- Hong Kong

- /

- Metals and Mining

- /

- SEHK:2600

How Board Changes at Aluminum Corp of China (SEHK:2600) Raise Questions About Its Global Sourcing Strategy

Reviewed by Sasha Jovanovic

- On October 31, 2025, Aluminum Corporation of China announced the immediate resignation of Mr. Li Xiehua from his Board and committee roles, citing work requirements, with no disagreements or outstanding concerns reported.

- This development comes amid significant changes in Guinea’s bauxite sector, where tougher local refining mandates and revoked mining concessions are shifting global supply chains for aluminum producers.

- We’ll explore how Guinea’s push for domestic alumina processing could reshape Aluminum Corporation of China’s sourcing costs and operational priorities.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Aluminum Corporation of China's Investment Narrative?

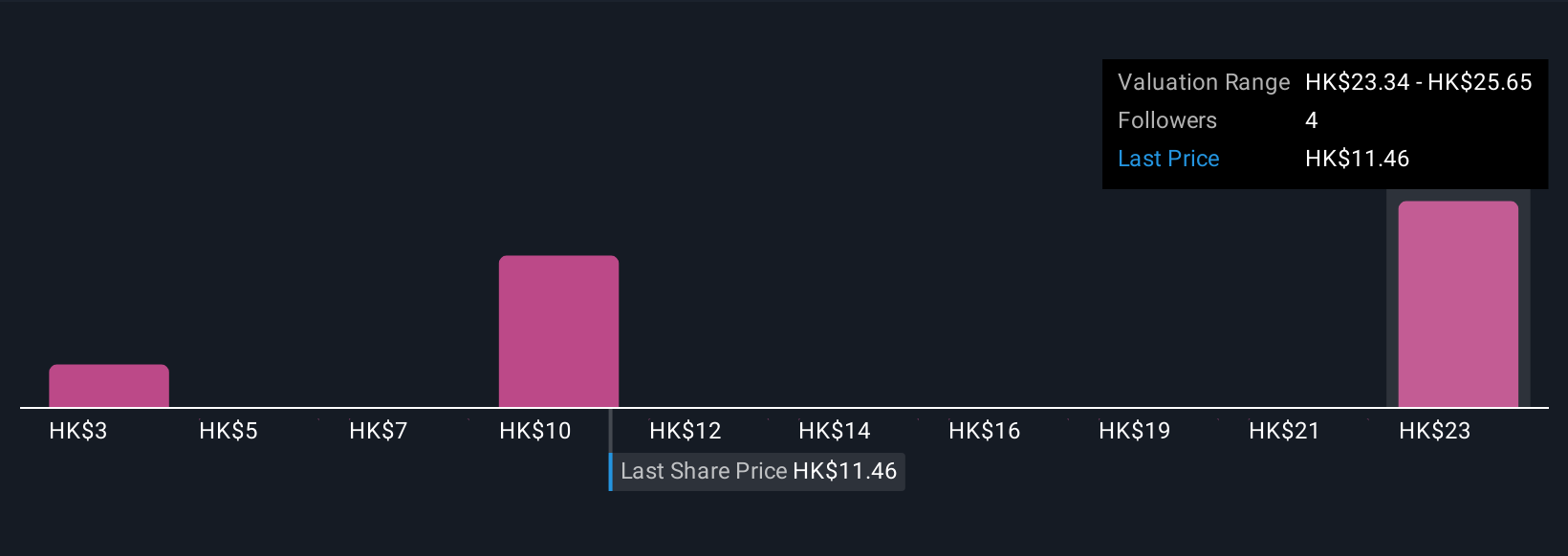

To feel comfortable holding Aluminum Corporation of China right now, you'd need confidence in the company's ability to manage rapidly changing supply conditions and adapt to government-imposed requirements in key resource markets like Guinea. The recent board resignation of Mr. Li Xiehua appears to be routine and not driven by disagreement, so its direct impact on near-term catalysts, like earnings momentum and joint venture execution, should be limited. However, Guinea’s tightening of local refining mandates introduces meaningful operational risk, potentially increasing sourcing costs or disrupting raw material flows. While the company's recent earnings growth remains strong and its shares still trade well below some prevailing fair value targets, this shift in Guinea may become a more pressing factor in upcoming quarters, especially given the company’s history of board turnover and fresh management. In short, the Guinea development is a new variable that shareholders can't ignore.

Yet even with robust earnings, resource nationalism could affect future cost structures.

Exploring Other Perspectives

Explore 3 other fair value estimates on Aluminum Corporation of China - why the stock might be worth less than half the current price!

Build Your Own Aluminum Corporation of China Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aluminum Corporation of China research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Aluminum Corporation of China research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aluminum Corporation of China's overall financial health at a glance.

No Opportunity In Aluminum Corporation of China?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2600

Aluminum Corporation of China

Primarily engages in the exploration and mining of bauxite, coal, and other resources in the People's Republic of China and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives