- Hong Kong

- /

- Metals and Mining

- /

- SEHK:2600

Chalco (SEHK:2600) Earnings Growth Outpaces Five-Year Trend, Reinforcing Bullish Narratives on Value

Reviewed by Simply Wall St

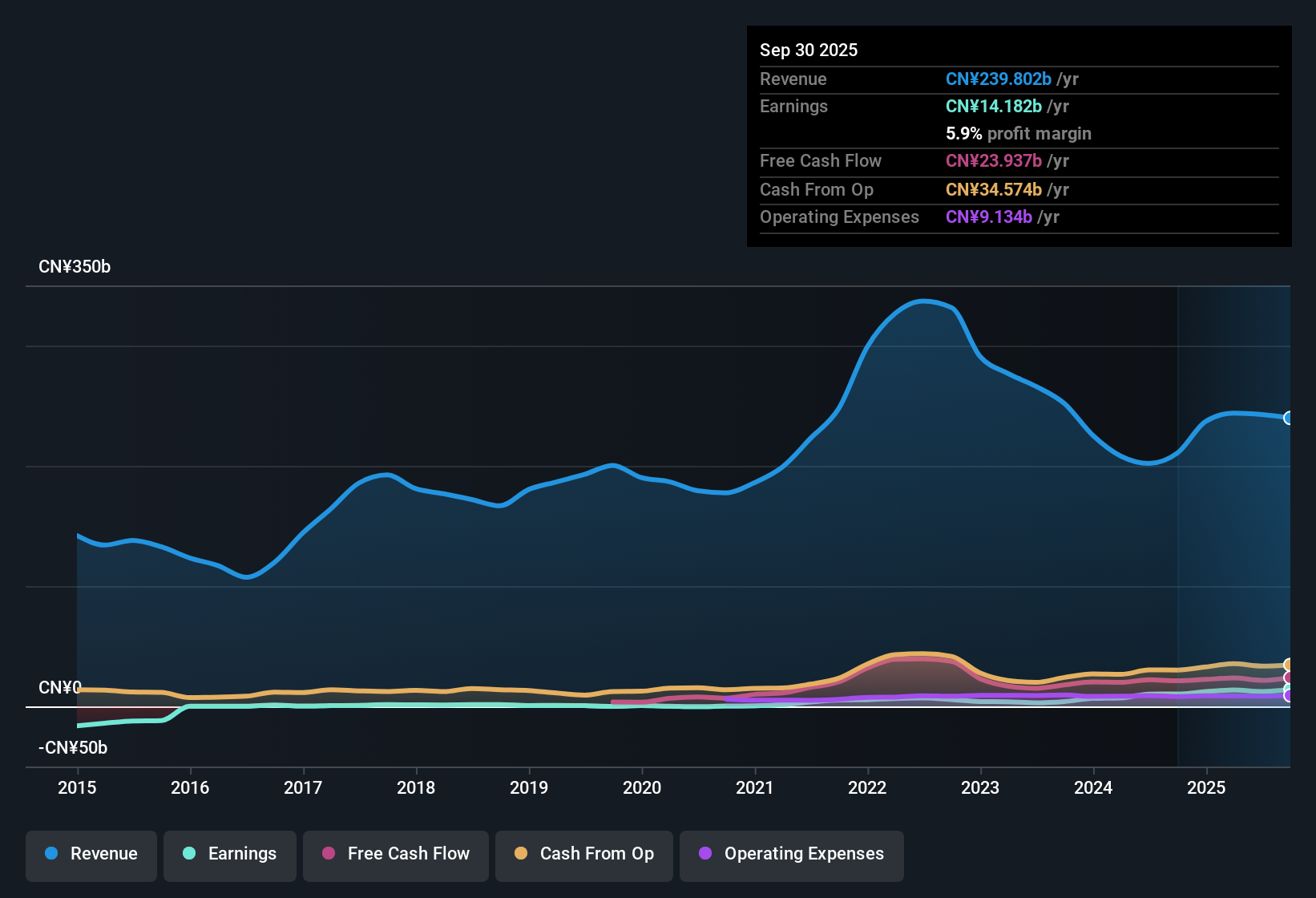

Aluminum Corporation of China (SEHK:2600) delivered earnings growth of 37.8% over the past year, outpacing its five-year average of 36% per year. Net profit margin improved to 5.9% from last year’s 4.9%, with forecasts pointing to 4.8% annual earnings growth and a modest 0.1% revenue increase going forward, both trailing the broader Hong Kong market. With a Price-To-Earnings ratio of 10.2x, which is below the industry and peer averages, and a trading price of HK$9.19 well under its estimated fair value of HK$23.28, the company’s ongoing profitability and value metrics stand out. Dividend sustainability remains the key risk for investors.

See our full analysis for Aluminum Corporation of China.Next, we will put these latest figures in context by stacking them up against the widely followed narratives for Aluminum Corporation of China, highlighting which market stories are confirmed and where expectations might need to shift.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Improve Beyond Recent Trend

- Net profit margin reached 5.9% for the latest period, up from last year’s 4.9%. This extends positive momentum not just year-on-year but also compared to its five-year average of 36% profit growth annually.

- In addition to this, the current margin expansion is viewed as a sign of operational improvements and cost efficiencies taking effect.

- The higher margin, combined with a 37.8% earnings growth rate, strongly supports the view that core business initiatives are outpacing sector headwinds.

- Proponents note that ongoing profitability and the quality of earnings may reinforce investor confidence even as industry demand cycles shift.

Growth Slows Versus Market Expectations

- While earnings are forecast to grow at 4.8% and revenue at just 0.1% per year going forward, both projections are below the broader Hong Kong market’s outlook. This signals a potential deceleration relative to peers.

- As a result, the prevailing market view recognizes the company’s earnings momentum but also points to sector-wide caution.

- Though recent achievements in profit margin are promising, softer revenue guidance versus the wider market creates a gap that critics highlight as a watch point.

- Notably, both optimism and restraint are justified, as operational improvements are evident, but sluggish revenue growth could limit outsized gains if not addressed.

Price-To-Earnings Signals Value Upside

- The Price-To-Earnings ratio at 10.2x is well below both the peer average of 21.2x and industry average of 16.4x. The share price of HK$9.19 is also materially under its DCF fair value of HK$23.28, highlighting a substantial discount by absolute and relative standards.

- The prevailing market view sees this value gap as a potential catalyst for re-rating if margins hold or sector sentiment improves.

- Valuation multiples support the argument that the stock is undervalued compared to both its immediate peers and the broader industry.

- However, with dividend sustainability identified as a key risk, some investors remain cautious about pricing in the full upside until payout ratios are clearer.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Aluminum Corporation of China's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite improving profit margins, Aluminum Corporation of China faces concerns about future revenue growth and the sustainability of its dividend payouts.

If you want more reliable yield and less uncertainty, investigate these 2002 dividend stocks with yields > 3% to discover companies with stronger, more sustainable dividends and attractive payout records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2600

Aluminum Corporation of China

Primarily engages in the exploration and mining of bauxite, coal, and other resources in the People's Republic of China and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives