- Hong Kong

- /

- Basic Materials

- /

- SEHK:3323

Market Might Still Lack Some Conviction On China National Building Material Company Limited (HKG:3323) Even After 25% Share Price Boost

China National Building Material Company Limited (HKG:3323) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 68%.

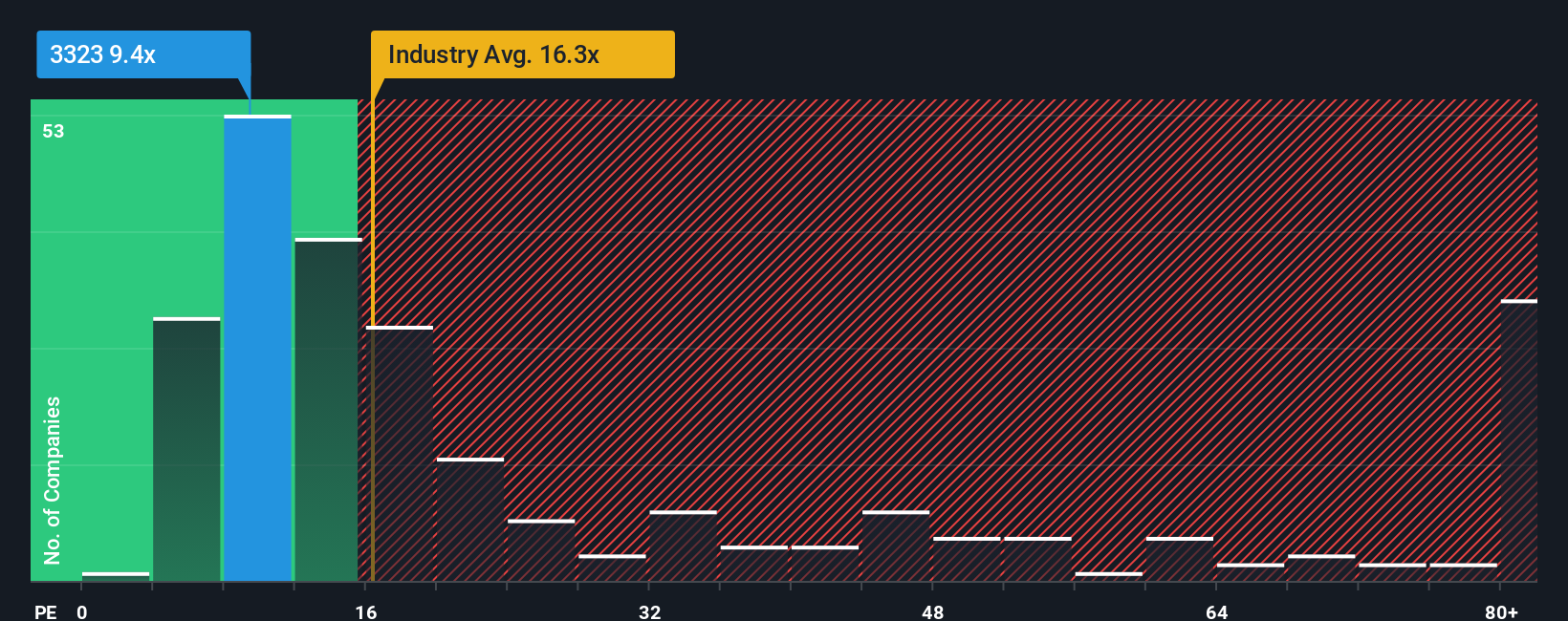

Even after such a large jump in price, China National Building Material's price-to-earnings (or "P/E") ratio of 9.4x might still make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 12x and even P/E's above 26x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's superior to most other companies of late, China National Building Material has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for China National Building Material

Is There Any Growth For China National Building Material?

China National Building Material's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 18%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 76% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 19% per year during the coming three years according to the ten analysts following the company. With the market only predicted to deliver 15% per year, the company is positioned for a stronger earnings result.

With this information, we find it odd that China National Building Material is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Despite China National Building Material's shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that China National Building Material currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with China National Building Material (at least 1 which is significant), and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3323

China National Building Material

An investment holding company, engages in building material, new materials, and engineering technical services businesses.

Undervalued with proven track record.

Market Insights

Community Narratives