- Hong Kong

- /

- Metals and Mining

- /

- SEHK:639

With EPS Growth And More, Shougang Fushan Resources Group (HKG:639) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Shougang Fushan Resources Group (HKG:639). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Shougang Fushan Resources Group

Shougang Fushan Resources Group's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Shougang Fushan Resources Group's EPS has grown 36% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

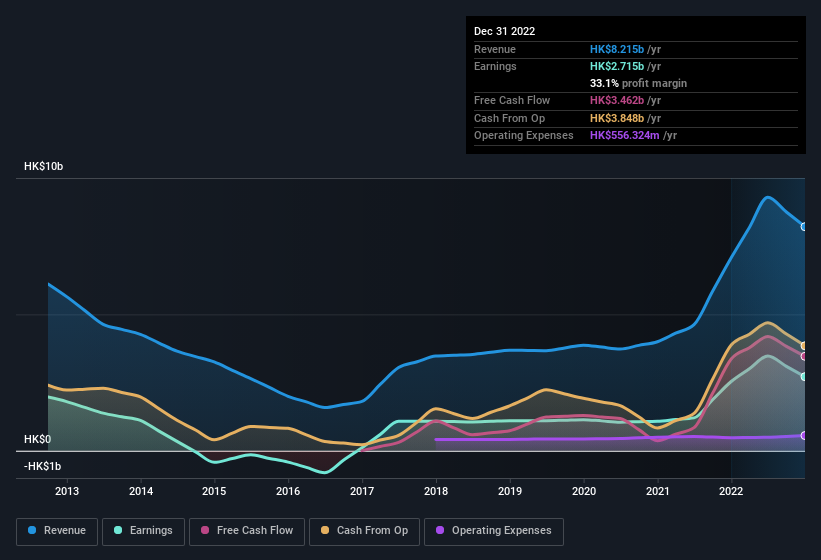

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Shougang Fushan Resources Group shareholders is that EBIT margins have grown from 55% to 60% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Shougang Fushan Resources Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Shougang Fushan Resources Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's good to see Shougang Fushan Resources Group insiders walking the walk, by spending HK$2.0m on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. It is also worth noting that it was Deputy MD & Executive Director Zhaoqiang Chen who made the biggest single purchase, worth HK$1.3m, paying HK$2.51 per share.

It's commendable to see that insiders have been buying shares in Shougang Fushan Resources Group, but there is more evidence of shareholder friendly management. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalisations between HK$7.8b and HK$25b, like Shougang Fushan Resources Group, the median CEO pay is around HK$4.6m.

The Shougang Fushan Resources Group CEO received HK$2.8m in compensation for the year ending December 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Shougang Fushan Resources Group To Your Watchlist?

For growth investors, Shougang Fushan Resources Group's raw rate of earnings growth is a beacon in the night. To add to the positives, Shougang Fushan Resources Group has recorded instances of insider buying and a modest executive pay to boot. On balance the message seems to be that this stock is worth looking at, at least for a while. Before you take the next step you should know about the 2 warning signs for Shougang Fushan Resources Group (1 is a bit concerning!) that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Shougang Fushan Resources Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:639

Shougang Fushan Resources Group

An investment holding company, engages in the business of coking coal mining and production and sales of coking coal products in the People's Republic of China.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives