- Hong Kong

- /

- Metals and Mining

- /

- SEHK:6885

Shareholders Of Henan Jinma Energy (HKG:6885) Must Be Happy With Their 63% Return

One simple way to benefit from the stock market is to buy an index fund. But many of us dare to dream of bigger returns, and build a portfolio ourselves. Just take a look at Henan Jinma Energy Company Limited (HKG:6885), which is up 13%, over three years, soundly beating the market decline of 13% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 24% in the last year , including dividends .

View our latest analysis for Henan Jinma Energy

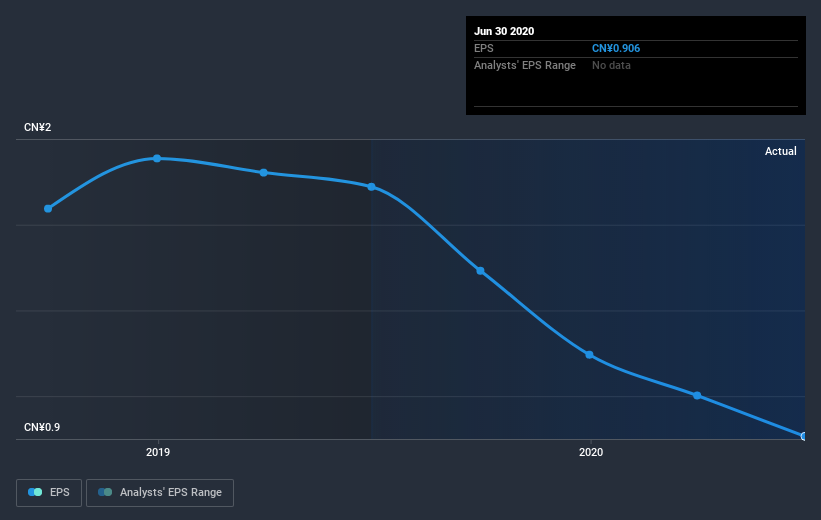

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Henan Jinma Energy was able to grow its EPS at 11% per year over three years, sending the share price higher. This EPS growth is higher than the 4% average annual increase in the share price. Therefore, it seems the market has moderated its expectations for growth, somewhat. We'd venture the lowish P/E ratio of 3.13 also reflects the negative sentiment around the stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Henan Jinma Energy's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Henan Jinma Energy's TSR for the last 3 years was 63%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Pleasingly, Henan Jinma Energy's total shareholder return last year was 24%. That's including the dividend. That's better than the annualized TSR of 18% over the last three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Henan Jinma Energy you should know about.

Of course Henan Jinma Energy may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Henan Jinma Energy or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Henan Jinma Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6885

Henan Jinma Energy

Operates in the coking chemical industry in the People’s Republic of China.

Slight risk and slightly overvalued.

Market Insights

Community Narratives