- Hong Kong

- /

- Metals and Mining

- /

- SEHK:323

Are Maanshan Iron & Steel Shares Still Attractive After 77.7% Rally Into 2025?

Reviewed by Simply Wall St

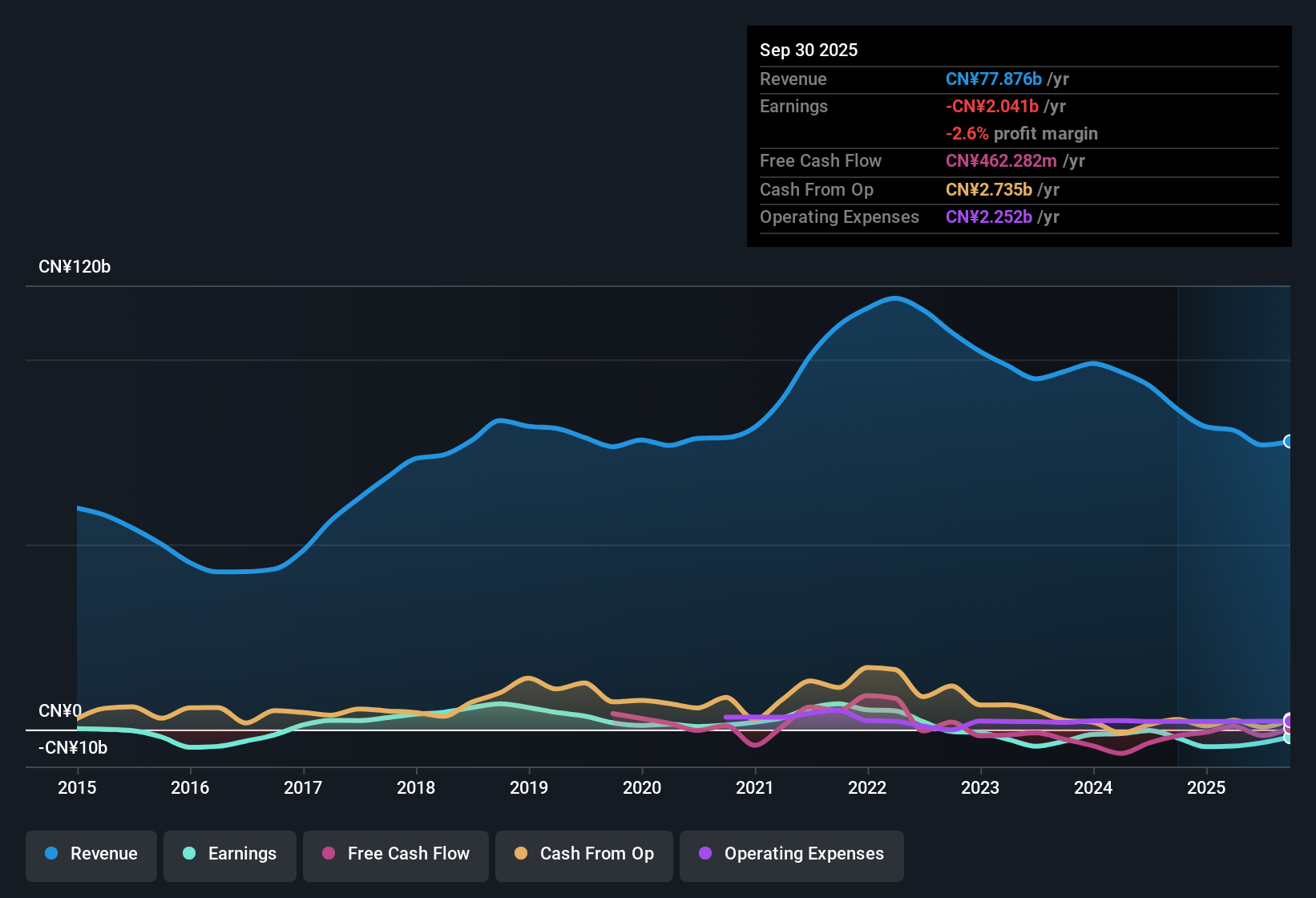

If you are standing at the crossroads with Maanshan Iron & Steel, wondering whether it is the right time to jump in or hold back, you are certainly not alone. Over the past year, this stock has been on an impressive run, climbing 177.5% and turning more than a few heads in the process. Even on a year-to-date basis, the numbers are striking, with a 77.7% gain that has outperformed much of the broader market. Shorter-term movements tell a slightly different story: a modest 1.2% rise in the last week suggests some stability, while the dip of 1.6% in the last month hints at profit-taking or a minor recalibration by investors.

So, what is behind these moves? Recent shifts in the steel industry have contributed to a renewed sense of optimism. Changing outlooks on infrastructure spending and evolving demand trends have helped reset the market’s expectations for companies like Maanshan Iron & Steel, with risk perceptions softening as growth potential becomes more visible. Still, despite these positive signals, investors are rightly asking whether the stock’s strong performance means it has become overvalued or if there is still more room to grow.

When we size up Maanshan Iron & Steel with common valuation yardsticks, it earns a value score of 3 out of 6, a clear sign that it is currently undervalued in half of the main categories most analysts watch. But is that enough? Before you decide whether to buy, hold, or sell, let’s break down the six key approaches used to value a company like this. Stick with me until the end, because there is an even smarter way to look at value that often gets overlooked.

Maanshan Iron & Steel delivered 177.5% returns over the last year. See how this stacks up to the rest of the Metals and Mining industry.Approach 1: Maanshan Iron & Steel Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) estimates a stock's intrinsic value by projecting future dividends and discounting them to reflect their value today. This model is best suited for companies with long, stable histories of consistent dividend payments, as it emphasizes the sustainability and growth prospects of those dividends.

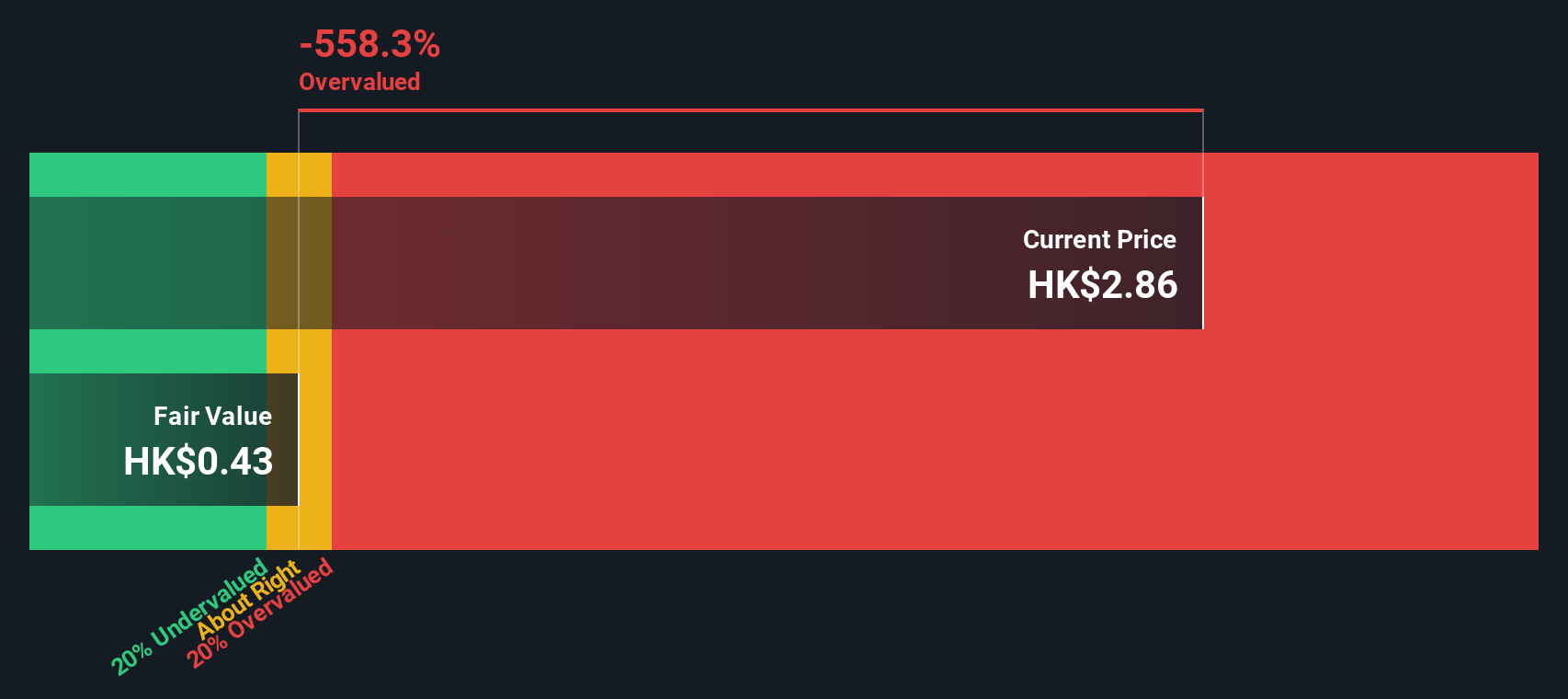

For Maanshan Iron & Steel, the DDM uses a recent dividend per share of CN¥0.079, a negative return on equity of -7.63%, and a payout ratio of -51%, which combine to produce a negative expected dividend growth rate of -11.5%. This growth estimate is calculated using the formula: (1 - Payout Ratio) x ROE, resulting in a projected decline in future dividends. Because of these factors, the model’s implied fair value comes out to just HK$0.45 per share.

Comparing this intrinsic value to the current trading price reveals a significant disconnect. The stock is trading at 451.9% above what the DDM suggests is fair. This signals an extremely overvalued stock according to the dividend outlook. In short, the underlying fundamentals cast doubt on the sustainability of the recent price surge.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Maanshan Iron & Steel.

Approach 2: Maanshan Iron & Steel Price vs Sales

The price-to-sales (PS) ratio is often the preferred valuation metric for companies whose profit margins fluctuate, such as those in the metals and mining industry. This multiple allows investors to assess how much they are paying for each dollar of revenue, regardless of short-term variations in profitability.

What constitutes a “normal” or “fair” PS ratio varies by industry, but it also depends heavily on growth expectations and perceived business risks. Companies with higher expected growth or lower risks typically command a higher PS ratio, while those facing challenges or cyclical downturns tend to trade at a discount.

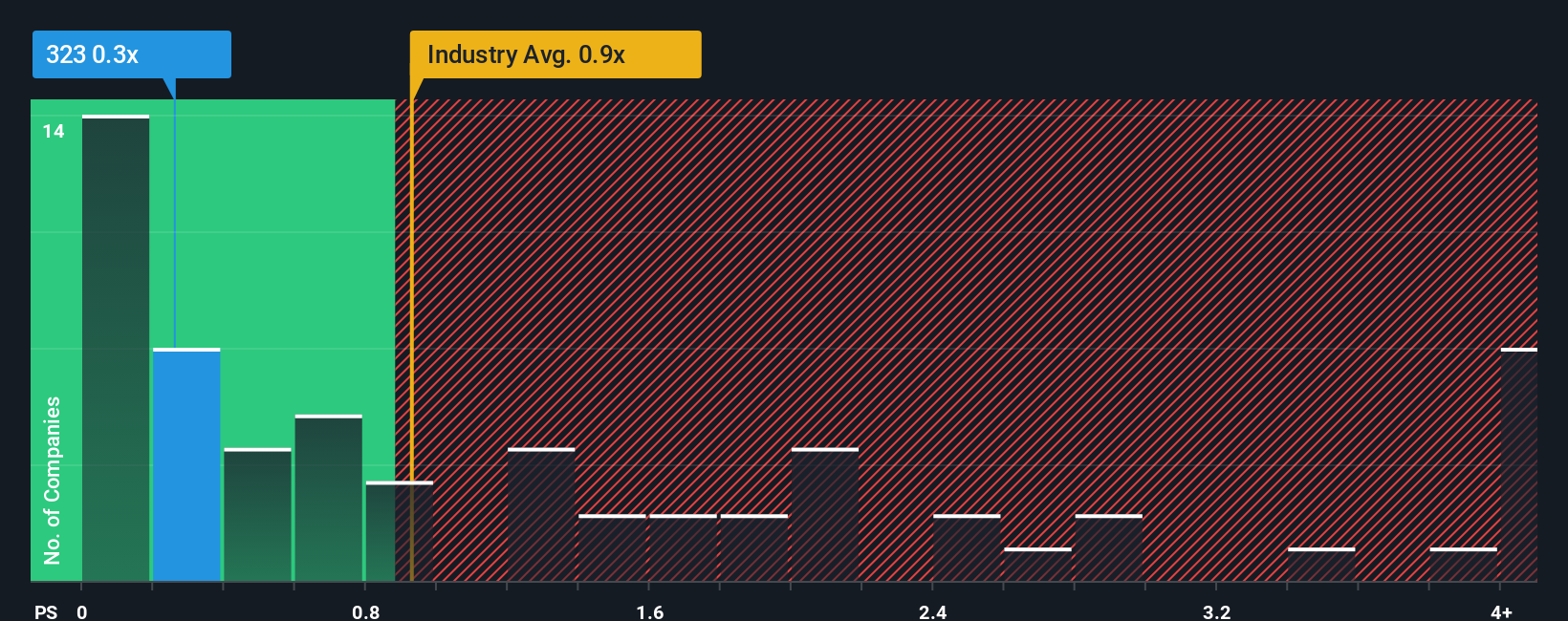

Currently, Maanshan Iron & Steel trades at a PS ratio of 0.23x. Comparatively, the industry average stands at 0.90x, and peers trade around 1.27x. At first glance, this positions the stock well below typical benchmarks, suggesting potential undervaluation. However, these raw comparisons can be misleading as they overlook important company-specific variables.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. Unlike blunt industry averages, the Fair Ratio takes into account Maanshan’s unique growth prospects, risks, profit margins, and its standing within the industry and market cap brackets. For Maanshan Iron & Steel, the Fair Ratio has been calculated at 0.39x. This is notably higher than the company’s actual PS multiple but not by a wide margin.

Given that the difference between the Fair Ratio and the current PS multiple is modest, this signals the stock is trading in line with its risk and growth profile based on sales valuation. In other words, the market appears to have priced it about right on this metric.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Maanshan Iron & Steel Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative goes beyond the numbers, letting you create and share your story about a company’s future by tying together your assumptions about growth, earnings, and risks, and seeing what that means for fair value.

In simple terms, a Narrative connects how you see Maanshan Iron & Steel’s business prospects (its big-picture story) to your forecast of its future revenue, profit margins, and earnings, then translates that into a fair value for the stock. This approach is available to everyone via Simply Wall St’s Community page, where millions of users can build, update, and share their Narratives in real time.

Narratives make decision-making clearer. If your Narrative’s fair value is above today’s share price, that could signal a buying opportunity; if it is well below, caution might be warranted. As new news or earnings are released, Narratives update automatically, keeping your analysis relevant and actionable.

For example, some investors believe urbanization and export growth will drive up margins and revenue, seeing fair value as high as HK$2.61, while others focus on persistent overcapacity and cost risks, and estimate a fair value as low as HK$1.96. This illustrates how different perspectives shape different investment decisions.

Do you think there's more to the story for Maanshan Iron & Steel? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:323

Maanshan Iron & Steel

Manufactures and sells iron and steel products, and related by-products in Mainland China, Hong Kong, and internationally.

Fair value with moderate growth potential.

Market Insights

Community Narratives