable growth stocks screener (2124 results) to focus on companies consistently delivering solid revenue and earnings growth across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:743

Asia Cement (China) Holdings

An investment holding company, manufactures and sells cement, concrete, and related products in the People’s Republic of China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives