How Does Starlite Holdings' (HKG:403) CEO Pay Compare With Company Performance?

Kwong Yu Lam is the CEO of Starlite Holdings Limited (HKG:403), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Starlite Holdings.

View our latest analysis for Starlite Holdings

Comparing Starlite Holdings Limited's CEO Compensation With the industry

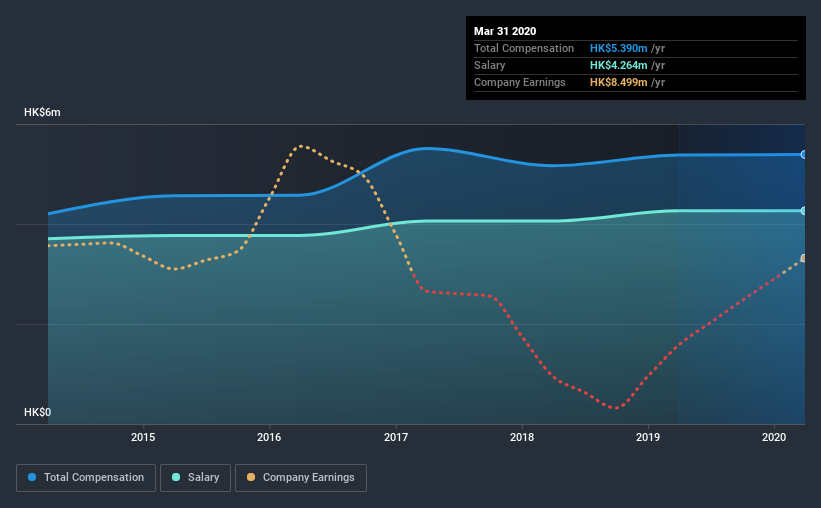

At the time of writing, our data shows that Starlite Holdings Limited has a market capitalization of HK$171m, and reported total annual CEO compensation of HK$5.4m for the year to March 2020. That's mostly flat as compared to the prior year's compensation. In particular, the salary of HK$4.26m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$2.2m. This suggests that Kwong Yu Lam is paid more than the median for the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$4.3m | HK$4.3m | 79% |

| Other | HK$1.1m | HK$1.1m | 21% |

| Total Compensation | HK$5.4m | HK$5.4m | 100% |

Speaking on an industry level, nearly 78% of total compensation represents salary, while the remainder of 22% is other remuneration. Although there is a difference in how total compensation is set, Starlite Holdings more or less reflects the market in terms of setting the salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Starlite Holdings Limited's Growth

Starlite Holdings Limited's earnings per share (EPS) grew 14% per year over the last three years. Its revenue is down 21% over the previous year.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Starlite Holdings Limited Been A Good Investment?

Since shareholders would have lost about 37% over three years, some Starlite Holdings Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As we noted earlier, Starlite Holdings pays its CEO higher than the norm for similar-sized companies belonging to the same industry. However, we must not forget that the EPS growth has been very strong, but it's disappointing to see negative shareholder returns over the same period. Considering overall performance, we can't say Kwong Yu is underpaid, in fact compensation is definitely on the higher side.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 3 warning signs for Starlite Holdings that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Starlite Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:403

Starlite Holdings

Starlite Holdings Limited, together with its subsidiaries, prints and manufactures packaging materials, labels, and paper products in Mainland China, Hong Kong, the United States, Southeast Asia, Europe, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives