- Hong Kong

- /

- Metals and Mining

- /

- SEHK:358

Jiangxi Copper (SEHK:358) Net Margin Improvement Challenges Slow-Growth Narrative

Reviewed by Simply Wall St

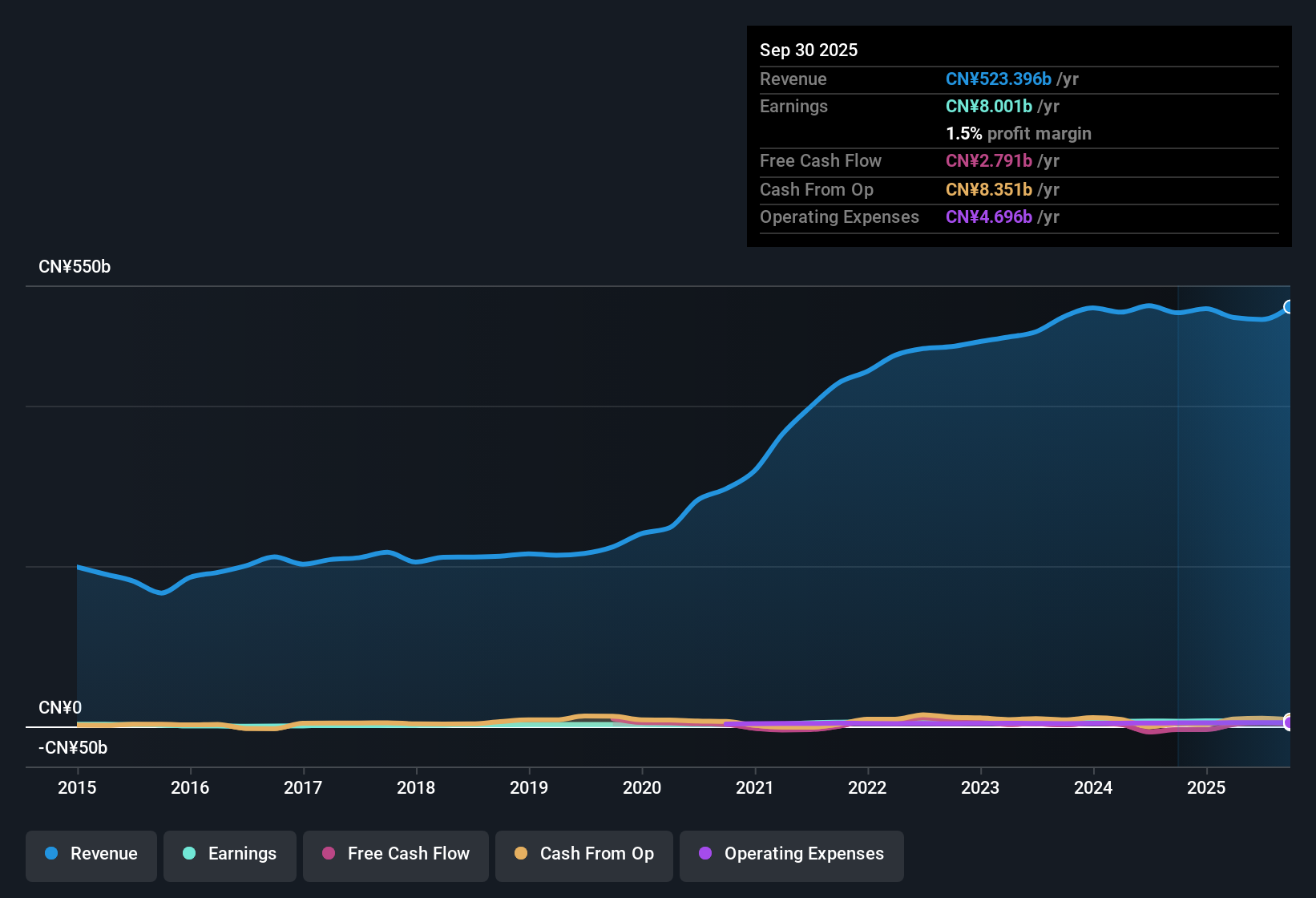

Jiangxi Copper (SEHK:358) posted net profit margins of 1.5%, ahead of last year’s 1.3%, with annual earnings expanding at an average rate of 15.6% over the last five years and an even faster 22.2% in the latest year. Looking forward, management expects earnings to grow by 6.9% per year, while revenue is projected to climb 3.1% per year. Both figures are below the Hong Kong market averages of 12.3% and 8.6% respectively. The company trades at a price-to-earnings ratio of 12.9x, well under its peer average and the industry benchmark. This, alongside high-quality past earnings and no material risks on record, is fueling constructive sentiment among value-focused investors.

See our full analysis for Jiangxi Copper.Next, we’ll see how these earnings numbers compare to the most widely followed narratives in the market, highlighting which views stand up to scrutiny and which may need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion Outpaces Sector Slump

- Jiangxi Copper’s net profit margins increased to 1.5% from last year’s 1.3%. This marks a clear improvement and also places the company ahead of many industry peers who are typically facing cyclical headwinds.

- Growing margins continue to reinforce investor optimism for operational efficiency and resilience.

- The company’s high-quality earnings, paired with its five-year average earnings growth of 15.6%, strongly support the argument that Jiangxi Copper can maintain above-average profitability even as the broader Hong Kong metals and mining industry faces slower demand.

- Momentum is particularly notable with last year's earnings growth outpacing its five-year average. Proponents believe this strengthens prospects for continued margin durability despite sector challenges.

Growth Guidance Falls Short of Market Pace

- The company’s forecast points to 6.9% annual earnings growth and 3.1% revenue growth, both of which lag behind the Hong Kong average forecasts of 12.3% and 8.6% respectively for earnings and revenue.

- This leaves Jiangxi Copper in a challenging position for those seeking rapid expansion.

- With guidance that is less ambitious than the rest of the market, questions arise about how long margin improvements alone can sustain investor enthusiasm while broader industry peers anticipate faster top and bottom line growth.

- The narrative highlights some tension. Revised outlooks could either prompt renewed investor interest or expose Jiangxi Copper to skepticism if slower growth continues, so any shift in management’s 2024 forecasts may quickly influence valuation sentiment.

Valuation Discount Signals Value Appeal

- Jiangxi Copper’s price-to-earnings ratio stands at 12.9x, lower than its peer average of 38.4x and the sector average of 15.6x. Its share price (HK$32.82) also remains significantly below the DCF fair value (HK$68.50).

- Such a steep valuation discount draws attention from value-focused investors.

- Supporters consider the gap to be an opportunity, especially in light of the absence of material risks reported and the company’s strong earnings quality. However, others may question whether the discount is warranted given the outlook for future growth.

- The combination of robust historical profitability and a substantial margin to intrinsic value presents a case for patient investors seeking assets trading at a discount to both peers and fundamental value.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Jiangxi Copper's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Jiangxi Copper’s earnings and revenue growth projections fall well below market averages, which raises doubts about its ability to outpace faster-growing peers.

If you’re seeking companies primed for stronger expansion, check out high growth potential stocks screener (62 results) to focus on leaders expected to deliver robust earnings growth ahead.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:358

Jiangxi Copper

Engages in mining, smelting, and processing of copper and gold in Chinese Mainland, China, Hong Kong, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives