- Hong Kong

- /

- Metals and Mining

- /

- SEHK:2600

A Fresh Look at Chalco (SEHK:2600) Valuation as Guinea Mining Rules Reshape Aluminum Supply Chains

Reviewed by Simply Wall St

Recent shifts in Guinea's mining sector, including new local processing mandates and transferred concessions, could impact global aluminum supply chains. For Aluminum Corporation of China (SEHK:2600), these changes may affect input costs and future supply stability.

See our latest analysis for Aluminum Corporation of China.

Aluminum Corporation of China’s momentum has been nothing short of remarkable. After a steady climb throughout the year, the share price has spiked by 161.85% year-to-date, capping off a stellar run with a 1-year total shareholder return of 140.87%. Recent volatility, combined with board changes and a shifting global supply landscape, suggests investors are betting on both near-term opportunities and the company’s long-term growth potential.

If global supply chain shifts have your attention, this is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With the share price already reflecting rapid gains and headlines buzzing over supply chain shocks, investors have to ask: is Aluminum Corporation of China still undervalued, or is all the future growth already baked in?

Price-to-Earnings of 12.9x: Is it justified?

Aluminum Corporation of China’s shares trade at a price-to-earnings (P/E) ratio of 12.9x, which positions it as undervalued compared to both sector peers and its industry average. With the last close at HK$11.6, the company appears attractively priced relative to recent profits and the multiples seen across the metals and mining space.

The P/E ratio measures how much investors are willing to pay for each dollar of recent earnings. For a cyclical commodity producer like Aluminum Corporation of China, this valuation metric is especially important, since earnings can fluctuate considerably with market cycles.

Trading at 12.9x earnings while peers average 21.9x and the industry sits at 17.2x suggests the market is either cautious about the company’s outlook or underestimating its potential earnings power. The estimated “fair” P/E ratio of 15.4x highlights room for the stock to rerate if performance delivers or sentiment improves.

Explore the SWS fair ratio for Aluminum Corporation of China

Result: Price-to-Earnings of 12.9x (UNDERVALUED)

However, slower revenue growth and a recent dip below analyst price targets signal that the bullish story may be at risk if market sentiment changes.

Find out about the key risks to this Aluminum Corporation of China narrative.

Another View: What Does The SWS DCF Model Say?

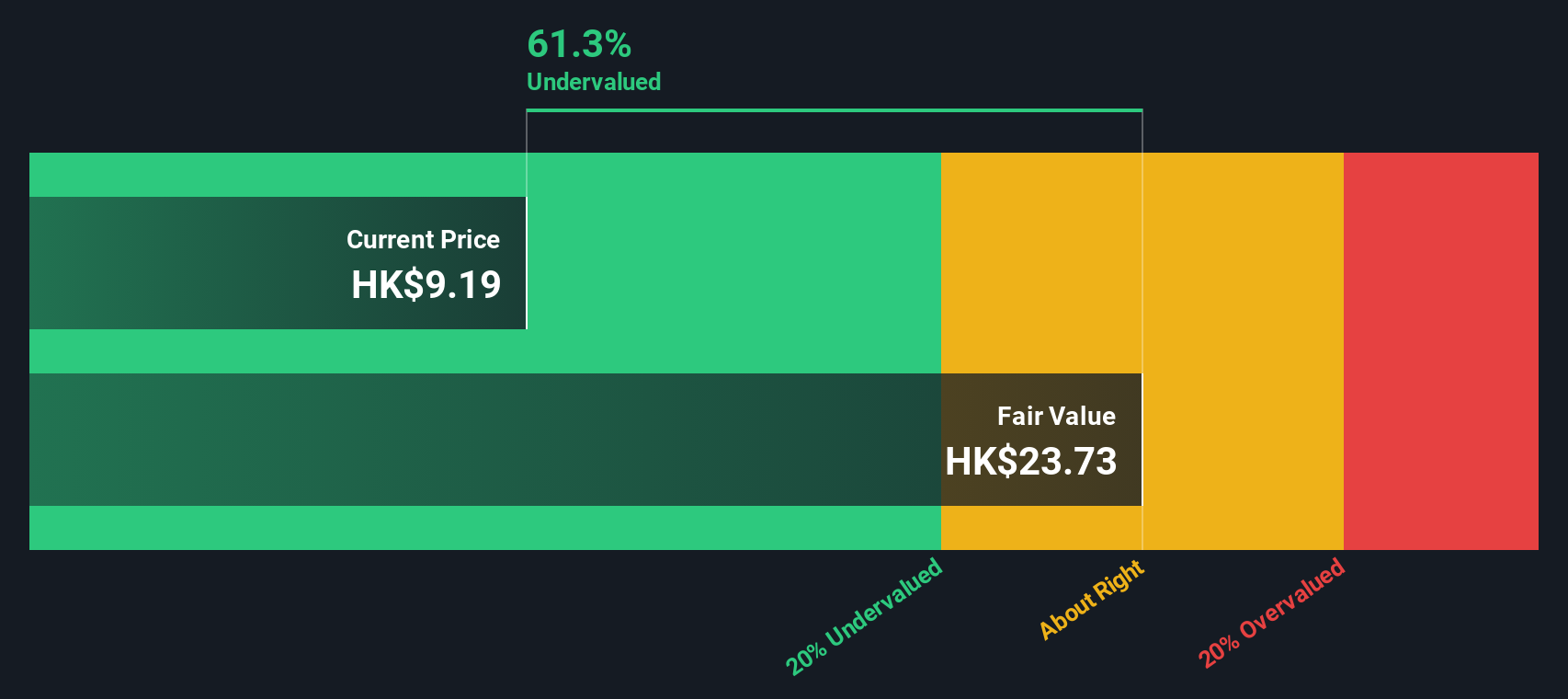

Looking through the lens of our DCF model offers a much more optimistic perspective. It places Aluminum Corporation of China's fair value at HK$25.58 per share, meaning the current price trades over 54% below this mark. However, are those long-term cash flow forecasts too bold, or is the market simply being overly cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aluminum Corporation of China for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 862 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aluminum Corporation of China Narrative

If this perspective does not quite align with your own, or you want to dig deeper into the numbers, you can easily build a personal narrative in just a few minutes, your way with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Aluminum Corporation of China.

Looking for more investment ideas?

Smart investors stay ahead by uncovering new opportunities outside the headlines. Make your next move with these hand-picked screeners to inspire your strategy, or you might miss tomorrow's biggest winners.

- Tap into reliable income by targeting companies known for strong payouts, starting with these 14 dividend stocks with yields > 3% offering yields above 3%.

- Catch the wave of artificial intelligence innovation by scanning these 26 AI penny stocks, where bright upstarts are changing how tech shapes our world.

- Position yourself ahead of the curve in tomorrow’s digital financial leaders by browsing these 82 cryptocurrency and blockchain stocks and their latest advances in secure digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2600

Aluminum Corporation of China

Primarily engages in the exploration and mining of bauxite, coal, and other resources in the People's Republic of China and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives