- Hong Kong

- /

- Metals and Mining

- /

- SEHK:2600

A Look at Chalco (SEHK:2600) Valuation Following New Joint Venture Announcement

Reviewed by Simply Wall St

Aluminum Corporation of China (SEHK:2600) has announced a joint venture with Chinalco, Yunnan Copper, Chihong Zinc & Germanium, and Chinalco Capital. This move is classified as a connected transaction under Hong Kong Listing Rules, so it requires public disclosure but does not affect company control or financial consolidation.

See our latest analysis for Aluminum Corporation of China.

Investor sentiment around Aluminum Corporation of China has been on an upswing, with the recent joint venture announcement likely adding to the momentum. The stock has recorded a one-day share price return of 3.76%, a 22.64% gain over the past month, and its year-to-date share price return stands at an impressive 105.42%. Looking at the bigger picture, long-term momentum is even more striking. The total shareholder return over the past five years has soared nearly 498%, highlighting sustained growth and renewed confidence from investors.

If this kind of strategic move makes you curious about what else is shaping the market, you might want to broaden your search and discover fast growing stocks with high insider ownership

With shares riding high and long-term returns outpacing the broader market, the key question is whether Aluminum Corporation of China remains undervalued by investors or if accelerating growth prospects have already been fully reflected in the share price.

Price-to-Earnings of 11.5x: Is it justified?

At a price-to-earnings (P/E) ratio of 11.5x, Aluminum Corporation of China shares appear undervalued compared to both peers and the wider Hong Kong Metals and Mining industry given its last close of HK$9.10.

The P/E ratio expresses how much investors are willing to pay for each dollar of company earnings. It is widely used to assess whether a stock is attractive relative to its profitability. For a large commodity business like Aluminum Corporation of China, this ratio is particularly meaningful, as it reflects market expectations for ongoing profit generation in a cyclical sector.

Currently, Aluminum Corporation of China’s P/E is not only below the Hong Kong Metals and Mining industry average of 16x but also trades well beneath the peer average of 21.2x. According to fair value calculations, the P/E ratio should be closer to 15.4x. This could trigger upward price momentum if market sentiment shifts in line with fundamentals.

Explore the SWS fair ratio for Aluminum Corporation of China

Result: Price-to-Earnings of 11.5x (UNDERVALUED)

However, subdued annual revenue growth and the current share price, which is trading above analyst targets, could dampen future optimism, even amid strong historical returns.

Find out about the key risks to this Aluminum Corporation of China narrative.

Another View: SWS DCF Model Signals Deeper Undervaluation

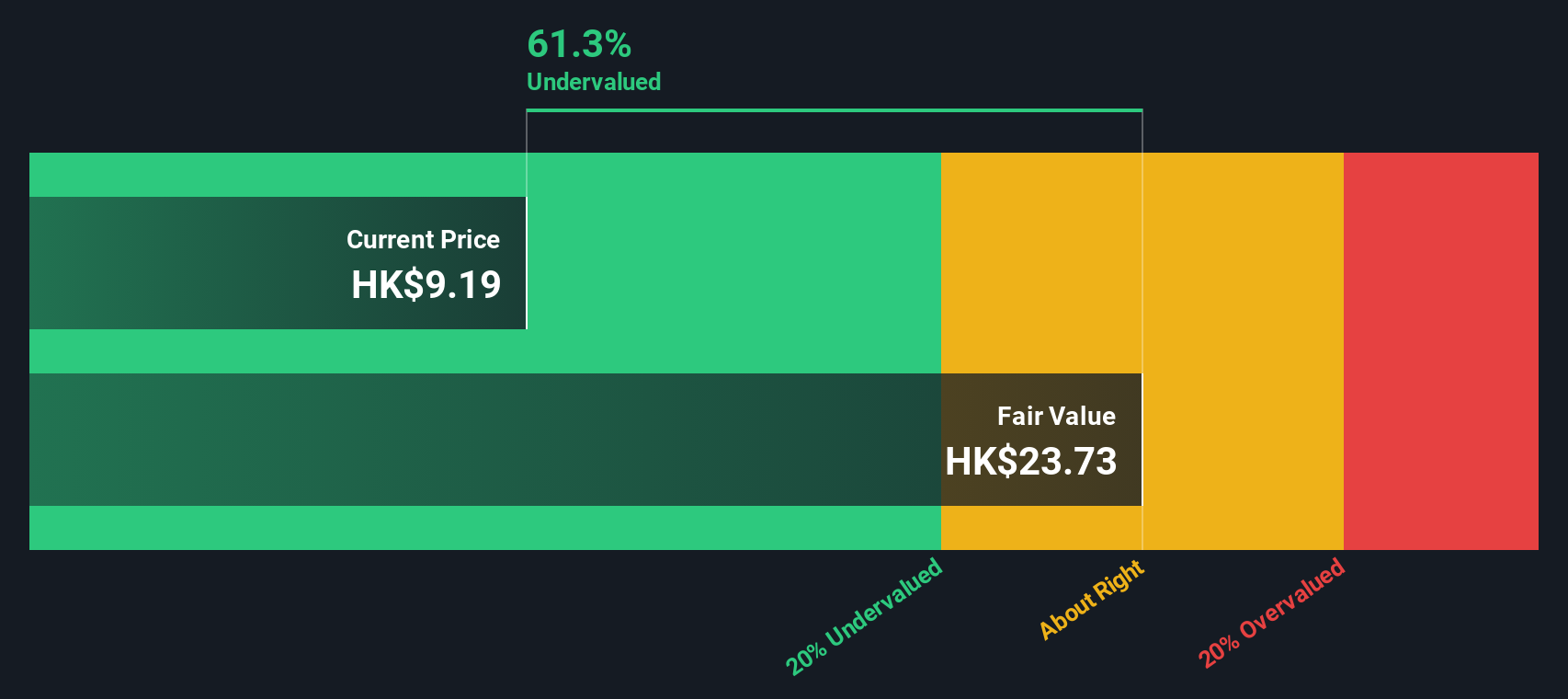

Stepping away from market-based ratios, our SWS DCF model suggests the shares could be trading at an even deeper discount. According to the DCF analysis, the fair value for Aluminum Corporation of China is HK$23.71. The stock is trading at just HK$9.10, indicating a discount of over 60%.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aluminum Corporation of China for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aluminum Corporation of China Narrative

If you'd like to test your own ideas or take a different perspective, it's quick and easy to build your own view of the numbers in just a few minutes. Do it your way

A great starting point for your Aluminum Corporation of China research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Want to stay ahead of the crowd? The right screens can reveal stocks with exceptional potential before everyone else sees the opportunity. Let Simply Wall Street’s custom screeners sharpen your strategy.

- Spot high-yield opportunities and kickstart your income strategy by reviewing these 17 dividend stocks with yields > 3% offering attractive returns for your portfolio.

- Tap into the explosive world of AI innovation and see which companies are redefining entire markets through these 27 AI penny stocks.

- Find undervalued gems trading below their intrinsic worth and strengthen your edge with these 876 undervalued stocks based on cash flows based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2600

Aluminum Corporation of China

Primarily engages in the exploration and mining of bauxite, coal, and other resources in the People's Republic of China and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives